A Big Threat Is Coming for Monster Beverage

Speaking from a personal perspective, I’ve never understood (let alone liked the taste of) the so-called “energy drinks” that you see flooding the market these days.

Loading up a carbonated beverage with sugar and caffeine – and calling it an “energy drink” – shouldn’t be a big breakthrough.

Specifically, two cans of Monster Energy contain 480 milligrams of caffeine, which translates into the caffeine equivalent of 14 12-ounce cans of Coca-Cola!

It’s not hard to get your heart beating out of your chest with those caffeine doses.

In fact, due to some past lawsuits about these extremely high levels, Monster Beverage (Nasdaq: MNST) now places warnings on all cans, which read “CONSUME RESPONSIBLY: LIMIT 3 BOTTLES PER DAY.”

How can they operate like this?

Well, Monster Beverage markets every product (admittedly) quite well…

Hitting on the extreme sports market, Monster Energy is widely connected to events like BMX, motocross, speedway, skateboarding and snowboarding.

But Monster Beverage will soon have some major competition from another beverage monster… Coca-Cola.

You see, back on July 1, an arbitration panel decided that the introduction and sale of a new line of energy drink products, Coca-Cola Energy, is allowed under the terms of a contract between the companies.

Under the ruling, Coca-Cola can sell and distribute Coca-Cola Energy, including in markets where it has already been launched. Coca-Cola is also free to launch the product in additional markets globally.

I’m bringing this to your attention now because Coca-Cola Energy is getting set to launch this competitive line of products in January. This could be a direct competitive threat to Monster Beverage – as it could shift energy-seeking consumers over to the Coca-Cola brand and taste.

I’ll admit that I’m not the extreme sports enthusiast who drinks these products. However, I believe Coke tastes better than the flavors Monster Beverage is selling right now. If consumers can get the same “energy boost” they want with the flavor of Coke, we might begin to see a shift in consumer preferences starting to take shape. And that’s trouble for Monster Beverage.

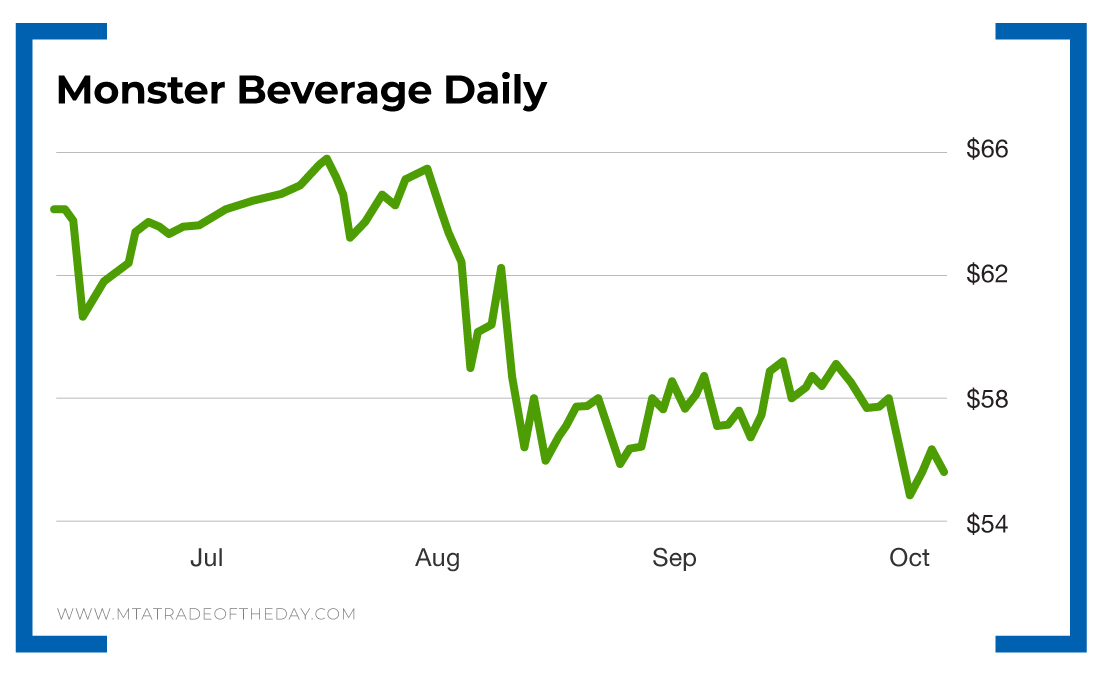

Action Plan: Just this morning in The War Room, members entered into a new Monster Beverage position that they will profit from if there is continued downside from the new Coke energy drink risk.

Sometimes, especially on Wall Street, all it takes is the threat of new competition to drive a stock lower – and that’s what we’re playing off of here. To play along, I invite you to join me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.