Dental Board of California Creates Unique Stock Play in SmileDirectClub

If you’ve ever had braces or a retainer…

Or if you’ve ever paid for braces or a retainer for your kids…

Then you know the immense cost – and the immense pain in the rear – the entire process entails.

That’s what SmileDirectClub (Nasdaq: SDC) is looking to exploit.

Using a unique methodology that it calls “teledentistry,” SmileDirectClub sales grew 190% last year.

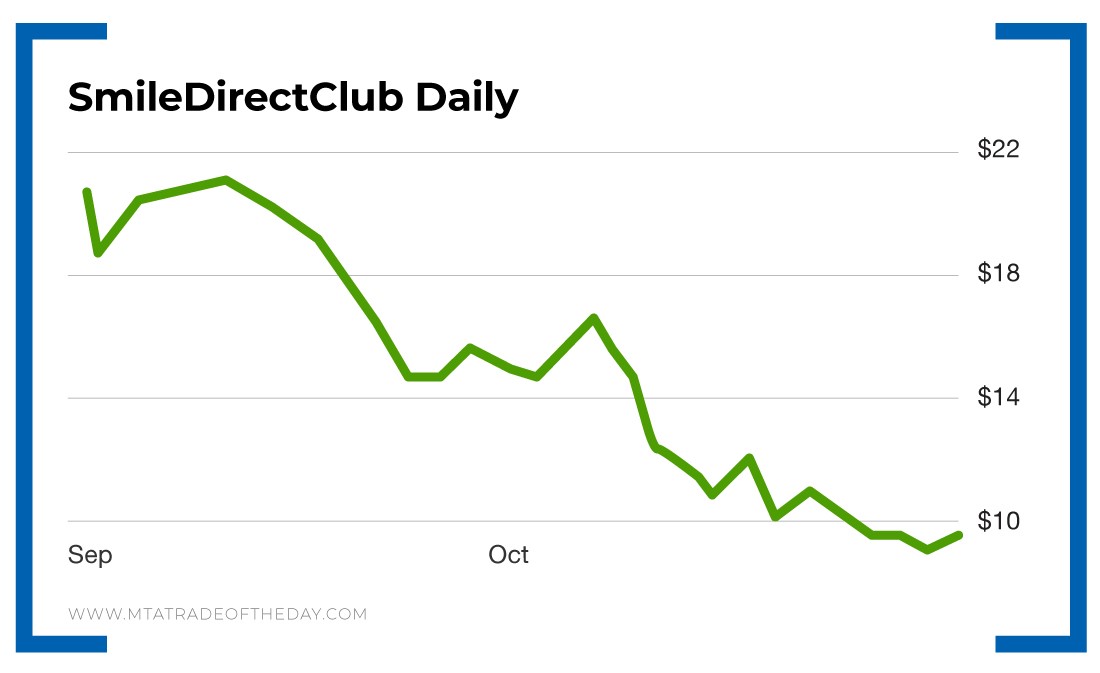

And yet the stock went public at $23 – and currently trades for $9.38.

How does 190% in sales growth equate to a 60% share price loss?

The story is quite fascinating – and could lead to an opportunity.

That’s why I’m bringing it to your attention today.

Here’s the rundown…

As a basic company description, SmileDirectClub provides members with a customized clear aligner therapy treatment both in the United States and internationally.

Think of the company like a disruptive type of orthodontist – much like Netflix disrupted the video rental business in the ’90s.

With a network of 225 state-licensed orthodontists and general dentists through its teledentistry platform, SmileDirectClub manages the entire process – without requiring in-person, monthly visits.

Here’s how the company works…

Step 1: Impressions

First, SmileDirectClub makes a 3D image of your teeth from either a scan at a SmileShop or an impression you take at home using a remote impression kit. This 3D smile is then reviewed by a licensed dentist or orthodontist who will guide the treatment plan (which averages about six months).

Step 2: Alignment Treatment

After the 3D scan is analyzed, the company sends you a kit that includes clear aligners, which are said to be as unique as your fingerprints. And then you begin your treatment from the comfort of your own home.

Step 3: Retainer

After completing treatment, you can check in with your dentist every 90 days (either in person or remotely) and purchase a set of retainers for $99 to keep your new smile in place.

The entire process is shipped to you in one big purple box. It’ll cost a one-time payment of $1,895. Or you can pay a $250 deposit plus $85 a month for 24 months ($2,290 total).

So, clearly, SmileDirectClub is rewriting how dentistry works.

And, as you’d expect, traditional dentists are not happy about this.

That’s where this story gets really interesting…

You see, according to SmileDirectClub, the Dental Board of California has been attempting to regulate areas where it has no authority.

Part of this regulation, according to the teledentistry company, claims that the board has been harassing its customers by “raiding” SmileShop stores without cause, all in an attempt to eliminate the competitive threat.

That’s why lawsuits have now been filed in California from SmileDirectClub against the board. The company claims that this situation “represents the dental lobby’s thinly veiled attempt to protect traditional dentistry at the expense of Californians.”

From an investment standpoint, it would seem like such dramatic measures to curtail the company indicates that the competitive threat is real.

However, here’s the issue…

SmileDirectClub never fully disclosed the entire situation surrounding these lawsuits in its S-1 statements, which has led to fear and confusion among investors.

As a result, in the two months that the shares have been public, the company’s gotten slammed.

Could this mean opportunity?

I think so.

Action Plan: As you know, Wall Street always tends to overreact to news that causes doubt or uncertainty – and this odd situation certainly qualifies. The raids from the Dental Board of California, as far as anyone knows, have not uncovered anything illegal or nefarious.

If SmileDirectClub can find a bottom and bounce above $9.86, that could represent an indication that the worst news is behind it. This would trigger my “first look” at playing an extended bounce. To get in on the action, I welcome you to join me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.