How Huge Earnings Could Result in a Speculative Play for Stitch Fix

Here we are, October 1…

The start of Q4…

And the start of one of the historically worst months in market history.

According to Macro Risk Advisors, the CBOE Volatility Index (VIX) tends to peak in October.

As a note, a “peak” on the VIX equates to a market under heavy selling pressure. The index is sometimes called the “fear gauge.”

Coming off September, the S&P 500 somehow shrugged off a series of troubling geopolitical news items (from impeachment news to China trade talks) to gain 1.7%.

So, as we head into October, it’s easy to realize that it might be hard to hold on to September’s upside. After all, Chinese trade talks resume October 10. That’ll be the first item to address this month.

From there, it’s a daily game of watching the news flow – and simply reacting to whichever way the markets move that particular hour – or minute.

In The War Room, I explained today that times like this (when markets are roaring higher one second only to come crashing back down the next) are troubling, frustrating times for most investors. However, for traders like us, they’re perfect for the tactical strategy behind our earnings strangles.

If you recall, an earnings strangle involves owning both a call and a put on the same company. The idea is that you profit if the stock makes a big move in either direction. As long as the move is large enough (typically 5% or higher is my goal), you stand to profit.

Want to track this strategy in real time?

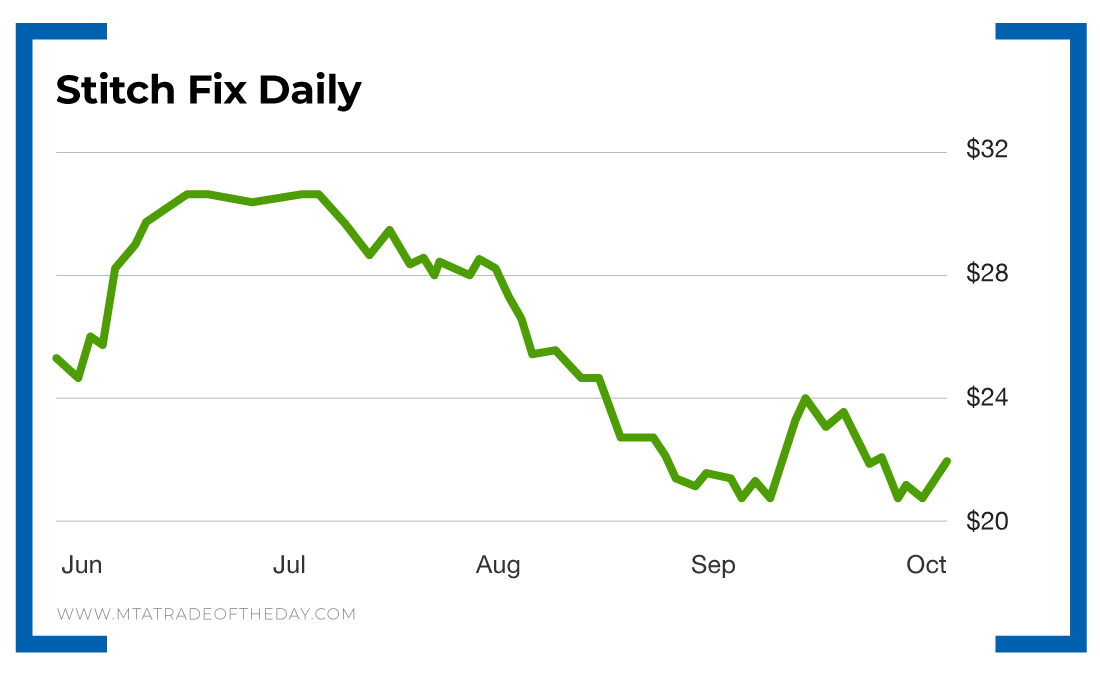

Okay, then let’s focus on a company called Stitch Fix (Nasdaq: SFIX).

I admit, I’ve never traded Stitch Fix before. I even had to look up what the company does. Turns out, it’s an online retail firm that sells denim, dresses, blouses, skirts, shoes, jewelry and handbags for men, women and kids.

So basically, you fill out your own personalized style profile. You pay a $20 “styling” fee to receive a shipment of clothes, shoes and bags that suit your lifestyle. Buy what you like and send back the rest – you’ll also get that styling fee credited to whatever you buy. Shipping and returns are free.

Stitch Fix is another online retail name, which explains the big earnings reactions.

And that’s the key: The last three moves on earnings announcements were 26%, 33% and 5%, all higher.

Not only that, but the short percent of the total float on Stitch Fix currently stands at 33.51%. This could set up for a massive short squeeze.

Action Plan: Let’s track this one together. Stitch Fix reports earnings before the open tomorrow. Two of its last three earnings reports resulted in huge earnings moves. And right now 33% of the entire stock’s float is sold short – which could set up for a big short squeeze tomorrow.

In The War Room, we may enter into a speculative trade to capitalize on this move. Take a peek at Stitch Fix tomorrow – and see if we’re catching a move big enough to profit!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.