Following the Insider Buying on Cleveland-Cliffs

Insider buying is one of my favorite signals for entering an investment. But it’s not as simple as seeing just one or even two insiders buying their own shares and then following suit. If that were the case, I’d have a hundred more positions in my portfolio every month.

You see, insiders buy all the time. But it has proven very successful to follow a certain pattern of insider buying…

It’s called cluster buying.

What this means is that more than two insiders buy their own shares in the open market at varying prices – usually at higher prices.

And the best signals to follow are when officers in the company are putting up their hard-earned money to invest in the shares.

That’s the case with the latest War Room stock pick. Yes, we are more than just options in The War Room – any opportunity to make money is one that we’ll go after!

Cleveland-Cliffs (NYSE: CLF) is a steelmaker – kind of. It’s a supplier of iron ore pellets to the U.S. steel industry.

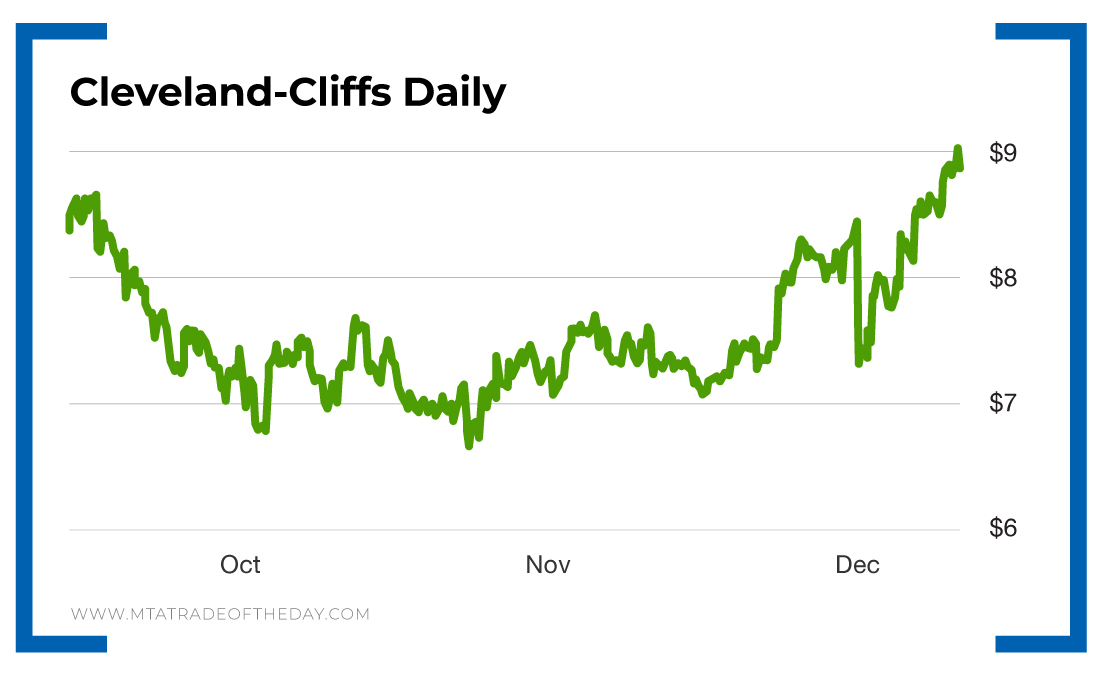

A couple of weeks ago, the company acquired AK Steel Holding Corporation, and the shares pulled back. Up until that point, the shares were behaving quite well compared with other companies in the sector like U.S. Steel, which has seen its share price plunge.

A few weeks before the acquisition, there was insider buying in the shares, which caught my attention. A few days after the pullback, insiders were at it again, buying more shares. And the insiders who have been buying are not just directors or majority owners…

They are part of the management team at the company and have been buying at varying share prices, above and below the current levels…

That’s a big positive flag in my book. And thanks to the ability to act instantly in The War Room, members were able to hop on board at very favorable prices. In fact, the shares are already up since we bought in just a couple of days ago.

Action Plan: When insiders buy, they know there are good things ahead. Those good things may not happen instantly, but insider buying is a very good indication of things to come. And here in The War Room, we have our pulse on all the action in the market – even things that are under the radar, like real-time insider buying. We spend a lot of money on our resources and feeds just for this type of trade.

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?