Berkshire Hathaway Announces New Stake in Restoration Hardware, Sets Up Trading Opportunity

On April 2, I published an article, titled “Time to Change My Mind About Restoration Hardware.”

If you acted on this advice, you’re a lot richer today.

Here’s a quick review…

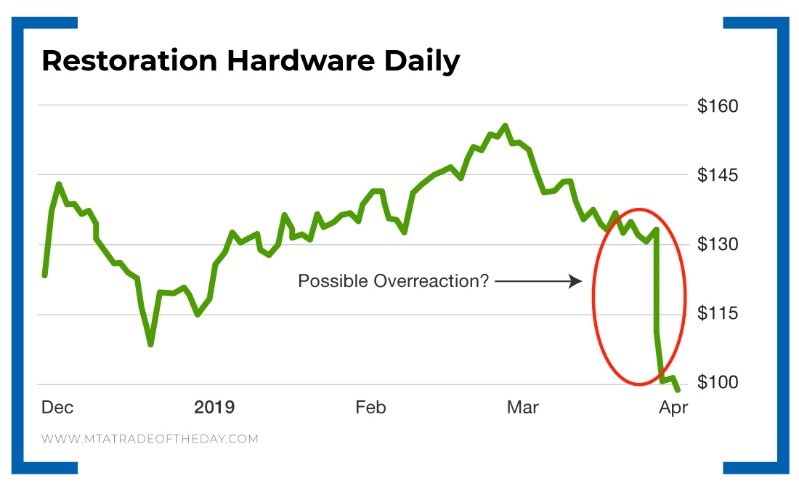

In April, I noticed that Restoration Hardware (NYSE: RH) shares were falling on earnings – and reported:

Last week, shares of the company fell more than $28 after 2019 earnings guidance came in just under $9, against the expectation of $10. Its stock dropped 20% on the news, and management blamed “negative trends in the high-end housing market.”

In response to this drop, I said…

Wall Street (on occasion) tends to overreact. This might be one of those times, and it allows us to get in on a strong stock for a far better price than before… I view this as a second chance to correct my thinking and a second opportunity to get into Restoration Hardware.

On that day, the action plan was simple. I said…

If we can see some stabilization in Restoration Hardware stock, a possible move above $105 might be where I’d start dipping a toe into the water. This earnings overreaction gap has quite a lot of room to fill.

Here’s what the Restoration Hardware chart looked like when this alert was posted:

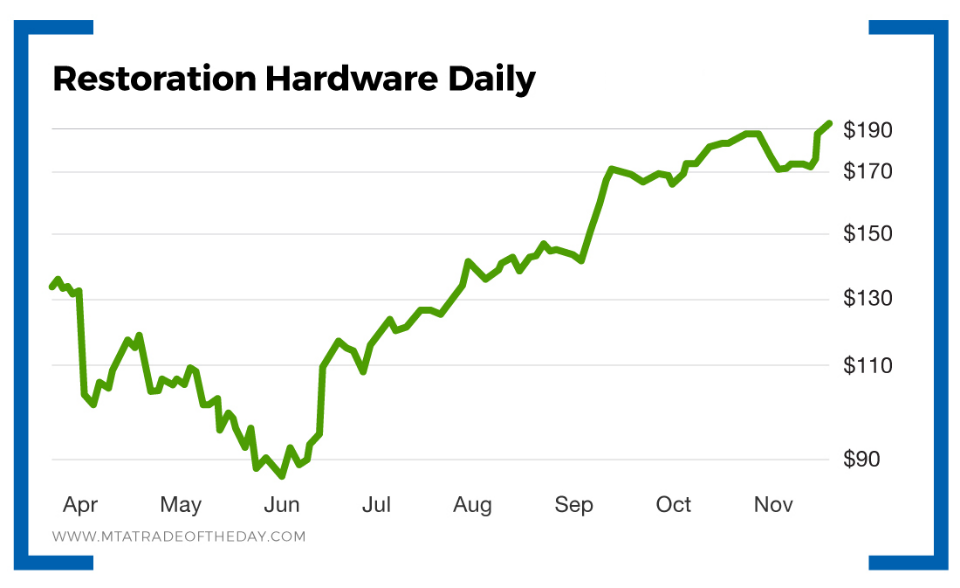

Fast-forward to today…

It was just reported that Warren Buffett – and Berkshire Hathaway – revealed a new investment stake in Restoration Hardware of 1.2 million shares as of the end of Q3.

This investment makes them the fourth largest shareholder in the hardware company – but it’s still considered “small” for Berkshire Hathaway.

So there still could be more to come. On this news, shares of Restoration Hardware are exploding.

Here’s the chart…

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.