A 13% Yielder That’s No Longer the Worst I’ve Ever Seen

The last time I wrote about AGNC Investment Corp. (Nasdaq: AGNC), I called it the worst dividend safety rating I’d ever seen.

I concluded that AGNC cutting its dividend seemed like a sure thing.

Less than a year later, AGNC lowered its dividend 11%, to $0.16 per share from $0.18. It was the eighth time it had slashed the dividend in the past 10 years.

Is dividend cut No. 9 coming soon?

If history repeats? Yes.

The good news is that AGNC no longer has the worst dividend safety rating I’ve ever seen. It’s not good, but it’s no longer the worst.

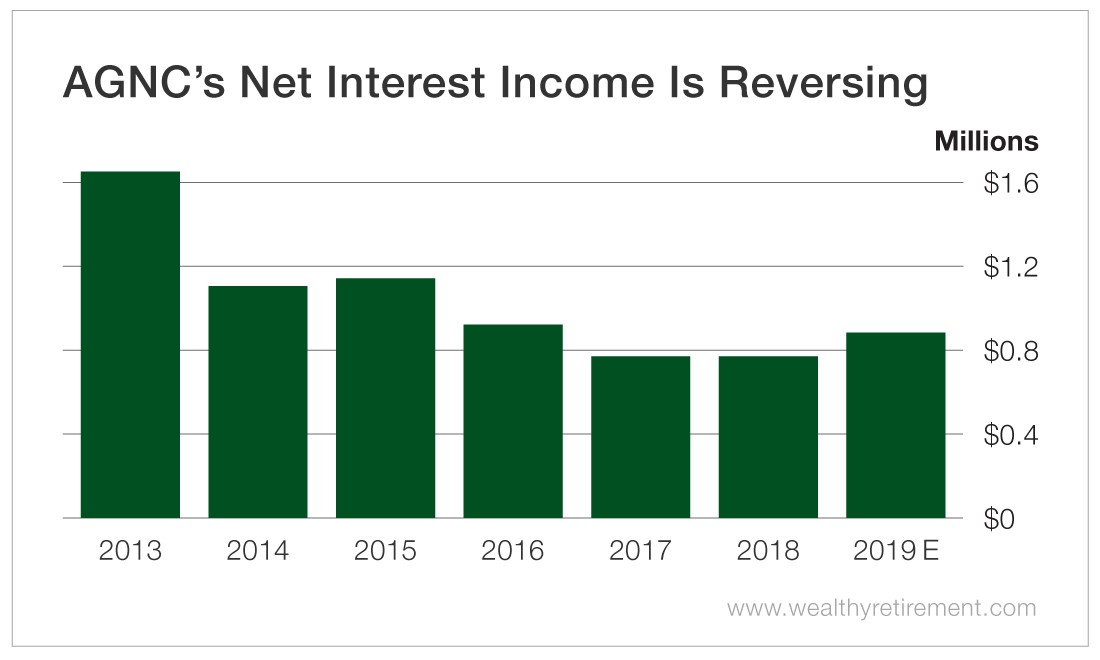

The one positive is that net interest income (NII) rose last year and is expected to rise again in 2019.

NII is how we determine whether mortgage real estate investment trusts (mREITs) can pay their dividends. It’s like cash flow for a regular corporation.

NII is the difference between how much money the mREIT collects in interest and how much it pays in interest to borrow the funds it lends out. Then expenses are subtracted.

Last year, AGNC’s NII was, surprisingly, slightly higher than it was in 2017. And in 2019, it is expected to climb again.

While a higher expected net interest income is certainly a good sign, it still doesn’t cover the dividend. Last year, AGNC paid $974 million. This year, because of a higher share count, that total is expected to climb to $1.1 billion.

So AGNC is still $200 million short of affording its dividend.

Growing revenue is a positive. Not being able to afford the dividend is a big negative, especially when combined with a horrid track record of slashing the dividend year after year.

AGNC no longer has the worst dividend safety rating I’ve ever seen. But it’s still bad.

I expect another dividend cut within the next 12 months.

Dividend Safety Rating: F

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.