Cluster Buying Strikes Again With AbbVie

A few weeks ago, I noticed a large insider buy at AbbVie (NYSE: ABBV), the giant pharmaceutical company that sells best-of-class drugs like Humira. It caught my eye, as the buy was for more than $1 million.

But that was not enough for me to issue a buy alert to War Room members.

One insider buy doesn’t represent anything unless it’s followed up by more buying from other insiders, especially officers of the company.

When only one insider buys shares, even if he or she makes multiple purchases, it’s not a good indication of anything more than faith in the company and a potential higher move on the horizon.

A single insider making multiple buys is more often than not a founder or major holder of the stock. Richard Kinder, co-founder and executive chairman of Kinder Morgan (NYSE: KMI), is an example of someone who makes these kinds of buys. Kinder often buys millions of dollars’ worth of shares in his own company. And the share price performance hasn’t really established any type of trend regardless of these purchases.

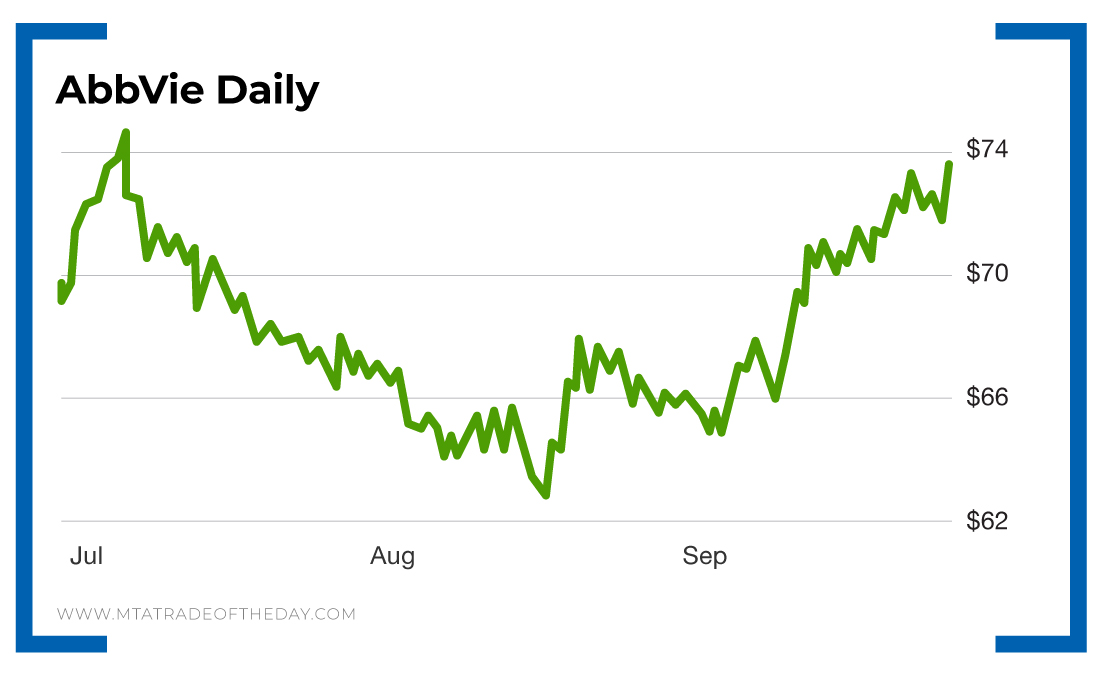

In the case of AbbVie, the insider buying has been sporadic… until now.

In the weeks following the first buy at AbbVie, several more insiders bought…

And they bought a lot! Since that first purchase in June, several insiders together bought more than $13 million worth of stock.

When several different insiders buy at varying prices over a short period of time, it’s called cluster buying… one of the best signals you can get about a stock and its direction.

As soon as I saw the latest insider buy, I formulated a trade recommendation to buy Long-Term Equity Anticipation Securities (LEAPS) on AbbVie.

My thinking was that we would jump in the trade, and if the shares moved higher in the short term, we would “leg in” to a spread to get our money off the table.

“Legging in” is a common strategy used to reduce the overall cost in a trade. This could take days, weeks or even months, which is why we use long-term options.

When you leg in to a spread, you sell options against the options that you own, similar to a covered call trade.

The play results in you taking some money off the table while limiting your upside to the spread (the dollar difference in the strike price between the calls you bought and the calls you sold).

AbbVie is a very strong company fundamentally. Because it is in the pharmaceutical sector, it has some volatility that can create quick profits… or losses. So we have to act fast to buy or engage a spread at the right time.

Action Plan: The War Room is the only place to beat the market to the punch in real time.

To learn more about the spread strategy and investing in high-quality situations like AbbVie’s, join us in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?