Get Positioned Before Canada Goose Holdings Reports Earnings

If you watch the Today show in the morning, you know Al Roker has been all over the arctic cold front that’s now covering most of the Midwest and eastern part of the country.

This windchill image tells you everything you need to know.

But we’re not a weather service…

We’re here to alert you to profitable trading opportunities.

So from an investment perspective, this sets up an interesting situation in Canada Goose Holdings (NYSE: GOOS).

As I’m sure you know, Canada Goose sells the premium, $1,500 jackets that appeal to everyone from men and women to children – and (if you have the extra money) even babies.

As of May 29, the company operated 11 retail stores – but it primarily sells via e-commerce in 12 countries worldwide.

Before the bell tomorrow morning, Canada Goose is scheduled to report its second quarter fiscal earnings. In reaction to its last two earnings reports, the company’s stock dropped 31.47% and 22.5%.

Will we see a similar downside move again tomorrow?

Going into the report, it’s anyone’s guess…

On one hand, Japan is acting as a major growth driver for the company in Asia – which could provide a boost.

But on the other hand, the Zacks consensus estimate is pegged at $0.35, which suggests no movement from the figure that Canada Goose reported one year ago.

You’d think that winter (and especially a cold November) would offer the perfect setup for the company…

But that’s not necessarily the case.

You see, on November 7, Canada Goose was downgraded from a “buy” to a “neutral” rating at D.A. Davidson – which included a price cut from $48 to $42 on the fear that the company’s high-end parkas and vests experienced “overzealous buying in the spring.”

As a result, Canada Goose could now be ready for a drop in sales this quarter. After all, this isn’t a jacket you need to replace each year. If enough consumers already have one in their closet, the buying frenzy could be over. And potentially the drop in sales could be trouble.

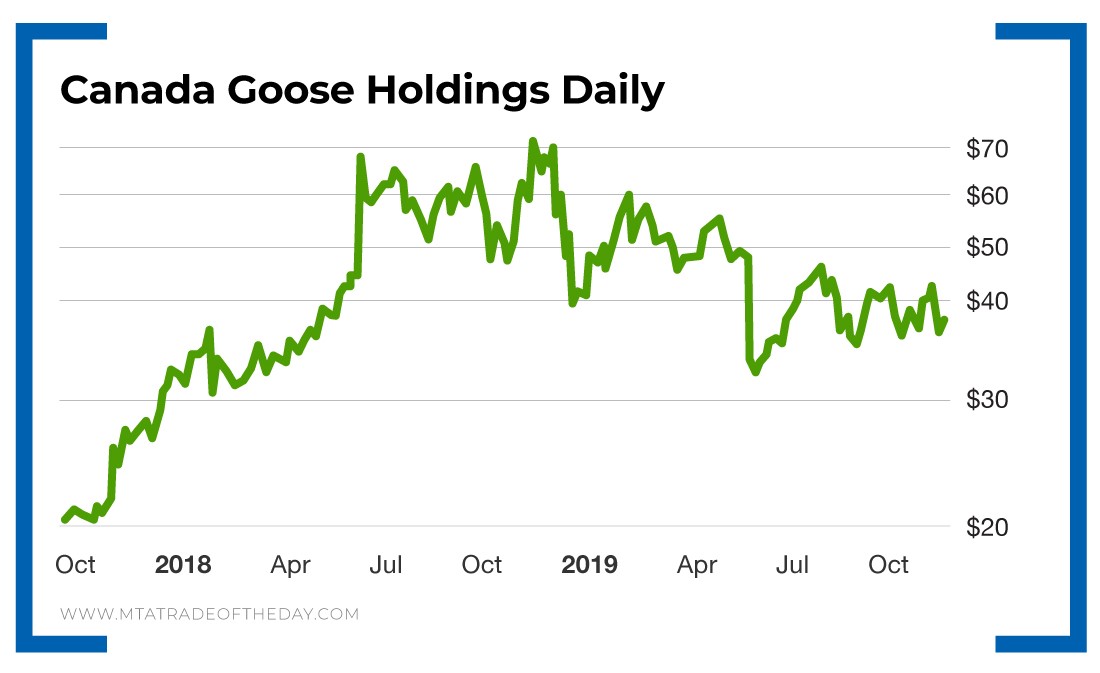

Action Plan: Looking at the two-year Canada Goose Holdings chart, you can see a tightening – and descending – range between $35 and $43 over the last five months. Depending on how the company’s earnings report goes tomorrow, this range could be broken with a downside move that extends to $30 (on weakness) or an upside move that extends up to $55 (on strength).

Given the last two earnings reactions, a downside move appears more likely. But with earnings, you never know. So aside from flipping a coin, how do you play this? Well, in The War Room, we’re getting prepared to profit off a move – whether it’s up or down.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.