Peloton Commercial Results in Quick Gain for War Room Members

This morning in The War Room, we had a great discussion about the drama that’s now following the holiday commercial put out by Peloton (Nasdaq: PTON).

Here’s the scoop…

As you know, Peloton sells $2,000 exercise bikes that come with a membership-based subscription model – and the company recently IPO’d on Wall Street.

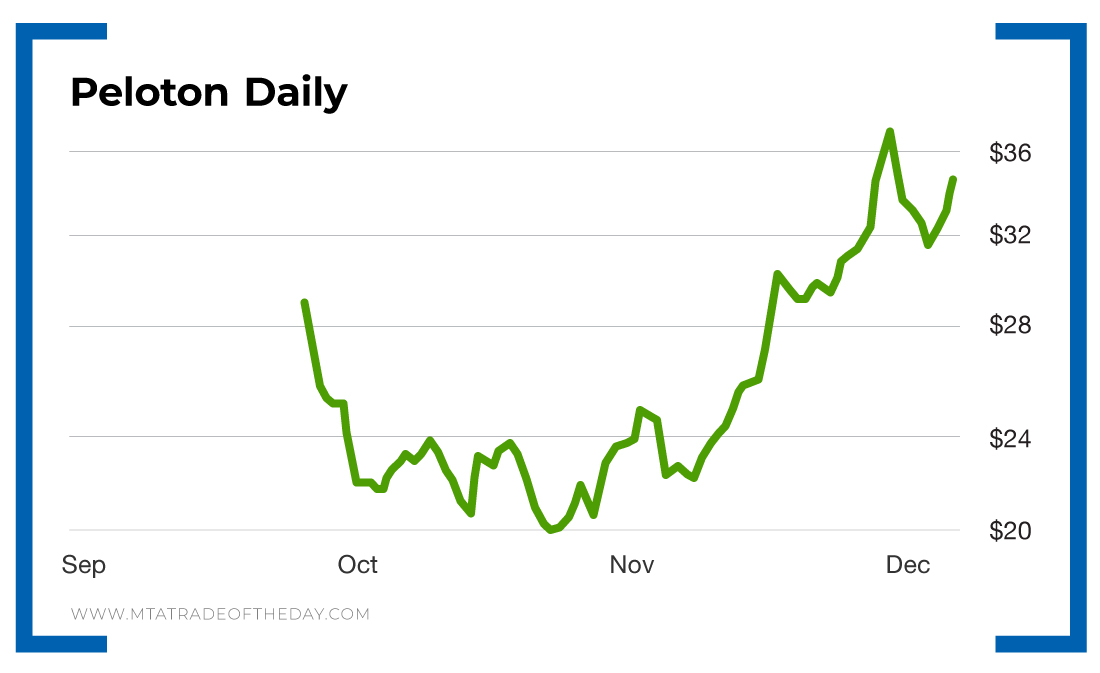

Since mid-September, Peloton shares have traded in a range from $20 up to $37.

But then the company’s holiday-inspired commercial came out…

In it, a husband surprises his wife on Christmas morning with a new Peloton bike, which she’s excited to get. She then goes on to document her experience of using the machine.

In emotions that range from nervous to proud – and even unmotivated – the woman in the 30-second commercial offers the viewer a yearlong summary of her experience. And in the end, the husband and wife are on the couch watching the summary with a sense of accomplishment.

However, some of those who viewed the commercial were anything but impressed with Peloton.

Comments like the ones below have flooded chat rooms and discussion boards across the country…

Ladies, exercise harder – be thinner for your man and then thank him for it.

The 116-pound woman’s yearlong fitness journey to becoming a 112-pound woman is just ridiculous. Come on.

In fact, the commercial has become a polarizing lightning rod of judgment.

So this morning in The War Room I said…

Here’s my take on the PTON commercial. As you know, they’re getting a ton of heat for a commercial showing a husband buying his wife an exercise bike for Christmas so she can lose weight. Some love it. The majority hate it. But here’ s my take: The point of an ad is to generate buzz. Generate discussion. And most of all – bring awareness for your brand. And guess what? If that’s what a good advertisement is supposed to do – then PTON nailed it. That’s why I like it here.

War Room members responded to this by saying…

I strongly agree! – Carl A.

I love PTON’s commercials and interesting you mention that. I work with the co-founder’s wife, and I always say how amazing their commercials are! – Madeline Z.

But here’s the important part…

Wall Street loves the reoccurring revenue model – which Peloton has. That’s why Wall Street was so excited when Disney introduced Disney Plus to challenge the Netflix monthly membership model. For a monthly fee, Peloton riders can connect their bikes to streamed exercise sessions that come with leaderboards and statistics.

Forecastable revenue is what Wall Street loves to see, which, in my mind, made the pullback associated with Peloton’s negative commercial reaction worth buying into.

Imagine…

If just 1% of the 700,000 people who initially viewed its commercial were to buy a bike, then the company will have truly hit a home run with this advertisement.

Action Plan: This morning, War Room members entered Peloton calls for $2.11, and then when Peloton bounced higher, members sold them for $2.65.

And going forward, I like the idea of Peloton moving up to challenge its recent high moving into the end of this month.

P.S. Oh, and if you’d like to watch the Peloton commercial for yourself, click here.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.