A Winning Trade with Crocs

Yesterday in The War Room, a dad joke turned into a winning trade.

And from the looks of things, this particular trade still has room to move.

Here’s the story…

It all started with this post I wrote yesterday afternoon…

Attention! To all the Dads out there who love cutting their grass wearing stained white socks and ugly rubber shoes – and then wearing that same footwear combination out to dinner that same night – this trade is for you. Use the November D15 expiration to move into Crocs (Nasdaq: CROX).

You probably know what I’m talking about. Crocs sells “casual lifestyle footwear and accessories for men, women and children worldwide,” including clogs, sandals, flip-flops, slides and boots.

Crocs are currently sold in more than 90 countries through 120 retail stores, 68 kiosks, 195 outlet stores and 13 company-operated e-commerce sites.

With Crocs set to report earnings, I knew the stock was setting up for a big move. After all, the company’s last three earnings reactions were one-day moves of 16%, 12% and negative 2%. That’s why I issued a trade.

But which way would the moves go?

For us, it didn’t matter. We were simply playing a big move in either direction.

As it turned out…

Crocs confirmed that ugly plastic shoes are back in style.

The company reported a strong “beat and raise” quarter in which adjusted earnings per share came in at $0.57, which was well ahead of the FactSet guidance of $0.39.

Revenue totaled $312.8 million, which was up from $261.1 million – and beat the $302 million expectation from FactSet.

And for the full year, CEO Andrew Rees said that revenue is expected to grow 11% to 12% year over year – up from previous guidance of 9% to 11% growth. This would represent an annual sales record, he said.

Not only that, but Crocs reported today that award-winning actor, activist and entrepreneur Priyanka Chopra Jonas is the newest face of the brand – acting as global brand ambassador for the 2020 “Come As You Are” campaign.

My wife also tells me that Ariana Grande wears Crocs, which is sparking a comeback among the younger set. Combine that with the current lineup of global ambassadors like the quirky Zooey Deschanel, Suzu Hirose, Kim Se-jeong and Gina Jin – and you’re looking at a perfect time for a fashion upsurge going right into the holiday shopping season.

But here’s what I really like about Crocs…

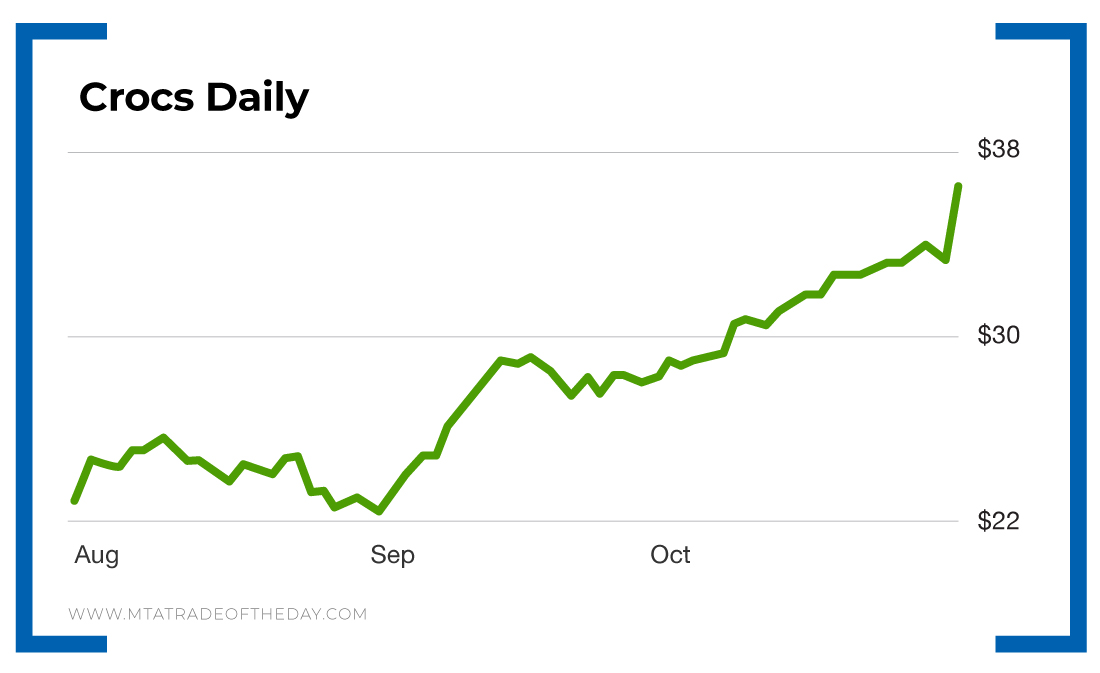

Action Plan: Going into yesterday’s close, Crocs shares were dropping. The shorts were getting ready to pounce on a weak earnings report. But now the script has been flipped. Right now the company carries a short percentage of 13.3%. This means that all those who were short yesterday – and licking their chops in anticipation of a fall – might decide to cover their positions today, which could lead to a “short squeeze” effect. If so, Crocs has room to run higher, which is a perfect storm headed into the holiday shopping season. As you can see, Crocs has been on quite a run. But from the looks of things, it’s going even higher.

If you want to start making winners each trading day, you’re invited to join me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.