Financial Literacy

What is a Bear Put Spread?

January 3, 2022

A bear put spread is a strategy in which investors stack puts to hedge against an unexpected upturn in the stock’s price.

What is Behavioral Finance?

January 2, 2022

Behavioral finance examines several psychological concepts and applies them to how today’s investors behave in public markets.

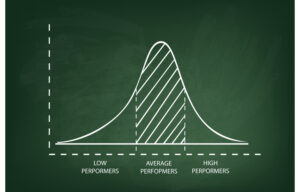

What is a Bell Curve?

January 1, 2022

A bell curve is a visual representation of normal data distribution, in which the median represents the highest point on the curve.

What are BAT Stocks?

December 31, 2021

BAT stocks mark the rise of Chinese tech stocks and their growing prevalence in investors’ portfolios in the United States.

What is a Bear Call Spread?

December 29, 2021

A bear call spread is simply a vertical call spread that bets on poor price performance. It’s sometimes called a credit spread.

What is a Backdoor Roth IRA?

December 28, 2021

A backdoor Roth IRA is effectively a strategy for making traditional IRA contributions, then converting them into Roth contributions.

What is a Balanced Fund?

December 27, 2021

Balanced funds have this title because, unlike more aggressive portfolios, they have both equity and bond components to consider.

What is a Bear Hug in Business?

December 26, 2021

A bear hug in business involves offering to buy a company’s shares at a significant acquisition premium, well-above the current market price.

- « Previous Page

- 1

- …

- 11

- 12

- 13

- 14

- 15

- …

- 91

- Next Page »