New Retirees Experience a “Spending Surge”

Editor’s Note: In today’s essay, Contributing Editor Aaron Task reveals why conventional wisdom about spending in retirement is misguided.

In fact, many newly retired people experience what’s known as a “spending surge” in their first few years after leaving the work world behind. And many of them aren’t prepared.

But here at Wealthy Retirement, we know how imperative it is to get a clear picture of how much you’ll need to live comfortably in retirement. That’s why we developed our Retirement Readiness Calculator.

This tool is free and takes less than five minutes to use. Take a moment today and give it a shot – and don’t let early retirement spending surges catch you by surprise.

– Mable Buchanan, Assistant Managing Editor

If you’re retired, or planning for it, you’ve probably heard of the 4% rule. It has been a key part of retirement planning since the 1990s.

The big idea: Withdrawing a maximum of 4% of retirement assets per year guarantees most people will not outlive their money.

The 4% rule assumed people would not be retired for more than 33 years, and it was based on a study of stock and bond returns from 1926 to 1976.

The “beauty” of the system was that the 4% number meant people could keep up with inflation without eating into their principal. Most of that 4% was produced by dividends and Treasury coupons.

Now, you’re probably already seeing some issues with this rule:

- Inflation, at least officially, is a lot lower today than it was from 1926 to 1976. However, so are bond yields. (These lower yields lead many people to question whether the 4% rule still works.)

- For a variety of reasons, dividends are lower today than they were during the period that was studied in order to create the 4% rule. The dividend yield of the S&P 500 is currently 1.8%. The long-term average is 4.3%.

- Thirty-three years is a long time for most retirees, but today, people are living even longer. The number of people over age 85 is projected to triple by 2050, according to the AARP Public Policy Institute.

More importantly, perhaps, the 4% rule was designed to provide a consistent stream of income in retirement. But the reality is that most people’s retirement spending is neither consistent nor steady.

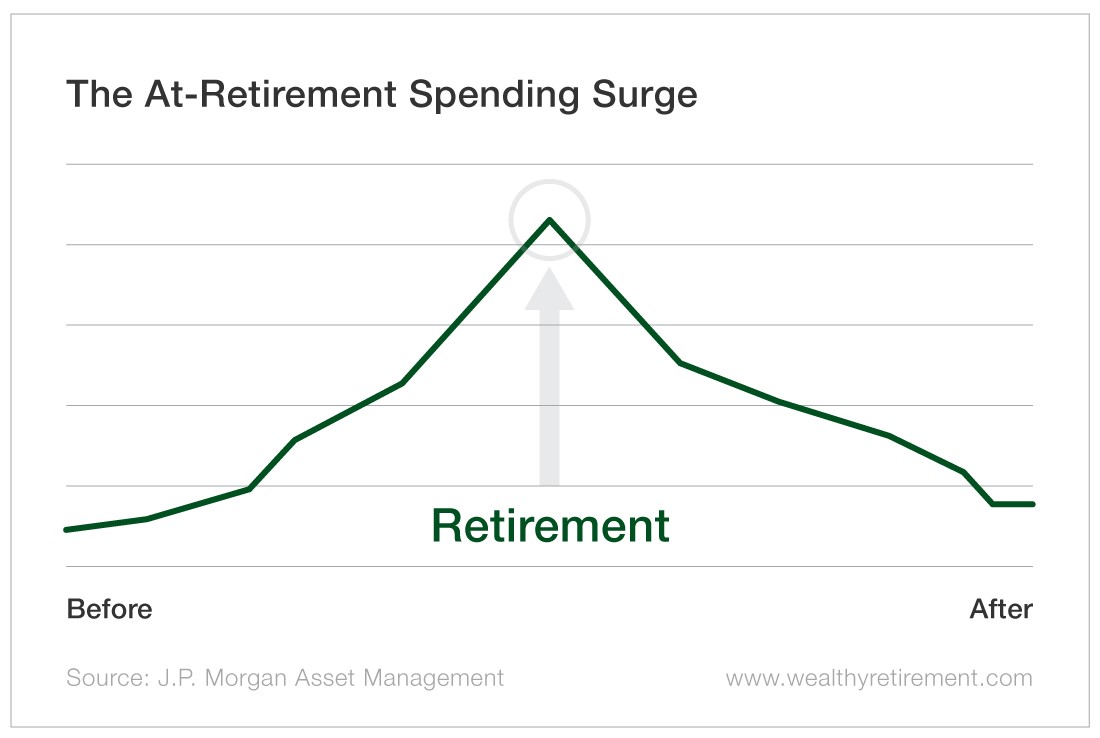

J.P. Morgan Asset Management analyzed the spending patterns of more than 5 million U.S. retirees.

This landmark study found the conventional wisdom about “constant spending” in retirement is wrong.

In fact, there’s “a high degree of retirement spending volatility.” Typically, this takes the form of a “spending surge” right before and immediately after retirement.

This “surge” is often the result of the expenses involved with moving, such as getting a house ready for sale and the purchase of a new residence.

Just before retirement is also when people often choose to get surgery, like a knee or hip replacement. And newly retired people are often the ones to take that “big trip” people have been waiting a lifetime to take – think African safari or riding a modern version of the Orient Express.

Unfortunately, the 4% rule – and conventional wisdom about saving for retirement – isn’t built to address the reality of how people really act (and spend) in retirement.

Now, I know what you’re thinking: Why focus on this surge? People are living longer, and healthcare costs are surging. So aren’t we going to need more (and more) as time goes on in retirement?

Again, J.P. Morgan found the reality is different from our preconceived notions. While spending on healthcare does rise as we age, that spending is “more than offset” by declines in every other category.

Think about it: The older we get, the less we consume and the less we need. An aging relative once declared she didn’t want any presents she couldn’t eat or read.

Also, most people don’t need long-term care for more than a few months. Again, there are exceptions, and healthcare costs can be astronomical if there’s prolonged illness. But J.P. Morgan found that while there’s usually a big spike in end-of-life medical care, it typically doesn’t last long.

And then… well, then you’re really not going to be spending money.

I’m certainly not recommending anyone “save less,” nor am I encouraging you to go on a spending spree in the early days of retirement. Many of us are drastically underprepared for retirement as it is. And everyone’s retirement needs and goals are different.

But rather than keeping your eyes only “on the horizon” and assuming you’ll have a frugal first few retired years to make the money stretch… make sure you’re prepared for a surge in spending. It’s completely normal and not a problem – as long as you know it’s coming.

The point is that there is no one-size-fits-all rule for retirement… nor is there one for pretty much anything else these days. Find a plan that works for you.

[adzerk-get-ad zone="245143" size="4"]About Aaron Task

Aaron is an expert writer and researcher who formerly served as editor-in-chief at Yahoo Finance, digital editor of Fortune, and executive editor and San Francisco bureau chief of TheStreet. You may have also seen him as a guest on CNBC, CBS This Morning, Fox Business, ABC News and other outlets.

A prolific writer and commentator, Aaron is the former host of Yahoo Finance’s video program The Daily Ticker. He has also hosted podcasts for Fortune (Fortune Unfiltered) and TheStreet (The Real Story). His latest on-air passion project, Seeking Alpha’s highly rated Alpha Trader podcast, features top Wall Street experts dissecting the market’s latest news and previewing significant upcoming events. He also regularly provides analysis for the free e-letter Wealthy Retirement, which we will be republishing here on Investment U.