Brexit Trade With the iShares MSCI United Kingdom ETF

Buy on the rumor and sell on the news is a very good strategy to live by on Wall Street.

At the first inkling of a Brexit deal, Royal Bank of Scotland shares shot up, and the options followed. But there was a pause as both parties, the U.K. and the European Union, walked back the timing of any deal.

There were still unresolved issues. Was there a second chance to cash in here?

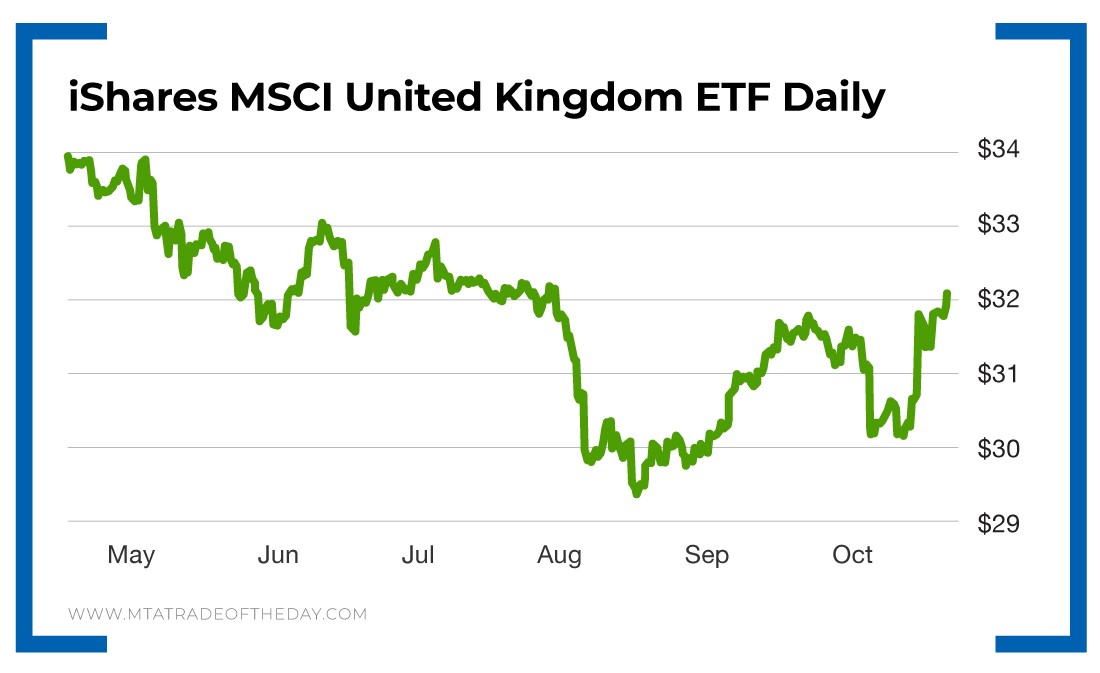

Wednesday, I recommended another Brexit trade. This was a super-cheap play on the iShares MSCI United Kingdom ETF (NYSE: EWU).

The reasoning behind this was the fact that today was the deadline the EU had set to come to an agreement. That gave members the perfect opportunity to go for a major win on the ETF play if such a hard-and-fast agreement were announced.

The risk was around $0.15 per contract, and the upside could have been a multiple of that – a perfect speculation… resulting in a low downside and huge upside!

The iShares MSCI United Kingdom ETF moved up 1%… hardly what I would classify as a monster move higher. This muted move on such positive news was, in my opinion, an indicator that the deal was still weak.

The options I recommended were up very slightly, but up nonetheless. The huge speculation was not materializing into big gains. Members who chose to do so did the right thing by selling their positions. Since the price of entry was so low, others may have hung on to a position.

There is an important lesson here…

If you are going to speculate, do it very cheaply, and if the desired outcome doesn’t happen right away, bail and preserve capital to speculate on another day.

The play could easily have gone much, much better, and it still might. But the market is sending us a signal that there may not be as big of a bang left in the Brexit play as we once thought.

Action Plan: The saying “Bulls make money, bears make money… but pigs get slaughtered” is just as true on Wall Street as it is in The War Room.

The ability to jump in and out of a trade using real-time information on a real-time platform proves invaluable. It’s time you got in on the game.

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?