6 Consumer Staples Stocks to Watch in 2021

The stock market keeps on hitting new highs. Although, consumer staples stocks haven’t been leading the charge. Relative to big tech and some other sectors, consumer staples are undervalued.

As a result, you can buy the defensive stocks below at a discount. They can help provide stability in your portfolio, along with a steady stream of income. Most of their dividend yields aren’t huge… but they’re still hard to beat in our low-interest-rate world.

On top of that, most of these companies have a long history of increasing their dividends…

List of Consumer Staples Stocks

- Procter & Gamble (NYSE: PG)

- Kraft Heinz (Nasdaq: KHC)

- Altria Group (NYSE: MO)

- General Mills (NYSE: GIS)

- Coca-Cola (NYSE: KO)

- Archer-Daniels-Midland (NYSE: ADM)

If you’re worried about inflation, these stocks can provide a great long-term hedge. They have the ability to pass along increasing costs to their customers.

To start out, let’s look at why the consumer staples sector is one of the best areas to invest. This might help put things in perspective. Furthermore, we’ll dive into each of the top six stocks and why they made the cut.

Why Buy Consumer Staples Stocks?

Consumer staples companies make and sell basic goods. These products include shampoo, laundry detergent, toothpaste, toilet paper, cigarettes, soft drinks and mouthwash.

No matter what the market is doing, people keep buying these basics. If commodity prices jump, these companies simply raise their prices… and their customers keep buying. It’s a safe and reliable business model.

Many of the world’s top investors buy into consumer staples stocks. Warren Buffett holds many of them in his portfolio. And you can easily do the same.

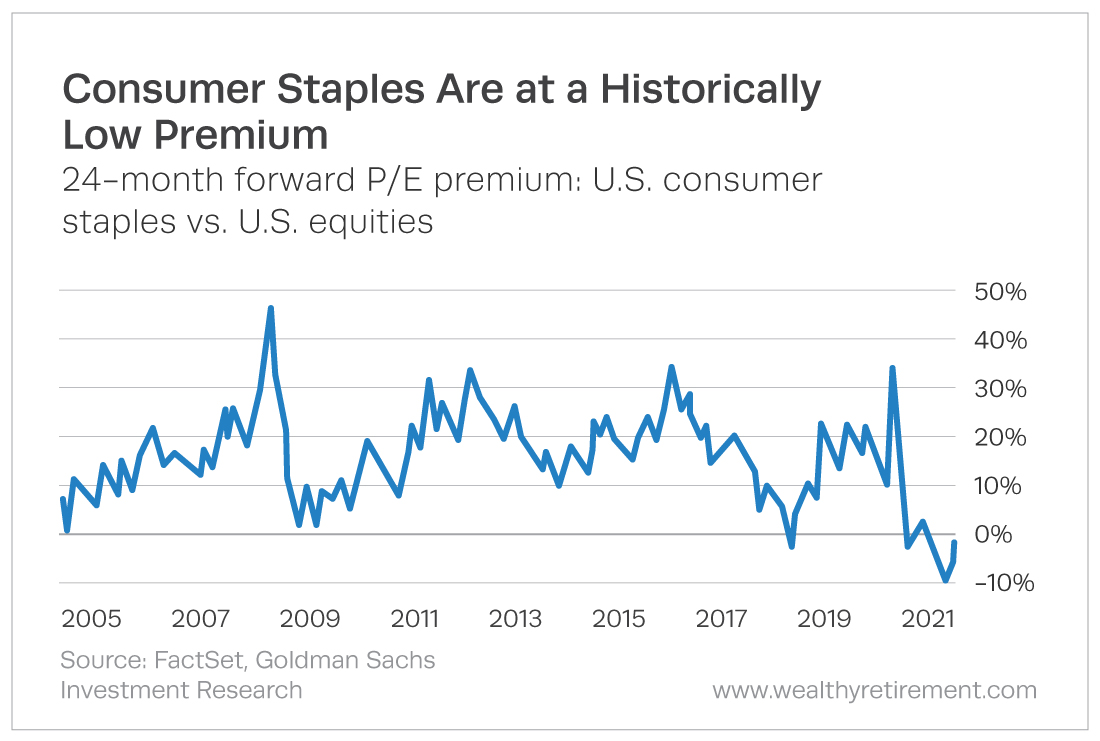

On top of this, consumer staples are cheap relative to the rest of the stock market…

Usually, these high-quality stocks trade at a big premium to the rest of the market. But today, they don’t. This is a great buying opportunity, and here are some highlights for the top companies to consider…

Top 6 Consumer Staples Stocks

Procter & Gamble Is in Your Home

With hundreds of different products, you’re likely already a consumer of Procter & Gamble’s goods. Its portfolio of brands includes Bounty, Tide, Downy, Gillette, Old Spice, Head & Shoulders, Herbal Essence, Febreze, Mr. Clean, Swiffer, Crest and many more.

No matter what the market is doing, people will continue to buy these products. This makes Procter & Gamble one of the safest stocks around. And as mentioned, it also has the ability to pass along increasing costs to customers.

With this pricing power and stability, Procter & Gamble has a long track record of paying bigger dividends. It’s raised its dividend each year for more than 60 years. That easily makes it a dividend king and a reliable dividend stock.

Kraft Heinz Is Warren Buffett-Approved

Kraft Heinz has had a rough run over the past five years. After a merger, its reorganization and high debt levels led to a downtrend. Although, it looks like a turnaround is underway.

Warren Buffett – via Berkshire Hathaway – also still owns a large stake in the company. He hasn’t given up faith in his investment, and Kraft Heinz is in his top five public holdings. So if you believe in Warren Buffett’s strategy, this might be one of the top consumer staples stocks.

On the dividend side, there was a cut a few years back. Although, even with the depressed share price, the dividend yield still comes in well above 3%. If it returns to dividend increases, this could be a great income play for years to come.

Altria Group Is a Top Sin Stock

Altria Group doesn’t have the best public image. It’s a sin stock that sells tobacco products. Although, for investors, that means a recurring customer base and steady cashflows. No matter what the market is doing, Altria Group continues to profit.

It’s a reliable business… but the tobacco industry is still in a long-term downtrend. To counter this, Altria Group is pushing into new frontiers. In 2018, it spent $1.8 billion to buy a large stake in a cannabis company. Altria Group is using its legal expertise to help push this new industry forward.

These efforts will hopefully help Altria pay bigger dividends for many years to come. Nonetheless, its legacy business won’t be disappearing anytime soon and it has steady cashflows. This makes it one of the best high-yield consumer staples stocks to consider buying.

General Mills Is More Than a Breakfast Staples Stock

General Mills makes and sells a wide range of foods. Many customers know the company for its cereals, such as Cheerios, although it also sells baking products, fruit, ice cream, pizza and snacks.

This lineup of food products makes it a well-diversified company. If one brand falls, the others can help keep cash flowing. One big push in recent years was the acquisition of Blue Buffalo Pet Products for $8 billion. This provides further diversification into a growing market.

As far as dividends, General Mills also has a solid track record. It’s paid dividends since 1898. And over the past 10 years, it’s raised its dividend nine times. The recent payout ratio also looks healthy.

Coca-Cola Is Another Buffett Favorite

You can find Coca-Cola’s products in more than 200 countries and territories. The company has also expanded beyond soft drinks. It sells waters, juices, coffees and teas. As consumer trends change, Coca-Cola helps to lead the charge.

Warren Buffett bought $1 billion worth of Coca-Cola stock back in 1998. And today, it remains one of his largest public holdings. Through multiple market crashes, Coca-Cola has survived and thrived.

This long history – along with Warren Buffett’s stamp of approval – makes it one of the best consumer staples stocks around. The dividend yield comes in around 3% as well.

Archer-Daniels-Midland Is a Big Ag Play

This company is a huge agriculture business that provides valuable inputs for other consumer companies. It’s vertically integrated and uses huge grain elevators, transportation networks and port operations around the world.

This network allows Archer-Daniels-Midland to buy, store, clean and transport agricultural commodities. Its global scale helps manage costs to stay competitive. This company is also one of our top agriculture stocks to beat inflation. You can click on that link to find the other investing opportunities.

New Insight and Investing Opportunities

The consumer staples stocks above have long track records. If you’re looking for steady income, they might be a good fit for your portfolio. Although, you should always do your own due diligence before investing. For even more investing opportunities, check out these articles…

If you’re looking for even more investing research and opportunities, consider signing up for Wealthy Retirement. It’s a free e-letter that’s packed with investing insight. You’ll hear directly from Marc Lichtenfeld, an income expert and bestselling author.

[adzerk-get-ad zone="245143" size="4"]About Brian Kehm

Brian Kehm double majored in finance and accounting at Iowa State University. After graduating, he went to work for a cryptocurrency company in Beijing. Upon returning to the U.S., he started working with financial publishers and also passed the CFA exams. When Brian isn’t researching and sharing ideas online, you can usually find him rock climbing or exploring the great outdoors.