Carl Icahn Reveals Profit Opportunity With Conduent

Sometimes a look at Schedule 13D filings made with the Securities and Exchange Commission (SEC) can lead to great moneymaking opportunities.

A Schedule 13D must be submitted to the SEC within 10 days by anyone who acquires beneficial ownership of more than 5% of any class of publicly traded securities in a public company.

These documents give the public transparency into purchases that large shareholders make in any public company. More importantly, they often contain hints about potential future events at the company, including hostile takeovers, company breakups or any other “change of control” situations.

That’s why I’m bringing Conduent (NYSE: CNDT) to your attention today…

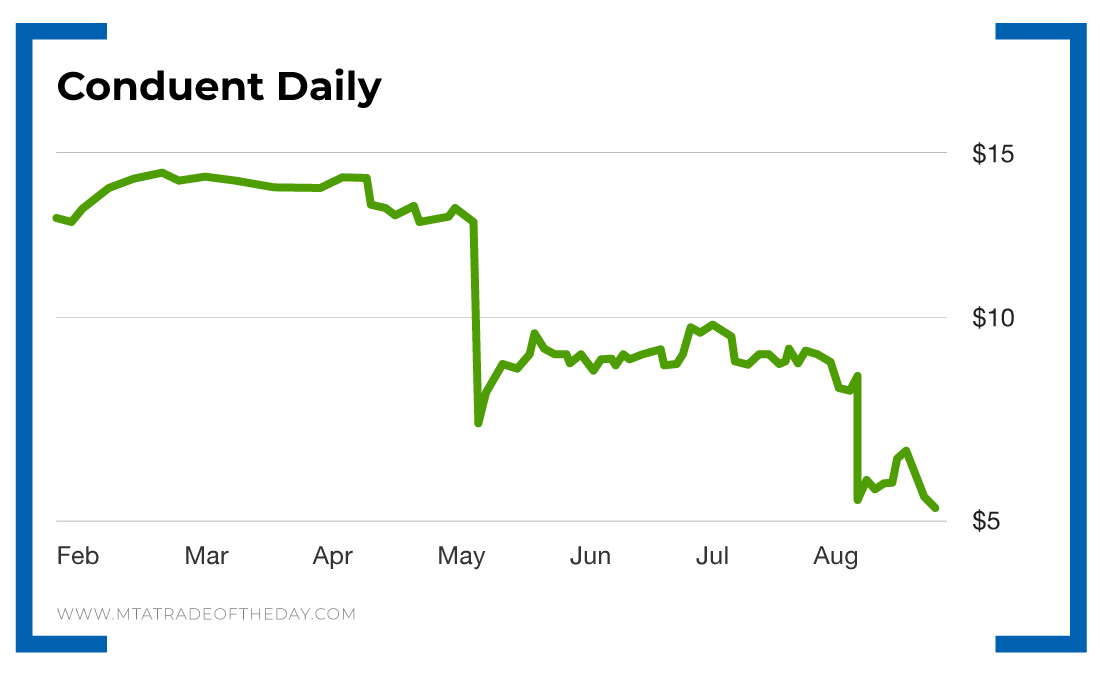

With a market cap of just $1.32 billion and a stock price around $6.15, Conduent isn’t a name you hear often in the financial media.

That’s what makes this story even more enticing…

Essentially, Conduent is a digital interactions company. In Southern California, it helps public transit systems operate their fleets to maintain on-time service for its passengers.

Conduent recently signed two new contracts that will upgrade hardware and software for buses in the San Diego Metropolitan Transit System, the North County Transit District and key parts of Orange County Transportation Authority’s system. The company’s computer-aided dispatch and automatic vehicle location technology will help assist drivers with routing and keep buses on schedule.

Conduent has exposure to Los Angeles County, where it has modernized the tolling system on Metro ExpressLanes. The new automated technologies will save drivers time while reducing congestion – thus improving safety on both the I-10 and I-110 corridors.

Back on August 16, Carl Icahn disclosed that he increased his stake in Conduent to over 38 million shares, after adding 1.9 million shares to his holdings on August 14 for $6.57 each. He now owns more than 18% of the outstanding stock.

This new buy came without the company citing any new plans or proposals – just a straight stock purchase of 1.9 million shares.

Action Plan: Is Carl Icahn up to something with Conduent? It’s impossible to say, but his actions – which you can extract from Schedule 13D disclosures – sure indicate that the answer is yes.

With the stock trading near a 52-week low around $6, it might be worth a small nibble to join Icahn and add some shares here. For exact buying and selling instructions and insight into more profitable opportunities, join me in The War Room!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.