Why BorgWarner Is a Company to Watch

Poor BorgWarner (NYSE: BWA)…

With the major market averages hitting new highs – seemingly on a daily basis – this engine parts maker from Auburn Hills, Michigan, has been overlooked and underappreciated all year long.

And no wonder. It makes “solutions for combustion, hybrid and electric vehicles worldwide.”

In other words, BorgWarner manufactures all of the boring components found inside engines – crankshafts, sprockets, four-wheel drive chains and hybrid power transmission chains.

I admit, it’s certainly not a page-turner to read about what the company makes, which is most likely why it’s currently flying under the radar of every analyst.

But today I’m here to tell you that BorgWarner could be one of the best bargains on the market.

Here’s the deal…

BorgWarner operates under two groups: Engine and Drivetrain.

The Engine Group develops turbochargers, hybrid power transmission chains, instant starting systems, coolant pumps, cabin heaters, battery chargers and ignitions.

The Drivetrain Group develops clutch modules, separator plates, transmission bands, electrohydraulic solenoids, rear-wheel drive and all-wheel drive transfer case systems, hybrid electric motors, and uninterrupted power source systems.

Historically, BorgWarner has been a maker of parts for standard, gasoline-fueled engines. But lately, the company has been transitioning into the hybrid market, which could represent the future of its auto parts supply operation.

During this transition period, BorgWarner has been drifting lower. Last week, it reported flat sales and lower guided margins. As a result, shares continued to decline.

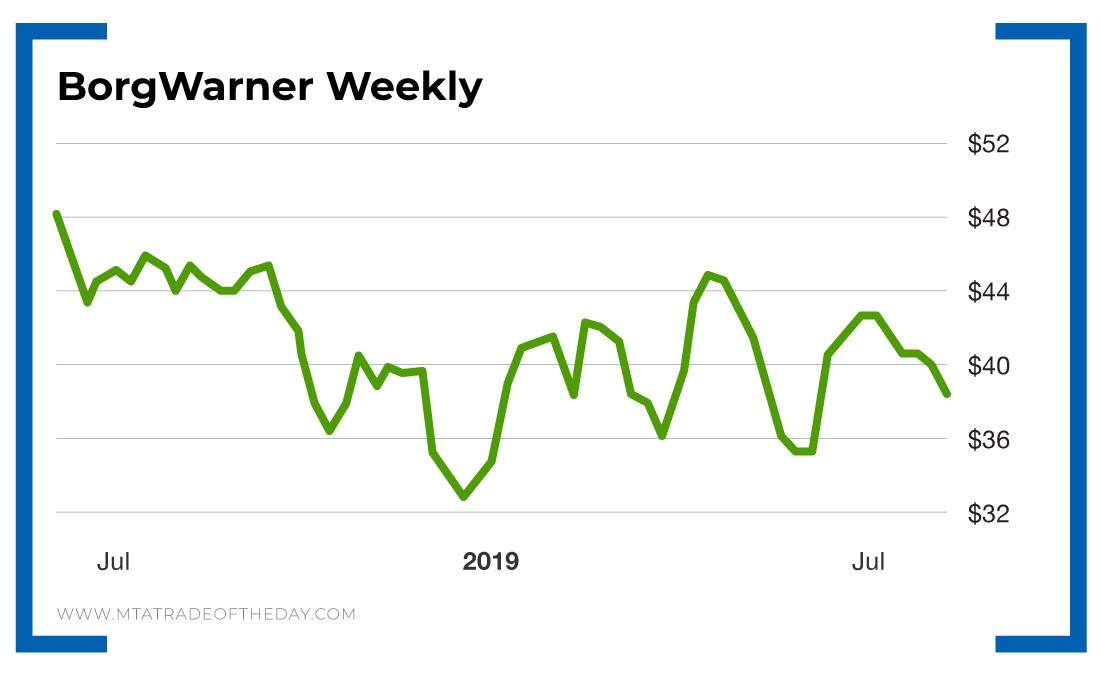

As you can see below, BorgWarner is down 17% over the last 52 weeks – compared with a 7% rise on the S&P 500.

However, if you look at BorgWarner’s numbers, you’ll see that it could potentially be one of the cheapest stocks right now. With a market cap of $7.86 billion and a book value per share of $21.28, BorgWarner currently carries a forward price-to-earnings (P/E) ratio of 8.99.

As a way of comparison, Warren Buffett considers anything with a P/E ratio of 10 reasonably priced – even cheap. Throw in a forward annual dividend yield of 1.79%, and you can get paid to wait for an eventual BorgWarner recovery.

Action Plan: The $36 level has been a strong support area for BorgWarner. As a medium-term play (meaning six months) buying around this support level could represent one of the best “buy low” opportunities this market is offering right now.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.