How to Play It Lower With The Cheesecake Factory

Let’s assume – for a moment – that the economy will begin the process of entering into a recession here in Q4.

If that happens, what’s one of the “stage 1” impacts that will be noticed right away?

Well, consumers will look for easy ways to trim their monthly expenses.

Oftentimes, the easiest way to start this process is to scale back when you dine out.

For instance, instead of paying $100 for a dinner for four, you start paying $75, or maybe even $50.

You see, you don’t stop taking the family out to eat…

You make the choice to go to a less expensive restaurant.

If we begin to see this shift, it could have a negative impact on a company like The Cheesecake Factory (Nasdaq: CAKE).

Since Brinker International gets 87% of sales from Chili’s, Anderson now rates it as a better holding than The Cheesecake Factory.

As of this August, The Cheesecake Factory owns and operates 219 restaurants in the United States, Puerto Rico and Canada.

Of these, 202 are under The Cheesecake Factory name, 14 are Grand Lux Cafes, two are under the RockSugar Southeast Asian Kitchen name and the remaining restaurant is under the Social Monk Asian Kitchen name.

Twenty-one of the 202 Cheesecake Factory-branded restaurants are international, located in the Middle East, Mexico and China.

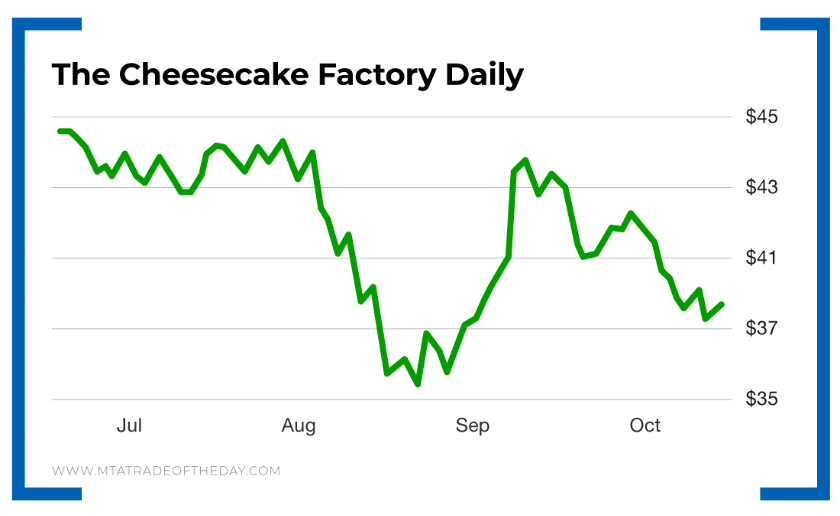

Looking at the stock’s performance, here’s what I find interesting…

Over the past 52 weeks, The Cheesecake Factory has dropped 24%, which is pretty awful considering the S&P 500 has gained 6.6% over the same period.

Not only that, but on October 2, The Cheesecake Factory closed a deal to acquire North Italia and Fox Restaurant Concepts for $308 million.

North Italia is upscale Italian cooking – where all dishes are handmade from scratch daily. It has 21 locations in 10 states and Washington, D.C.

Fox Restaurant Concepts was founded by Sam Fox, a 10-time James Beard Award semifinalist for restaurateur of the year, a New York Times bestselling cookbook author and one of the 50 most influential people in the restaurant industry, as ranked by Nation’s Restaurant News for the fifth consecutive year. The company operates 47 restaurants across eight states and Washington, D.C.

So as I look at this situation, here’s what I see…

Action Plan: Here you have a company – The Cheesecake Factory – that has been down 24% over the last 52 weeks. That was a period when the economy was humming along and people were eating at higher-ticket restaurants.

But now we’re facing a threat of a recession – and The Cheesecake Factory makes a $300 million acquisition of two high-ticket restaurant franchises? If the company struggled to make this work in a strong economy, what will happen if the economy shifts and consumers start eating at Applebee’s or Chili’s instead?

From the looks of things, The Cheesecake Factory is a name you’ll want to play lower – with a first look at a retest of last August’s support around $36. Learn how to profit off this move by following along with me in The War Room. Join today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.