General Electric Shares Rise Despite “Cooked Books” Accusation

There wasn’t enough time for me to do a full fundamental analysis on General Electric (NYSE: GE) yesterday. Regardless, I shared my thoughts on recent happenings with the company, and War Room members came out ahead.

Here’s the backstory…

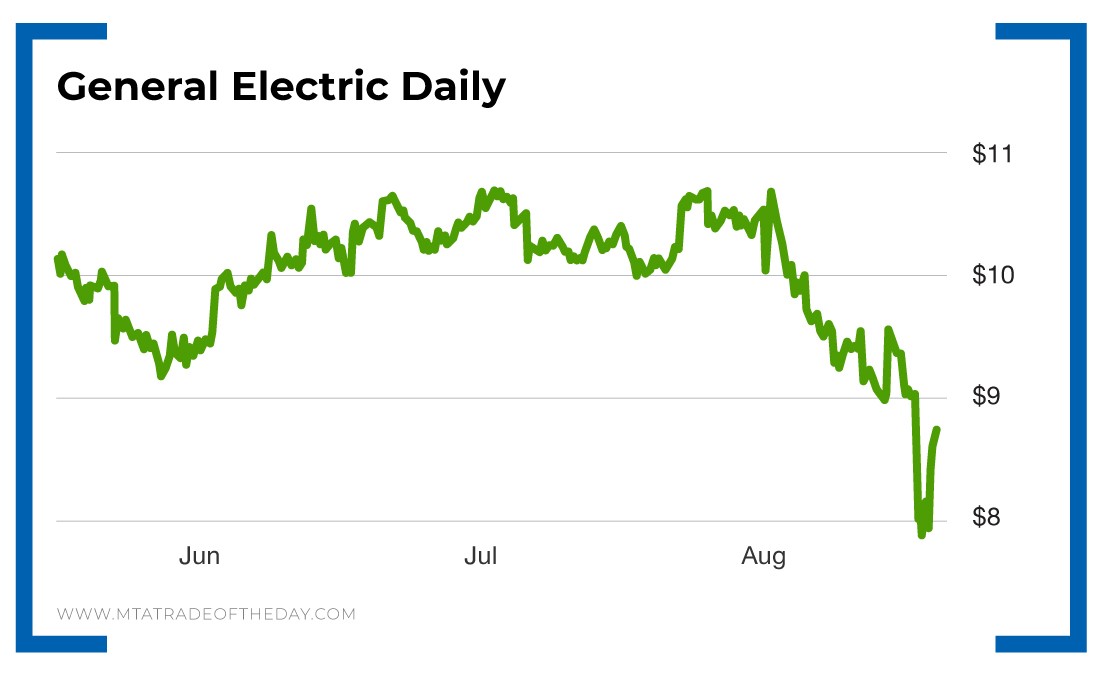

An analyst came out with a report Thursday that GE was cooking its books.

This was no ordinary analyst…

It was Harry Markopolos, the same one who called out Bernie Madoff’s Ponzi scheme. His opinion is definitely worth some weight. And that weight knocked GE shares down for a loop.

Just the day before, the CEO of GE bought millions of dollars’ worth of stock in the open market. That was after even more buying in preceding weeks.

Without being able to do the analysis I like to do, I didn’t want to put out a formal recommendation. Instead, I told War Room members that the GE options were priced like a lotto ticket, with better odds, and that the $8.50 calls looked like a great bet. This is what I said on Thursday at 2:30 p.m. ET:

Corporate General Electric employees and supporters (like Stanley Druckenmiller, who was once short General Electric and just announced he bought shares on this plunge) are coming out to refute the earlier report. This could get interesting. Speculators may want to look at the $8.50 calls expiring next week, trading around $0.20 for a pure flyer.

I continued a half hour later to say this:

The way I look at it (I can’t recommend General Electric formally because I have done no research on it, and it probably wouldn’t help anyway) is that it’s cheaper than buying a bunch of scratch-offs, and if General Electric refutes the report, the odds are way better. I find it interesting that the report was released today, a day before the weeklies expire.

You see, The War Room is a community of traders who share great ideas – just like this GE trade. Without enough time to put in the analysis like I did with The RealReal, I shared the GE idea in real time with everyone just in case any speculators wanted to try the play.

Members of The War Room were free to act on the advice if they liked – and a couple did.

Today, GE shares soared, and the CEO bought millions more in company stock on the open market.

Action Plan: These gains were in addition to the gains Bryan racked up with his plays on Applied Materials and Caterpillar, which closed out the same day.

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?