Interactive Brokers Is One Name That’s Lost in the Brokerage Bonanza

Welcome to the final month of the 2019 trading year. The one main question facing every trader and investor alike here in December is simple…

Will December 2019 end a fantastic investing year with a Santa Claus rally?

Or will 2019 end the way last year ended – with a massive market correction?

In future Trade of the Day issues, as we move into this critical final month of 2019, this will be our major focus. But in the meantime, we have a potentially undervalued opportunity to introduce to you today – and it comes from a sector that’s been making some huge news.

So let’s dive in…

As I’m sure you know, Charles Schwab shocked the brokerage industry last month by eliminating trading commissions.

And then, as if that weren’t enough, the company followed that major news by announcing last week that it’ll buy rival TD Ameritrade in an all-stock deal valued at roughly $26 billion.

If all goes as planned, this deal will close in the second half of 2020 – and it will create a brokerage giant with more than $5 trillion in combined assets.

On this news, shares of Charles Schwab jumped 13.6%, going from $44 to $50. TD Ameritrade did even better, jumping 31.25% from $40 to $52.50.

With both of these major brokerage houses popping, it pays to examine the reaction in the brokerage house that I feel is actually the most innovative of the group: Interactive Brokers (Nasdaq: IBKR).

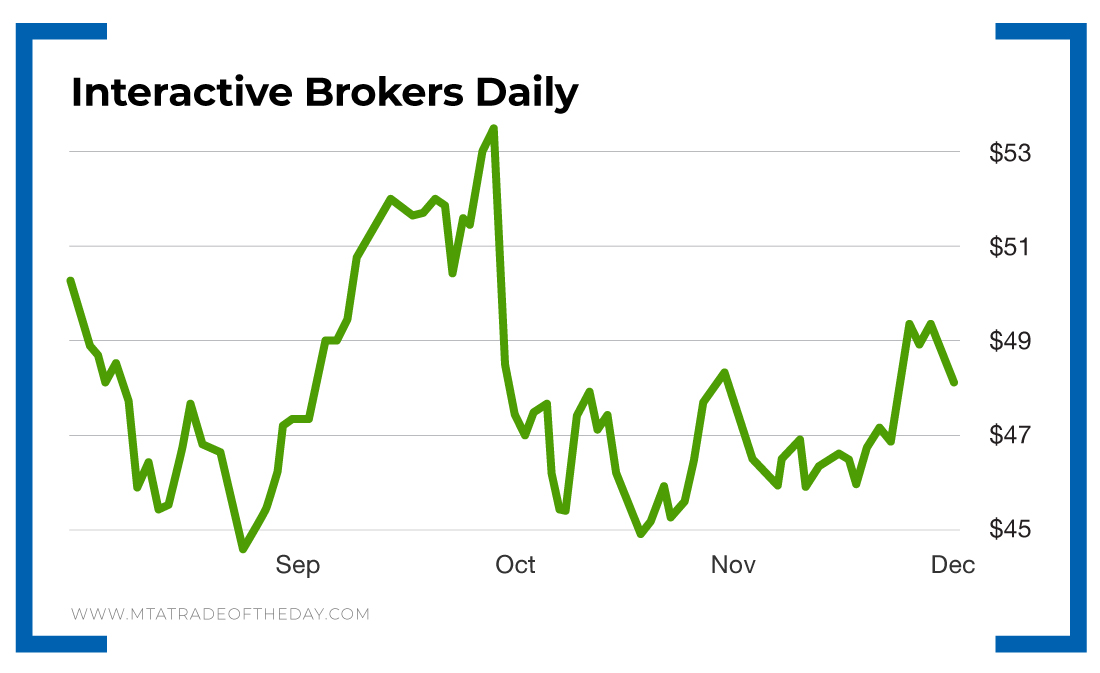

Founded in 1977 and headquartered in Greenwich, Connecticut, Interactive Brokers has moved up only 4.8% – from $46 to $48.25 – on the news of this massive brokerage consolidation.

But if you take a closer look, you’ll see that Interactive Brokers is the one that should be receiving most of the investor attention.

First off, like most of its competitors, the company began offering commission-free U.S. stock and exchange-traded fund trading in September via a new service called IBKR Lite.

I really like Interactive Brokers’ “Interactive Advisor” feature, which offers advancements such as robo-offerings that allow you to invest in a globally diversified portfolio that continually rebalances itself.

But what I like most is its fractional stock trading feature. For instance, if you don’t have $1,880 to buy one share of Booking Holdings, Interactive Brokers allows you to buy a fractional share – thus eliminating any barriers to investing in more expensive securities.

Lost in all the recent brokerage hoopla is the fact that Interactive Brokers is the one name that’s truly making advancements worthy of your investment capital.

Action Plan: As a “sympathy” play, buying Interactive Brokers stock around the $47 level seems like a logical and safe entry point. With its new innovations – such as buying and selling fractional shares – combined with the major deals now occurring between Charles Schwab and TD Ameritrade, Interactive Brokers is an investment that makes a lot of sense.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.