Is This Double-Digit Distribution Running on Empty?

Oil stocks got a lot of attention earlier this week after a drone seemed to attack a Saudi Arabian oil field. Crude prices briefly spiked on the news.

So this week, we’ll evaluate the dividend safety of Global Partners LP (NYSE: GLP).

Global Partners is a master limited partnership (MLP) with a 10.5% yield.

This MLP is one of the Northeast’s largest independent owners, suppliers and operators of gas stations and convenience stores.

The price of oil has been trending up since it bottomed in 2016. Global Partners’ cash available for distribution (CAD), a measure of cash flow for MLPs, has also been rising.

CAD was up a whopping 200% in 2018, rising from negative $121.4 million in 2016 to $121.1 million. But CAD was still 4.6% lower than the $126.9 million the company generated in 2015.

This year, analysts expect the MLP’s CAD to fall 31.5% to $82.96 million as the company focuses on capital expenditures and new projects.

Declining cash flow is always concerning, but the good news is that Global Partners has enough to cover its 2019 distribution.

The MLP is expected to pay out $73.4 million in distributions this year, giving it a payout ratio of 88.5%, below SafetyNet Pro’s 100% threshold for MLPs.

I wouldn’t get too comfortable, though.

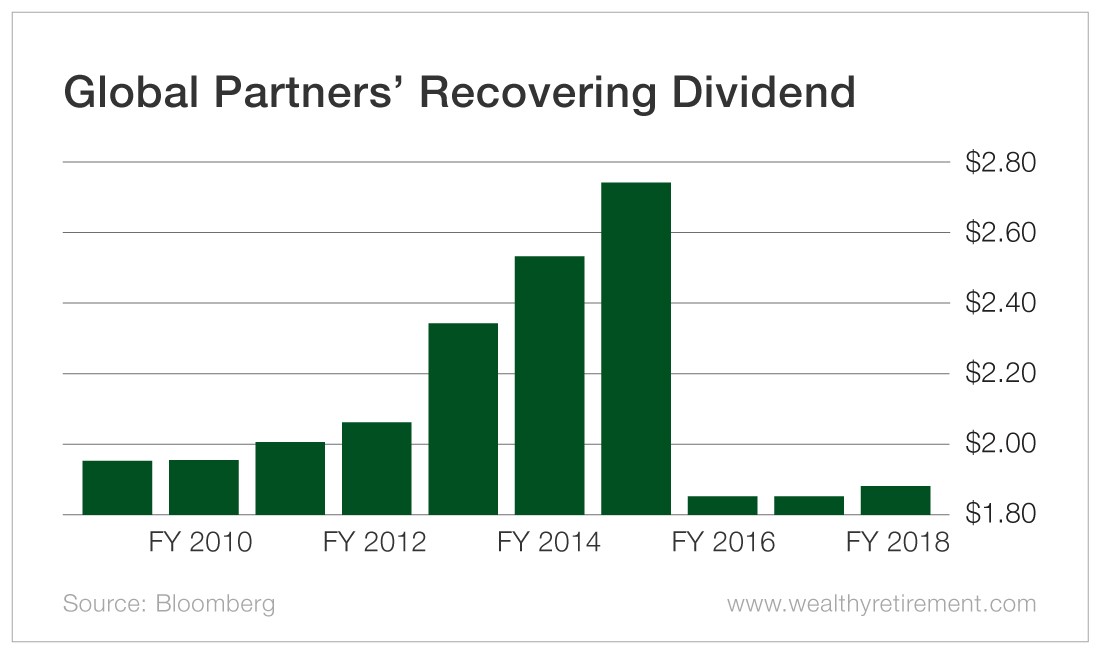

In 2016, Global Partners cut its annual distribution by 34% from $2.74 to $1.85 per share. It was the MLP’s first cut since it went public in 2005.

As cash flow climbed last year, the company began raising its distribution again. This year’s distribution is expected to be $2.05 per share.

Singer-songwriter Cat Stevens wrote that “the first cut is the deepest,” but in the case of Global Partners’ distribution, it may not be the last.

If oil hits the skids, Global Partners’ cash flow could be at risk. If that happens, the company’s dividend could be in danger of running out of gas.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like analyzed, leave the ticker in the comments section.

You can also search Wealthy Retirement to see if Marc has recently written about your favorite stock. Click on the magnifying glass in the top right corner of our website and type in the company name for best results.

[adzerk-get-ad zone="245143" size="4"]