This Bet Paid Off Big… for YOU!

With the NBA finals on fire and the NFL picking back up, DraftKings (Nasdaq: DKNG) is killing it.

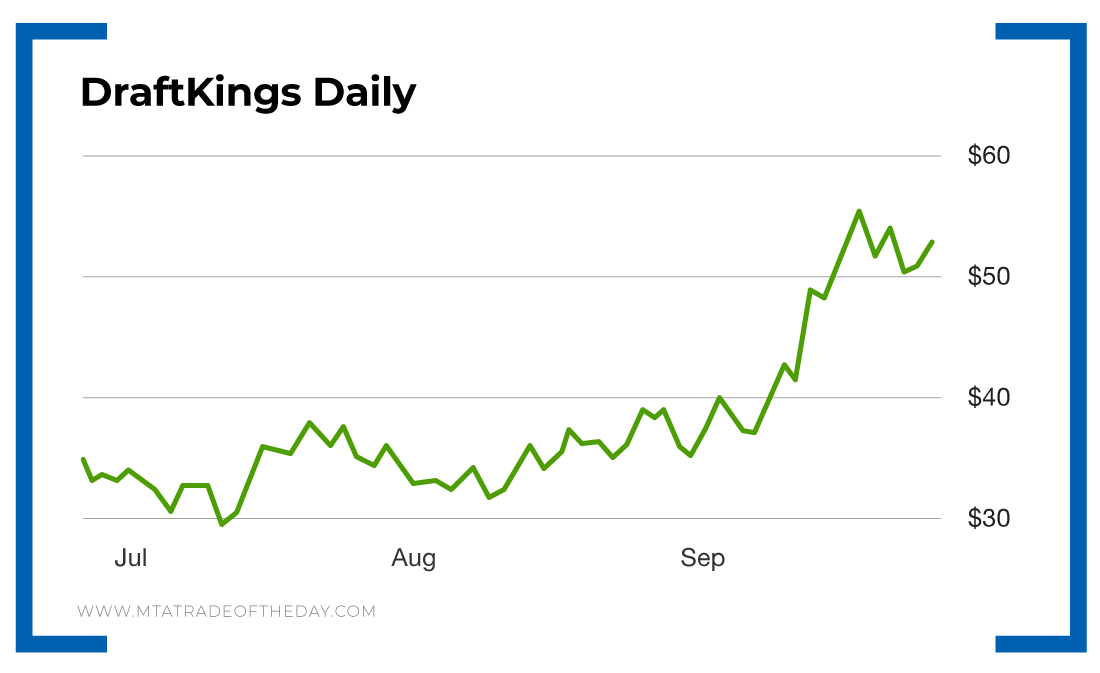

Back on July 9, right here in Trade of the Day, I broke down exactly why and how you should build a position in DraftKings.

Here’s what I said…

But there are more blue skies ahead for DraftKings. Right now, the shares are trading lower based on the lack of clarity about when pro sports and the fantasy leagues that accompany them will get in gear. The COVID-19 pandemic is making things much harder to predict. And Wall Street hates uncertainty. However, that uncertainty provides opportunity for you to begin to build a position in DraftKings at current levels and even at lower levels if the shares trade lower. The reason you want to bet on DraftKings is not for what happens today, but for what could happen in the future when the economy finally opens and catches its stride. And this company is sitting on a pile of cash… $450 million, to be exact, with no debt. That gives it the staying power to outlast the pandemic. There are three ways to play this…

1. You can buy the shares trading in the low $30s and plan on making two or three buys at $30, $25 and $20 to average your cost lower if the shares trade down or if there is a correction in the market.

2. You can control the shares with Long-Term Equity Anticipation Securities (LEAPS) options. DraftKings has options going out to 2022 – more than 18 months until expiration. They are expensive, so you may want to use a spread trade.

3. One of my favorite strategies is to use a put sell to try and pick up the shares for a lot less than the current price or get paid for trying.

Regardless of which method Trade of the Day readers chose, they cleaned up!

War Room members also cashed out of a spread for a huge gain.

It’s not the first gain on DraftKings either.

It’s a constant winner in The War Room for one reason… It’s the “BOB” of gambling stocks!

What’s a BOB?

BOB simply means best of breed, a term we use to refer to a company that dominates the space it occupies.

DraftKings went public through a special purpose acquisition company (SPAC) at around $17 per share. It hasn’t looked back, currently trading at more than $53 per share… and in a matter of months. And The War Room has been along for the ride the entire time.

What makes DraftKings the best of breed?

Well, it has cash, and lots of it. More than $1.2 billion on the books. Better still, it’s got zero debt. And the company is signing deals left and right to be the venue of choice for bettors.

Action Plan: Online gambling and fantasy leagues are not going away. And, if people are willing to bet, they can do it on DraftKings’ platform… from the comfort of their couch!

[adzerk-get-ad zone="245143" size="4"]About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?