How to Play an Earnings Strangle With Johnson & Johnson

In yesterday’s issue of Trade of the Day, I outlined all of the possible risks that the market is now facing from the so-called “Washington Risk.”

In other words, news out of Washington (specifically the current U.S.-China trade negotiations) now has 100% influence on the minute-by-minute movements of the major market averages.

As we have recently witnessed, any news item – or any tweet – can dramatically change the market’s direction – either up or down – in the blink of an eye.

For instance, Art Cashin – who has seen just about every major market move in the last five decades, warned us on CNBC:

October is known for its volatility – keep your seat belt fastened.

To me, you have the real possibility of the markets being up 300 or down 300 on any given morning – which is entirely dependent on the overnight news flow.

Given this situation, I asked this in yesterday’s Trade of the Day…

As traders, how should we play this?

One answer was yesterday’s portable generator play on Generac Holdings (NYSE: GNRC).

But for today, I have a secondary strategy…

It’s something I call an earnings strangle.

You see, in The War Room, deploying our earnings strangle strategy during times of directional uncertainly is the perfect way to play large, volatile moves in either direction.

The method involves trading around a large, market-moving event – such as an earnings release. You’d own both a call – and a put – on the same company.

That way, you don’t care which direction a stock moves…

All you care about is the “delta,” or magnitude, of the move. As long as the stock move is large enough – either up or down – you’re positioned to profit.

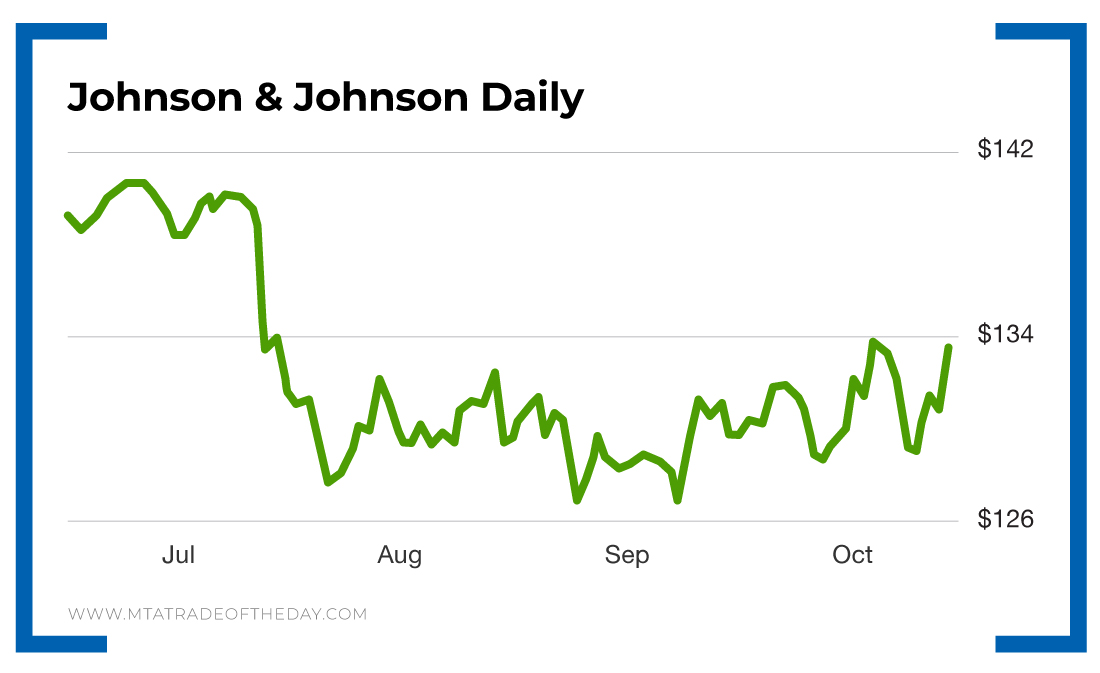

A great example of this occurred this morning with Johnson & Johnson (NYSE: JNJ).

Historically, Johnson & Johnson doesn’t make big earnings moves.

However, for War Room members…

This made the play cheap enough to enter for a very reasonable price.

Yesterday afternoon in The War Room, members paid a total of $2.18 for a combination of Johnson & Johnson calls and puts.

Going into the report, we knew that the medical device company has gained only 1.3% this year, far lagging the S&P 500’s gain of 18.3%.

So we asked the question…

Could this be the report that kick-starts Johnson & Johnson – especially considering the litany of recent court verdicts going against them?

Or would this be another reason for investors to sell Johnson & Johnson and run for cover?

Honestly, it didn’t matter either way.

As long as Johnson & Johnson had enough movement in any direction, War Room members would cash in.

So here’s what happened…

This morning, the world’s largest drugmaker beat earnings expectations after announcing earnings per share (EPS) of $2.12. This beat the Wall Street estimate of $2.01.

The company also reported sales of $20.7 billion, which beat the FactSet consensus estimate of $20.1 billion.

And to top it off…

Johnson & Johnson raised full-year EPS guidance to a range of $8.84 to $8.89, which was above the prior guidance of $8.73 to $8.83.

This news sparked a 3% upside move. Granted, this wasn’t as explosive as some other earnings moves – but for us, it was good enough.

Action Plan: The combination of Johnson & Johnson calls and puts War Room members entered yesterday for $2.16 were sold today for around $2.66.

In a market where you don’t know which direction things will be moving when you wake up, that sort of trading consistency is critical in the midst of such extreme directional uncertainty. For more insight on how to profit from an earnings strangle, and much more, I invite you to join me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.