Disney Stock Could Fall With Release of The Rise of Skywalker

Managing expectations is never easy – especially when it comes to Wall Street.

And when it comes to Walt Disney (NYSE: DIS), the plot thickens even more.

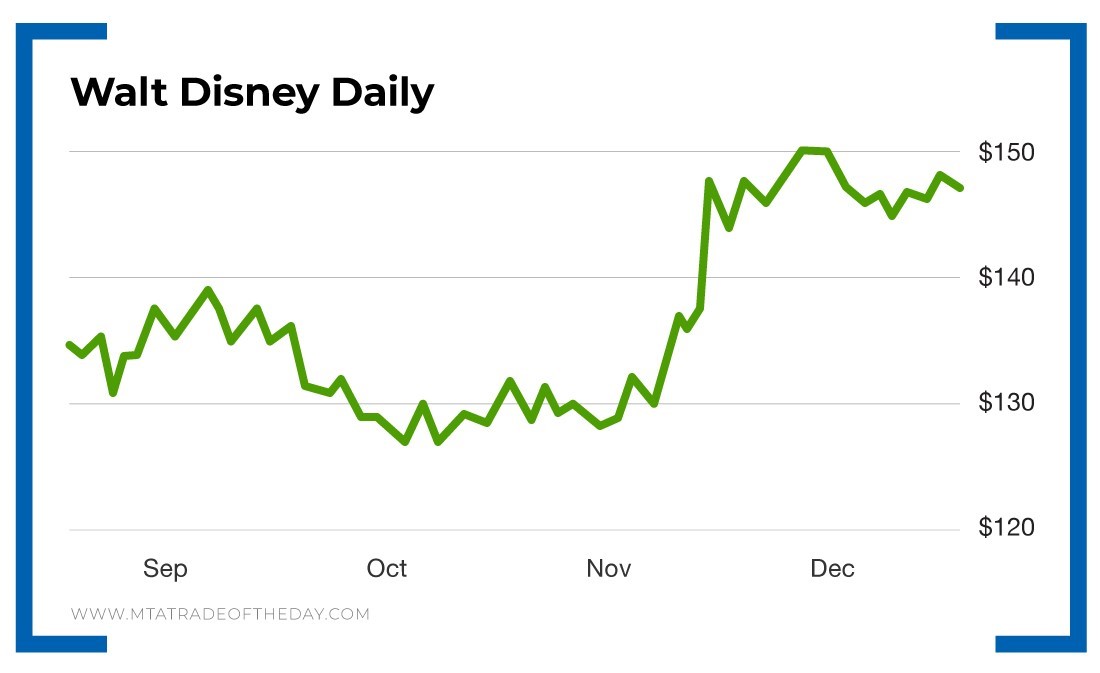

You see, Disney stock zoomed higher back in November when the company released its new Disney Plus streaming service. And then the upside continued when Frozen II exceeded box-office receipts.

Add it all up, and Disney is up 34% over the last 52 weeks, which is outpacing the 27% gain of the S&P 500.

But now it could be setting up for a disappointment, which is why I’m bringing it to your attention in today’s Trade of the Day.

Here’s the situation…

On December 20, Disney is set to release the final chapter in its Star Wars series, The Rise of Skywalker.

Going into this final movie, director J.J. Abrams has a monstrously difficult task.

First, he has to satisfy a multitude of extremely picky Star Wars fans – giving the film series the final send-off it deserves.

Second, he has to tie up countless story arcs that – until now – have yet to be given proper closure. Who are Rey’s parents? What’s her tie to Kylo Ren?

And third, he has to deliver a movie that makes more than $1 billion worldwide – just to keep Disney shareholders happy.

So… when I saw the news today on Bloomberg, which revealed that “Star Wars: The Rise of Skywalker is on track to be one of the worst-reviewed films in the nine-picture saga,” I started to worry that all of these lofty expectations could have a negative impact on Disney stock.

Specifically, The Rise of Skywalker has received positive reviews from only 57% of the critics tracked by movie rating site Rotten Tomatoes.

That’s concerning because only The Phantom Menace, released in 1999, received a worse rating – at 53%. If you don’t know, angry Star Wars fans believe the prequel franchise, which included The Phantom Menace, was nothing more than a filthy cash grab.

Could Disney be setting itself up for another angry mob of fans? Perhaps.

According to the BBC’s Nicholas Barber, “[The Rise of Skywalker] was dull.”

Entertainment Weekly’s Darren Franich called the movie a “zombie.”

Going into the release, Disney (a company that typically offers conservative forecasts) estimates that the movie will open with U.S. weekend sales of $160 million – or more.

As a point of comparison, The Last Jedi took in $220 million in its opening weekend two years ago and grossed $1.33 billion worldwide.

Clearly, Disney is counting on a big box-office showing. But based on the early buzz about the movie, Disney could receive a disappointing result.

Action Plan: I think we have a “sell on news” situation shaping up. After all, Disney stock already hit a high of $150 earlier this month and has since pulled back – only to set a lower high. This is an early indication that the bulls are losing steam.

If The Rise of Skywalker looks unlikely to beat the opening day results of past Star Wars installments, Disney stock could easily pull back to the $140 level – or below. So as a trader, I’d be looking to play Disney lower leading up to this possible expectation letdown.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.