Tracking a $2.9 Million Bet on Beyond Meat

By the time you read this, Beyond Meat (Nasdaq: BYND) will probably have released its latest earnings report – which was due today at 4 p.m. ET.

The expectation is earnings per share of $0.05 on revenues of $77.1 million.

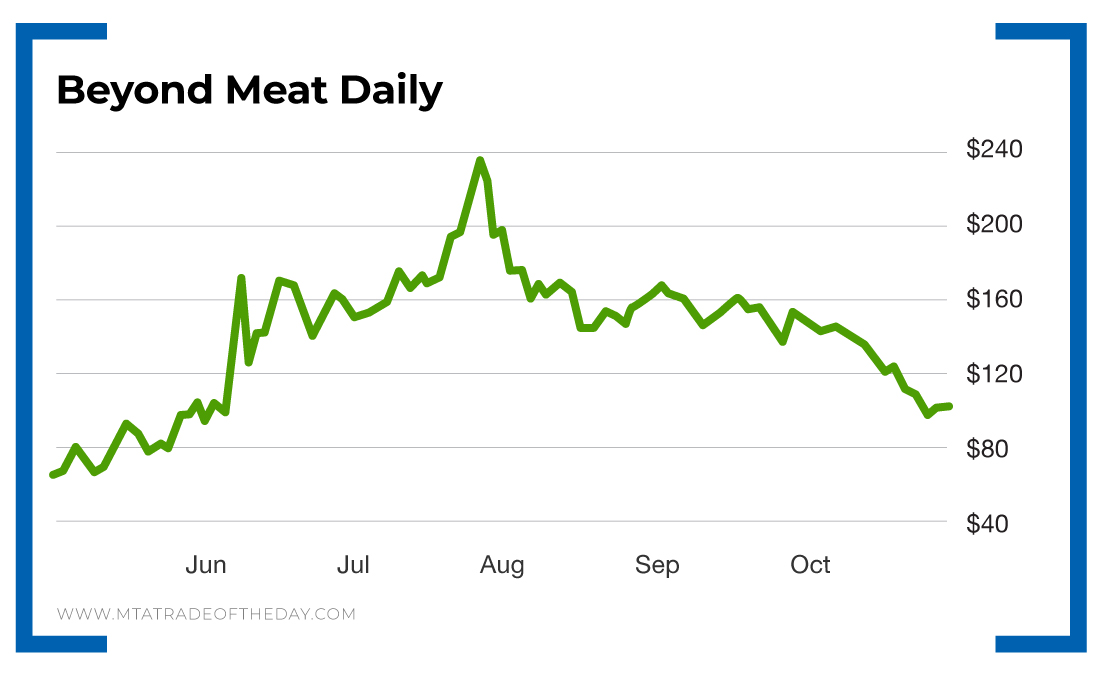

As I’m sure you know, going into this report, Beyond Meat has been one of the most volatile stocks of 2019.

With a 52-week low and high ranging from $46 to $239, it’s clear Beyond Meat has been Wall Street’s biggest roller coaster this year.

Quarterly revenue growth year over year of 287% has ballooned Beyond Meat’s forward price-to-earnings ratio to an absurd 391.29.

Here’s an update on Beyond Meat from Markets Insider…

In response to guests’ interest in plant-based dining and flexitarian diets, Denny’s has partnered with Beyond Meat to launch the Denny’s Beyond Burger. Available at all Los Angeles-area Denny’s locations beginning today, the new Denny’s Beyond Burger features a 100% plant-based Beyond Burger patty topped with freshly sliced tomatoes and onions, crisp lettuce, pickles, American cheese and All-American sauce on a multigrain bun – offered morning, noon, night and late night. And to prove that this is no “trick,” this Halloween night between 4 p.m. and 7 p.m., Denny’s will celebrate the introduction of this plant-based offering by “treating” guests to a FREE Beyond Burger (with a purchase of any beverage) at any of its Los Angeles-area restaurants. While available exclusively in the Los Angeles market currently, Denny’s will roll out the new Denny’s Beyond Burger nationwide in 2020.

As you know, I always keep an eye on the earnings calendar – and I noted in The War Room that Beyond Meat was one of today’s high-profile reports.

But here’s the interesting part…

Last week, I noted that a “Sharp Paper” trader bought 2,075 of the Beyond Meat November $100 puts. This purchase totaled more than $2.9 million – as the puts were bought for $14 each when Beyond Meat stock was trading for $98.29.

So this makes us wonder…

Could this be an indication that Beyond Meat is ready to fall even further?

Someone out there certainly believes it will happen, as they just placed almost $3 million on it.

Will this massive Sharp Paper bet pay off?

By the time you’re reading this – you’ll already know the answer.

Action Plan: At the open of trading tomorrow, we’ll be keeping a sharp eye on the movements of Beyond Meat. The company’s last two earnings reports have resulted in a 17% move lower, followed by a 16% move higher. No matter what happens, there appears to be plenty of movement for a quick trade. If something presents itself, War Room members will be the first to know. So what are you waiting for? Come join me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.