A Cash Flow Gusher Secures This 6.6% Yield

Oil stocks are about as popular as gangsta rap at a nursing home.

Wannabe tough guy rappers brag about money that they don’t really have. Meanwhile, investors in oil stocks are (to quote Rakim, one of the greatest rappers of all time) “paid in full.”

Climate change and the negative impact of burning fossil fuel have oil companies out of favor. College students protest their existence, and some investment managers shy away from them for social reasons.

Yet despite low oil prices, these companies continue to generate tons of cash flow.

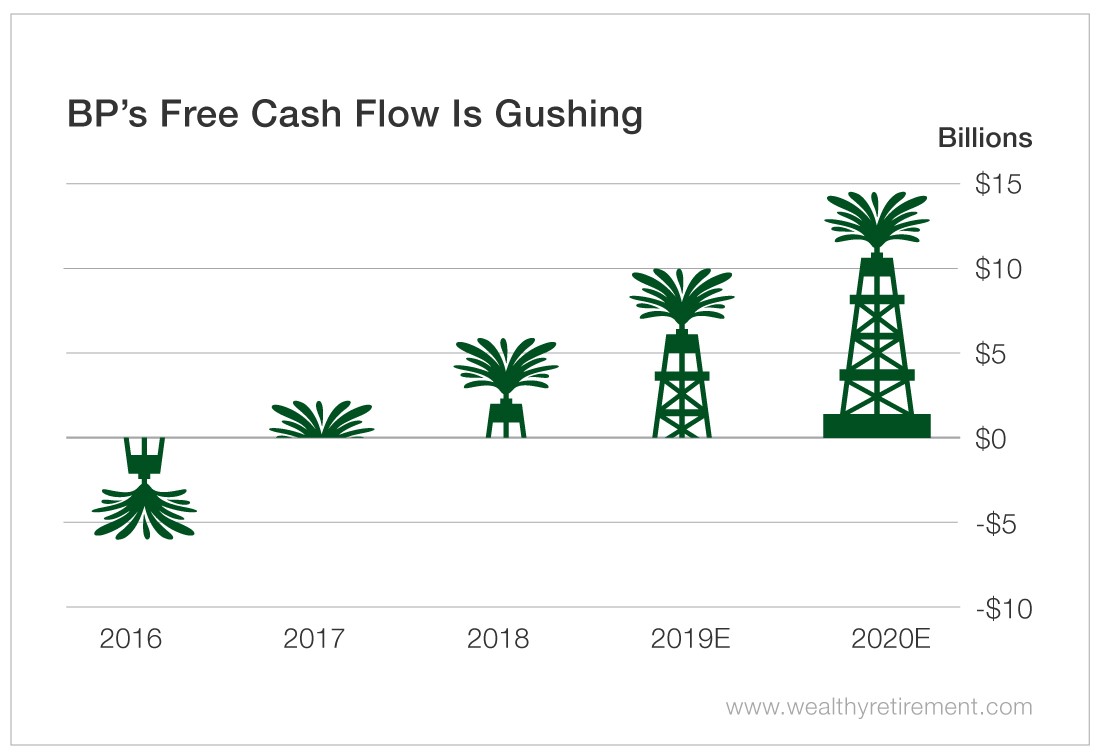

I last covered BP (NYSE: BP) in Safety Net back in February. At the time, the company was expected to generate $10.9 billion in free cash flow while paying out $6.7 billion in dividends.

That cash flow estimate for 2019 has come down to $10 billion, but that still easily covers the now $6.6 billion dividend forecast.

Next year, cash flow is predicted to soar to $14.8 billion. Earnings are forecast to rise 15% and double that figure over the next five years. Over the next three years, free cash flow is projected to more than triple.

As free cash flow climbs next year, BP’s payout ratio is expected to fall from 66% to 44%. So the payout ratio is well below SafetyNet Pro’s 75% threshold.

We want to see less than 75% of cash flow paid out in dividends to give us confidence that a company can continue paying its dividend during tough times.

The only blemish on BP’s dividend safety is that it eliminated the dividend for three quarters in 2010 after the Deepwater Horizon oil spill.

Barring another disaster, which is always a risk in the oil business, BP’s dividend should be as safe as a mint condition Run-D.M.C. vinyl record at my mother’s house.

In other words, no one is going to touch it, so it should be just fine.

Dividend Safety Rating: B

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.