Hyster-Yale Materials is the Most Purchased Insider Stock in 2019

When it comes to recognizable stock names, Hyster-Yale Materials Handling (NYSE: HY) isn’t a name that immediately comes to mind.

In fact, you’ve probably never even heard of the company before…

After all, this Cleveland, Ohio-based farm and heavy construction machinery company makes a line of lift trucks, attachments, and aftermarket parts. Hyster-Yale Materials won’t find itself on anyone’s list of top 2020 investment ideas.

However, there’s a very good reason I’d like to bring it to your attention today, which is why I’ve decided to feature it in today’s Trade of the Day.

But first, I admit…

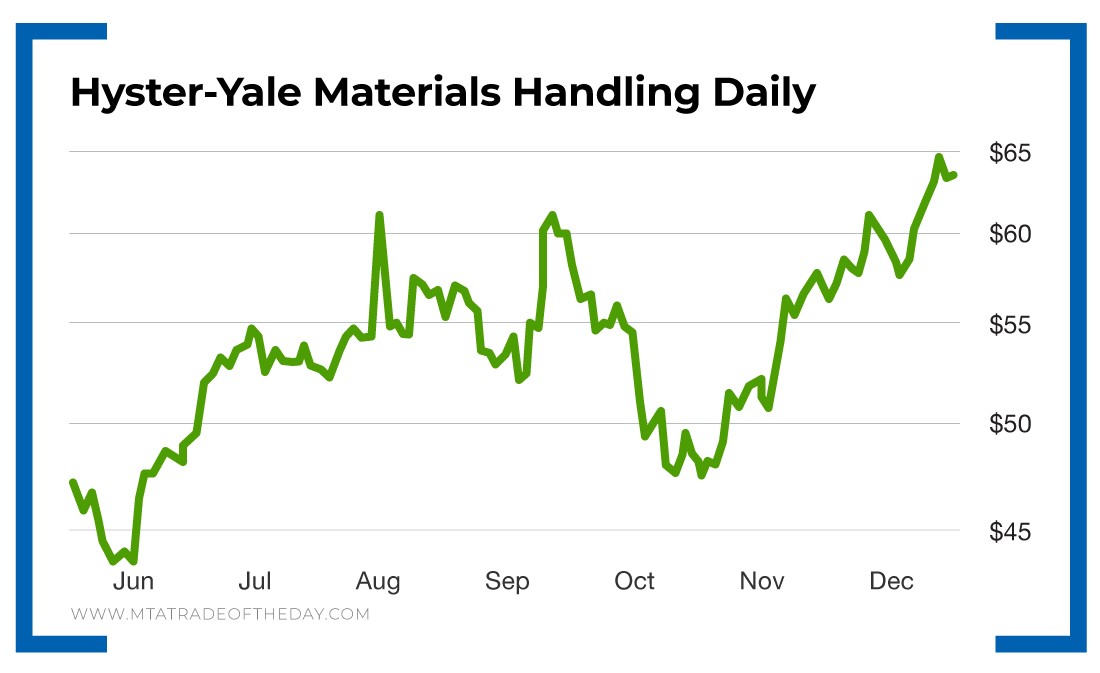

By all counts, Hyster-Yale doesn’t pop off the screen when you run a standard valuation analysis on it. Over the last 52 weeks, it has gained only 4.4%, which grossly underperforms the 25.4% return of the S&P 500.

Quarterly year-over-year revenue growth of negative 2.3% and year-over-year quarterly earnings growth of negative 16.9% doesn’t necessarily pop off the page either.

And the chart – for lack of a better description – has been a snooze.

So once again, it’s pretty easy for everyone to pass over this name.

However, here’s the one statistic that raised my eyebrow…

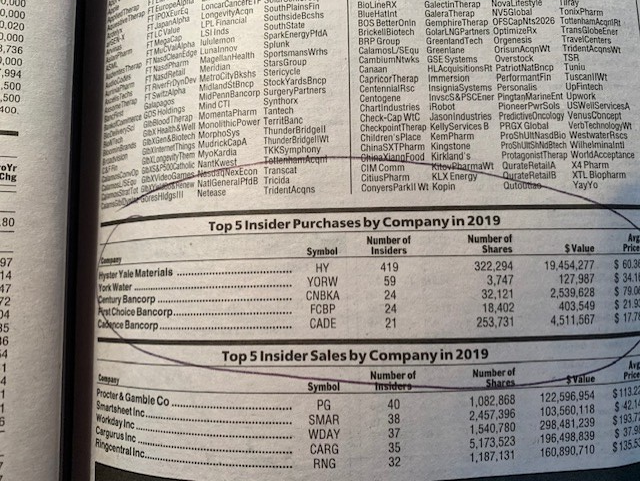

When you examine the entire list of insider buys in 2019, no publicly traded stock has seen more insider buys than Hyster-Yale Materials.

It’s true.

And in fact, it’s not even close…

You see, Hyster-Yale Materials had 419 separate insider buys this year – totaling 322,294 shares and $19.4 million.

For comparison, the second-highest-rated stock on this list is The York Water Company. The company had only 59 insider buy transactions. That means Hyster-Yale had nearly seven times more insider buy transactions than the No. 2-rated company in 2019.

You can see for yourself below…

Action Plan: What does this mean? Well, here’s my takeaway. There are literally thousands of reasons for an insider to sell shares. They might think their stock is overvalued. They may have information that’ll soon push their shares lower. Maybe they just want to buy themselves a new yacht. Or perhaps they need extra cash to pay for another divorce settlement. The point is the reasons for insider selling are countless.

On the flip side, there’s only one reason for insiders to buy. And that is because they think their stock is going up.

Do Hyster-Yale insiders know something that we don’t know? Perhaps. It’s impossible to say for sure. However, what we do know is that 419 separate transactions in 2019 make it pretty clear: Hyster-Yale insiders like their stock – and they’ve bought it more than any other company insiders have bought any other stock in 2019.

For that alone, Hyster-Yale is worth adding to your speculative portfolio for some sort of news item – or renewed growth – going into 2020.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.