How DRIP Investing Can Transform Your Retirement

Building a retirement that lasts through the years doesn’t have to mean reinventing the wheel.

So in this week’s State of the Market YouTube video, Chief Income Strategist Marc Lichtenfeld revealed his favorite wealth-building tools: dividend reinvestment plans, or DRIPs.

Marc is such a believer in the power of dividend reinvestment that it’s an integral part of his signature 10-11-12 System…

This powerful strategy is designed to generate 11% yields in 10 years or 12% average annual returns in 10 years with dividends reinvested.

And in 2018, this theory was unknowingly adopted by an acquaintance Marc now fondly calls “The Smartest Guy I Know“…

He’s in it for the long term. He’s building his nest egg every month by adding shares of dividend-payers and reinvesting the dividends. It doesn’t matter whether the market is on fire or in the dumps. He has his investments on autopilot. The money goes in every month, and he doesn’t touch it.

I spend a lot of time analyzing markets, researching stocks and trying to find the very best investments for my readers.

But the truth is the best thing you can do for your portfolio is follow my buddy’s lead. Find some stocks you like, buy some shares and add to them (or some new ones occasionally) at regular intervals regardless of market action.

The best part? DRIPs make it automatic…

How to Accumulate Wealth: DRIP by DRIP

To understand how this works, let’s explore one of our favorite online tools here at Wealthy Retirement: our Dividend Reinvestment Calculator.

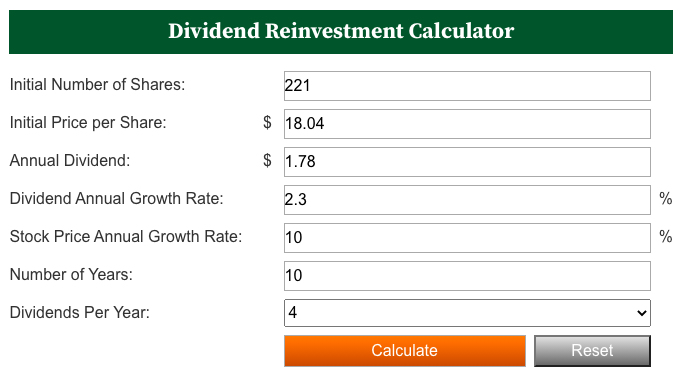

Let’s say that you have an investment in Enterprise Products Partners (NYSE: EPD).

Yesterday, the master limited partnership was trading at $18.04 with a $1.78 annual dividend.

To follow proper position sizing, let’s presume that you have a $100,000 portfolio and allocate around $4,000 to Enterprise.

That would give you 221 shares. If Enterprise Products Partners tracks alongside the long-term return of the market, its share price will grow an average of 10% per year over the next 10 years.

Meanwhile, the stock’s average dividend growth rate is 2.3% per year.

Here’s what that looks like in the calculator…

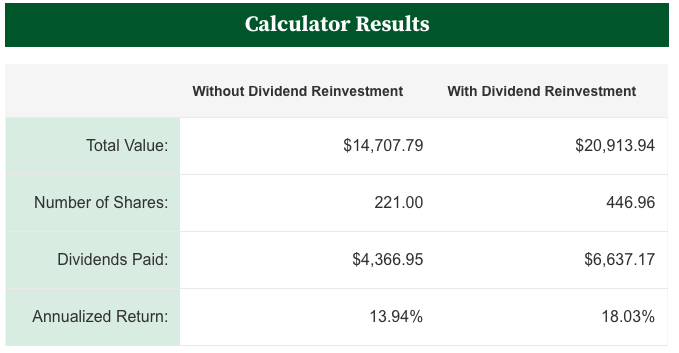

This tool can help you assess how much of a difference dividend reinvestment can make for your final return.

Reinvesting dividends is easy and can be done through your broker or through individual companies. (For tax and convenience purposes, it’s easier to go through your broker.)

You can request that the dividends of all your stocks, or just some of them, be reinvested.

Granted, many shareholders of dividend payers prefer to collect the passive income – but the calculator makes a compelling argument for why you should at least consider reinvesting…

The difference is dramatic…

In this scenario, reinvesting your dividends over 10 years gave you a 4% higher annualized return than what you would have earned collecting the income.

This is thanks to the power of compounding.

Each quarter as you received and reinvested your dividend from Enterprise, it would have bought fractional shares, which would have earned more in dividends and so on.

(Remember, Marc’s 10-11-12 System is designed to produce at least 12% annual returns over 10 years with dividends reinvested. Enterprise Products Partners’ potential 18.03% annualized return trounces that!)

What Are You Waiting For?

Because we know the market goes up over the long term, dividend reinvestment doesn’t have to be a frightening commitment.

In fact, shareholders who reinvest dividends are some of the most fortunate ones when a bear market strikes. Their automatic purchases ensure that they buy at the stock’s low.

While this also means that they buy at less depressed levels, dividend reinvestors are hardly suffering by “buying at the top.”

In 2018, Marc wrote, “If you bought stocks at the absolute top of the market just before the Great Recession, you’d have a total return of 71% today and 118% if dividends were reinvested.”

Not too shabby…

This powerful strategy presents an unmatchable opportunity to grow your wealth by leaving it alone.

Take a look at this week’s State of the Market to learn how you can get started.

[adzerk-get-ad zone="245143" size="4"]