A 20% Yield With a Good Chance of an Upgrade

When I decided to write about EnLink Midstream (NYSE: ENLC) and its 20% yield, I remarked sarcastically to our Director of Research, “I’m sure it will be a safe yield.”

Twenty percent yields almost never are.

I won’t go so far as to say that EnLink’s yield is safe – it’s not. But it does stand a real chance of receiving an upgrade next year.

EnLink has raised the distribution 19 times since 2011, though often just by a fraction of a penny. Still, the distribution is 3 1/2 times higher than it was eight years ago.

That being said, EnLink lowered the distribution in 2009 and 2010. SafetyNet Pro looks very unfavorably at companies that cut their dividends.

It indicates that the dividend is not sacred to management and it will reduce it when times get tough.

The company has grown its distributable cash flow (DCF) sharply this year because it acquired its master limited partnership. Wall Street currently expects DCF to be $727 million in 2019 compared with $231 million last year.

Management had previously forecast DCF to be between $715 million and $735 million. In its most recent quarterly report, management said DCF would be closer to the lower end of that range.

Here’s where this creates an opportunity for an upgrade…

The current consensus estimate for DCF next year is $712 million – slightly lower than this year’s estimate. SafetyNet Pro is penalizing EnLink for the lower expected cash flow in 2020.

If DCF comes in at the bottom of the range this year, if the company can generate a few million dollars more in cash flow than Wall Street forecasts – to where it comes in above 2019’s total – and if all else remains equal, it will receive an upgrade.

Who knows, maybe the company is sandbagging this year’s estimate just to be eligible for a SafetyNet Pro upgrade next year…

Additionally, the company’s debt is too high. But just by a little.

EnLink’s debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) ratio is 4.2.

SafetyNet Pro’s cutoff is 4. If debt-to-EBITDA is at 4 or higher, the rating is downgraded.

Management told Wall Street to expect debt-to-EBITDA to be between 3.9 and 4.2 at the end of 2019. So if company executives can bring that number lower, even below 4, there’s an opportunity for another upgrade.

Both the debt and 2020 cash flow are big “ifs.”

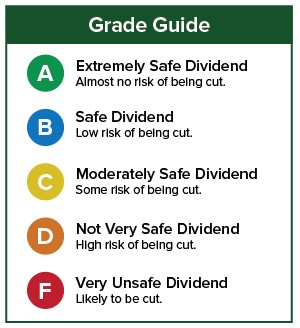

But if either or both of those numbers get in line with what SafetyNet Pro (and I) look for, you could see a big upgrade from a rating that indicates the dividend is not very safe to one that shows the distribution has a low risk of being cut.

This will be a fun one to follow, especially considering its 20% yield.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.