Flying Car Stocks That Are Cleared For Takeoff

In 1989, Marty McFly hopped in his flying DeLorean so he could travel to the future and fix his family. In this film, Marty travels to the year 2015. Well, it’s now almost 2022 and you still can’t buy a flying car at the local car lot. However, that doesn’t mean that flying car stocks aren’t being developed.

Right now, there are several companies that are working to make flying cars a reality. In addition to being awesome, flying cars will also solve a major societal issue. That issue is the intense gridlock that is starting to stifle many metropolitan areas. In particular, Boston commuters spent almost 6 full days in traffic in 2019. Other cities with major congestion are Chicago, Philadelphia and Los Angeles. Any company that offers commuters an alternative to sitting in traffic will surely have lots of eager customers.

Since hating traffic is universal, the flying car market has the potential to be huge. Due to this, investors are eagerly looking for potential flying car stocks to buy. However, since the industry doesn’t technically exist yet, it’s a little tough to find any publicly-traded flying car stocks. To help out, I’ve found a few companies that are leading the way.

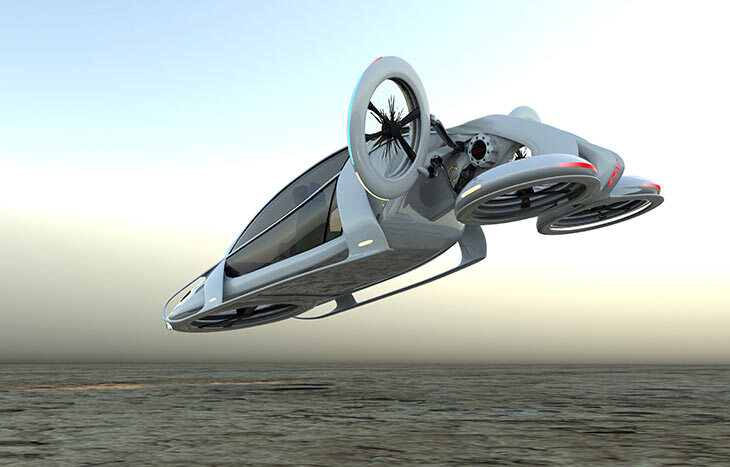

Keep in mind that most of these companies are technically “electric vertical takeoff and landing (eVTOL) aircraft. Instead of a car with wings, think of a slightly smaller personalized helicopter.

With that said, let’s take a look at a few of the best flying car stocks to buy.

Flying Car Stocks

Joby Aviation (NYSE: JOBY)

As Joby Aviation just went public, this might be the first that you’re hearing about this flying car stock. However, that doesn’t mean its team hasn’t been working hard for years. Joby was launched in 2009 and released its first prototype in 2015. More recently, it purchased Uber’s flying car division. Joby expects to start commercial operations as soon as 2024.

Joby’s helicopter has a vertical takeoff, can seat 4 passengers (plus the pilot) and reaches a top speed of 200 mph. This makes it perfect for congested metropolitan areas like Los Angeles. Joby’s helicopters would be able to turn an hour-long drive into a 15-minute flight. The phrase that Joby uses to describe its business is “electric aerial ridesharing.”

In the second half of 2021, Joby went public through a merger with SPAC Reinvent Technology Partnerships. It has only released data from Q3 2021 and reported a net loss of $78.9 million. However, this loss is expected since commercial flights aren’t starting until 2024.

Other than that, Joby is in the process of receiving its Part 135 Air Carrier Certificate. This certificate is required before starting revenue-generating passenger flights. For risk-averse investors, you might want to wait until after this certificate has been secured. For opportunistic investors, you can get into this flying car stock at a cheaper price before it gets this certificate.

Joby’s stock has remained steady at approximately $9/share since the merger was made official.

Archer Aviation (NYSE: ACHR)

Archer Aviation is another flying car stock that just went public via SPAC. In late 2021, it merged with Atlas Crest Investment Corporation. According to Archer Aviation’s website, it is “powering the future of urban air mobility.” Archer offers a similar style of flying car to Joby (eVTOL).

Notably, Archer has secured a partnership with United Airlines. This is actually a very significant advantage. United will be there over the coming years to offer capital and expertise. Additionally, Untied could potentially become a very large customer for Arher.

Archer plans to unveil the first generation of its aircraft in 2023. It is considering Los Angeles and Miami as it’s flagship cities. Similar to Joby, it has only reported financial results from Q3 2021. In this quarter, it announced a net loss of $177 million.

Archer’s stock has dropped by about 40% since the merger was approved. However, it’s so early on for this flying car stock that I wouldn’t worry much about its movements.

EHang (Nasdaq: EH)

The final flying car stock is located in China. EHang offers eclectic passenger-grade autonomous aerial vehicles. Out of all three of these companies, Ehang has the most public financial information available.

In 2020, EHang posted $180.09 million in annual revenue. This represented a 47.84% increase from 2019. However, it also reported a total net loss of $87.62 in 2020. Just like with the previous flying stocks, I wouldn’t focus too much on these early initial losses.

Ehang’s stock is up 125% over the past year.

Those are the three major flying car stocks that appear to be closest to bringing a product to market. However, there are a few other flying car stocks worth mentioning.

Honorable Mentions

Just like with self-driving cars, many companies are quick to jump on the bandwagon. Every company wants to act as if it’s on the cutting edge of the industry. However, many of these flying car stocks are vague on how close they are on delivering on its promises.

For me, it’s a little tough to get excited before actual prototypes are delivered. With that said, here are a few other companies that could potentially become flying car stocks. These companies have mainly just released very initial concepts of what its car would look like:

- Xpeng – This is a Chinese electric vehicle manufacturer. It recently revealed its concept for a flying car which it expects to launch in 2024.

- Hyundai – Launched a partnership with Uber to develop flying taxis.

- Kitty Hawk – Kitty Hawk actually has a really cool prototype that rides like a flying jetski. Its product looks like something a stormtrooper might ride in Star Wars. The reason that it’s listed as an honorable mention is because it’s a startup (and not publicly traded). However, it has entered a partnership with Boeing. You could technically invest in Kitty Hawk by buying Boeing stock.

- CityAirbus by Airbus – Airbus has an impressive prototype as well. It’s on the honorable mention list because Airbus is such a massive company. Any money it makes from CityAirbus will still be a very small portion of its total sales. This makes it difficult to classify it as a flying car stock. The same holds true for Kitty Hawk and Boeing.

Flying Car Stocks: The Future of Transportation

I hope that you’ve found this article valuable when it comes to learning a few potential flying car stocks to buy. As usual, all investment decisions should be based on your own due diligence and risk tolerance.

For more insights into the latest investment news, sign up for our free e-letter today! You’ll receive analysis on the market’s emerging trends directly from the experts, all for free.

[adzerk-get-ad zone="245143" size="4"]About Teddy Stavetski

A University of Miami grad, Teddy studied marketing and finance while also playing four years on the football team. He’s always had a passion for business and used his experience from a few personal projects to become one of the top-rated business writers on Fiverr.com. When he’s not hammering words onto paper, you can find him hammering notes on the piano or traveling to some place random.