Banks Are in a Dangerous Race to Zero

Our neighborhood block party was this past Saturday.

Every August my neighbors and I apply for a permit from the county (that’s my job), we block off the street with a few traffic cones, we set up grills and beer-filled coolers, and we have a street party.

I always look forward to this event as a chance to catch up with neighbors I enjoy but rarely see.

There’s one guy who, every year like clockwork, asks for my outlook on the economy and the financial markets. I’m always happy to provide it, with the caveat that I’m no market guru (for that, I tell him, become an Oxford Club Member).

This time he had a question about a piece he had just read online about zero and even negative interest rates being adopted by central banks around the world. He read that the purpose of negative rates – when lenders have to pay borrowers interest – is to get people and businesses to start borrowing and spending, rather than saving. If the policy succeeds, it should boost consumption and investment and spur economic growth.

So, there’s a race to zero – and beyond! – going on among the world’s central banks. More than 30 of them around the globe have cut interest rates already this year. And more are guaranteed to come.

Several are already in negative interest rate territory, including the Bank of Japan and the central banks of Sweden, Switzerland and Denmark. The European Central Bank (ECB), which sets policy for 19 nations and oversees the euro, currently has a negative deposit rate. More cutting is expected later this year from the ECB.

Other major central banks are doing their best to keep up. The People’s Bank of China, the Reserve Bank of India, and the South Koreans and Russians are hacking away at rates.

The Federal Reserve – the most important of them all – cut its target rate in July despite the fact that U.S. unemployment is near a half-century low.

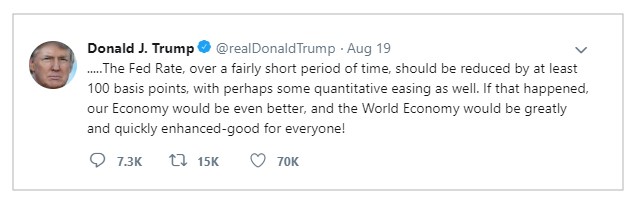

The cheerleaders rooting on this race to the bottom are vocal ones indeed. Chief among them is President Trump, who routinely badgers – and berates – Fed Chair Jerome Powell for his unwillingness to cut rates fast and furiously.

Trump brags about the strength of the U.S. economy on one hand, and on the other he urges the Fed to slash its target rate by 100 basis points (that’s 1 percentage point – the rate currently sits between 2% and 2.25%).

So back to my neighbor. “Do these zero and subzero interest rates really work?” he wanted to know.

It’s not a yes or no question, unfortunately. And, of course, there’s a wide variety of opinions on the matter, as interest rates affect the economy and currencies in many different ways.

In tricky situations like this one, I often look for a metaphor. This time, fortune smiled on me with a perfect one smoldering right in front of us.

The block party was just getting going, and another neighbor was starting his grill. While many of us use propane, he insists on charcoal because he says it gives the meat a better flavor. Fair enough.

But he was struggling to get this fire to sustain itself.

So, every five minutes or so he would douse his coals with yet more lighter fluid. Sure enough, the flames flared in a satisfying mini-inferno every time. (One time he was a bit too close and I worried he would singe his eyebrows!) I can’t say I didn’t enjoy the spectacle.

But the problem with this unwilling fire wasn’t a lack of accelerant. After all, he had used an entire bottle of the stuff.

In fact, the charcoals were arranged poorly – they were too spread out to get the sustained ignition needed to cook those burgers and brats.

The fire, a grilling economist might say, didn’t need more cheap stimulant. It needed a structural reform. The charcoals needed to be concentrated in a pile, perhaps using a chimney starter. Had the fire been constructed correctly, just a bit of lighter fluid would have done the trick.

The same goes with many of these sluggish economies in need of a boost.

Instead of throwing more cheap money at consumers and businesses in hopes they’ll go on a spending spree, governments should improve their business environments with smarter regulations and less red tape. They should make labor markets more flexible so companies are willing to hire (especially in Europe!). And they should simplify their tax systems so companies and individuals can effectively plan for the future.

There is no shortage of ways to make an economy more efficient and productive. The supply of lighter fluid, by contrast, is bound to run out.

[adzerk-get-ad zone="245143" size="4"]About Matt Benjamin

Matt has worked as an editorial consultant to the International Monetary Fund, the World Bank, the Economist Intelligence Unit and other global macro-institutions. He wrote about markets and economics for U.S. News & World Report, Bloomberg News and Investor’s Business Daily, among other publications. He also worked for several years as head of political economy for a Financial Times-owned macroeconomic consulting firm, advising hedge funds around the world. Matt’s claim to fame is that he’s interviewed two U.S. presidents and has spoken with five Federal Reserve Chairs from Paul Volcker through Jerome Powell. Matt also served as The Oxford Club’s Editorial Director for two years.