Disney Plus Technical Issues Could Trigger a Pullback With Disney Stock

I have two questions to introduce in today’s Trade of the Day…

First, wasn’t “cutting the cord” supposed to save you money?

Yes…

And second, what’s worse than seeing an endless spinning wheel when trying to get your technology to work?

Nothing…

With both of those questions in mind, let’s look at the situation facing Walt Disney (NYSE: DIS) right now.

Yesterday, Disney launched its new streaming service called Disney Plus.

Add this new streaming service to the current list that’s available to you on the market right now – and here’s what you’ve got:

- HBO: $14.99 per month

- HBO Max: $14.99 per month

- Amazon Prime Video: $8.99 per month

- Netflix: $8.99 per month

- Disney Plus: $6.99 per month

- Hulu: $5.99 per month

- Apple TV: $4.99 per month.

Keep in mind, those are only the introductory prices. Add-ons and additional services cost even more per month.

So as a consumer, how do you make all these à la carte decisions?

Disney Plus has Star Wars – plus 7,000 TV episodes and 500 other movies.

Apple TV Plus has the new Jennifer Aniston newscast show.

Netflix has Stranger Things.

HBO has Hard Knocks, and it’s getting South Park, Friends and The Big Bang Theory.

Oh, and I didn’t even include Showtime and Starz.

So this brings me back to Disney…

Upon the company’s much-anticipated launch, it was reported that “technical glitches” prevented some subscribers from accessing its “whole new world” of streaming content (sorry, I couldn’t help but add in that Aladdin reference).

In response, subscribers received an error screen with a concerned-looking Mickey Mouse and a message that read, “There seems to be an issue connecting to the Disney+ service. Please try again later if the issue persists.”

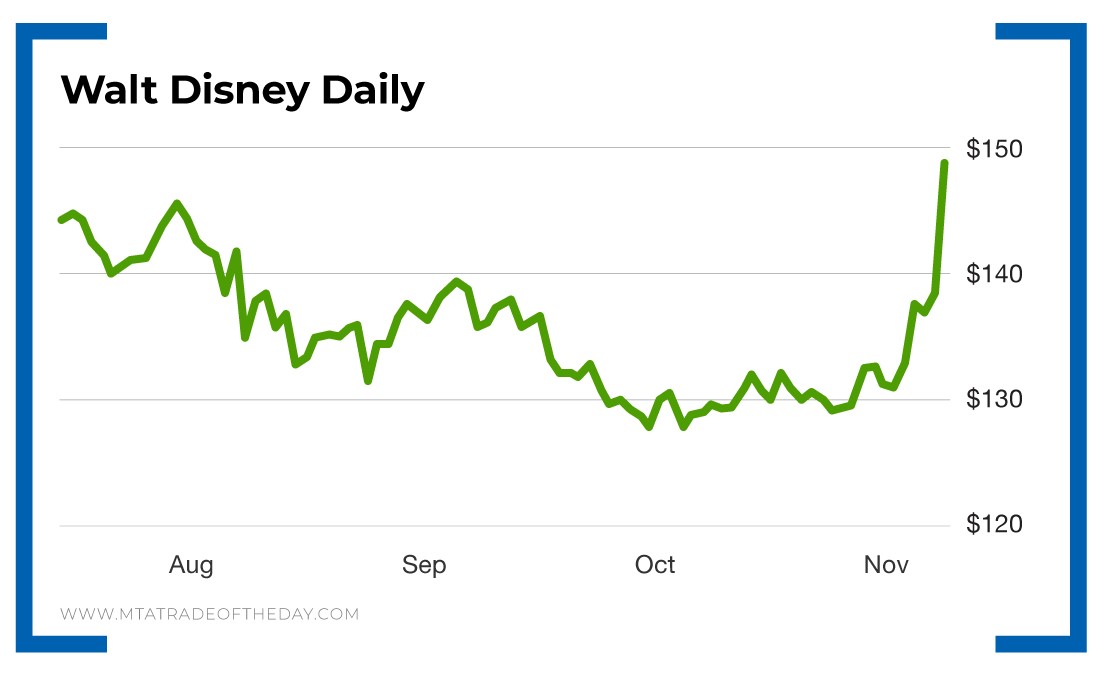

In response to this, we made a play in The War Room yesterday – and closed it today for a quick profit. We noted the “sell on the news” event – and added put options on Disney.

Action Plan: They say that a growing neighborhood has officially hit its peak when a new Whole Foods opens up. Well, using the same thinking, the streaming TV war may have just hit its peak with the entrance of Disney Plus. If that’s the case, getting positioned for a pullback after today’s massive spike makes sense.

We already did it once this morning in The War Room – and I’m sure we’ll be looking to do it again.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.