What’s More Important… Wealth or Income?

When I was a kid and a teenager, I always worked.

Whether I was shoveling snow in the winter or working at an ice cream store, I didn’t really have many costs back then. A concert ticket was probably my biggest expense (I remember paying $15 to see Rush).

So I saved my cash for a rainy day. And it started raining when I was in college. The money I earned in high school and during summers kept me afloat (barely) my junior and senior years.

As a young investor, I was all about trying to build wealth. Those lessons from my youth fueled my desire to build a nest egg and ensure I had cash I could tap into if I needed it.

As I got older and had built a safety net (six months of expenses in cash), my focus shifted to generating passive income. That wasn’t because I needed the money at the time, but because it’s a great way to compound wealth.

And eventually, when I’m no longer collecting a paycheck, I want to have pieces in place that will generate income for me.

Most people save and invest in order to draw that money down when they retire. My goal is to create enough income from my investments that I never have to touch the principal.

A very important component of my income investing portfolio is dividend stocks – particularly Perpetual Dividend Raisers. These are companies that raise their dividends every year.

Owning stocks of companies that raise their dividends every year accelerates compounding if you’re reinvesting the dividends, and it helps you stay ahead of inflation if you’re collecting the dividends.

Here’s what I mean:

Let’s say you invest $10,000 in a stock that pays a 6% yield but does not grow the dividend.

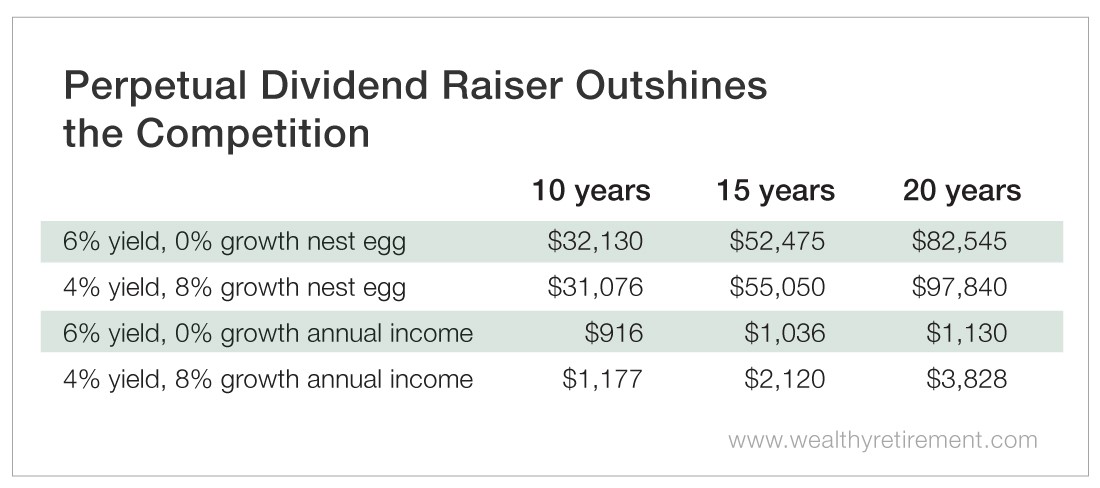

If the stock appreciates at a pace in line with the historical average of the S&P 500, and if you reinvest the dividend for 10 years, you’ll have $32,130 after 10 years, $52,475 after 15 years and $82,545 after 20 years.

Furthermore, after 10 years, you’re collecting $916. After 15 years, $1,036. And you’ll receive $1,130 after 20 years.

Now, what happens if we start off with a lower 4% dividend yield, but that dividend grows 8% per year?

After 10 years, the nest egg is slightly lower at $31,076. You’ll have more at 15 and 20 years than you did with the flat 6% yielder. Your totals will be $55,050 and $97,840.

Perhaps more importantly for the investor who starts collecting the income at 10 years, the Perpetual Dividend Raiser generates $1,177 – substantially more than the $916 in the earlier example.

After 15 years, the income rises to $2,120. If you let the money compound for 20 years and then begin receiving the dividend checks, you’ll take home $3,828 – more than three times the amount with the higher starting, but static, yield.

How about if you need the income today and don’t have time to reinvest the dividend and let it compound?

A $10,000 investment in a stock that yields 6% and doesn’t grow its dividend will generate $600 in income every year.

The 4% yield that grows by 8% every year starts off paying you $400 per year.

By year seven, you’re making $637 – more than the 6%-yielding stock.

At year 10, you’re collecting $799 – 33% more than the $637 paid by the 6%-yielding stock.

After 15, years you’re collecting just about double the amount of the other stock with $1,159, and five years after that, your income is $1,726 – nearly three times the amount of the 6% stock.

This is a perfect illustration of why I strongly recommend Perpetual Dividend Raisers for long-term investors.

Your nest egg will grow faster, and you’ll receive more income than if you chased yield and bought stocks that paid higher dividends but didn’t grow those dividends.

Though the money I earned in high school and over summers helped me get through college, it was a sickening feeling to draw down those reserves knowing there wasn’t much left for a real emergency.

Perpetual Dividend Raisers help ensure I never have that experience again. Owning stocks that generate more income every year should help me avoid draining the nest egg at a rapid pace.

What are some of your favorite strategies for generating income? Let us know in the comments section below.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.