Increase Your Buying Power With Dividend Growth Stocks

Are the prices of things you buy going up?

Sure, inflation is low at 1.8% – but how about the prices of things you actually buy?

Food prices have climbed 2.1% over the past 12 months, a little higher than the overall rate of inflation. Water bills increased an average of 3.6% this year.

By the end of 2019, electricity prices are forecast to climb 3.6%. Despite Washington’s bluster, drug prices are expected to rise 4.5% in 2020.

And if you’re going to be paying college tuition like I will be for the next seven years (two kids, not one who’s taking his time), you’ll be unhappy to learn that those already exorbitant fees soar about 8% per year.

So even though inflation is rather tame, many of the costs we incur every day continue to grow at a faster pace than the official inflation rate.

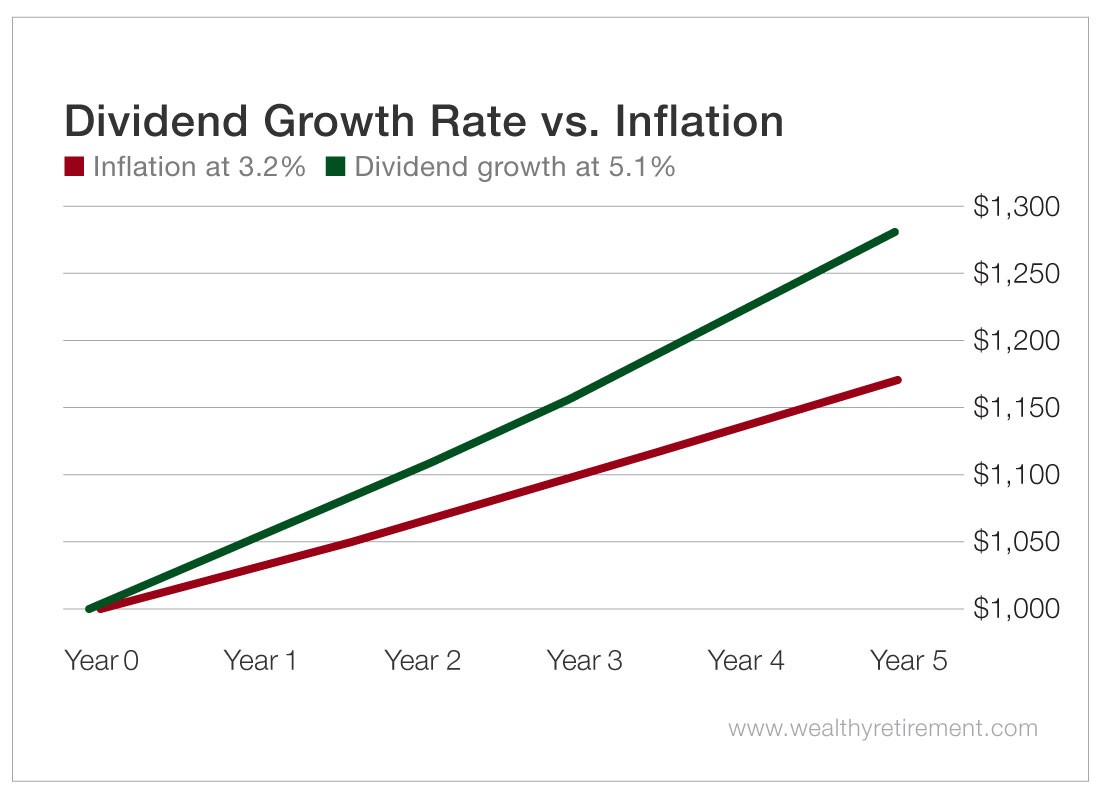

And that official inflation rate is historically low. The average annual increase going back to 1913 is 3.2%. After just five years at the U.S. average rate of inflation, what previously cost $1,000 will now run you $1,171.

That can be troublesome for someone who is living off their investments and receiving small cost of living allowances on their Social Security checks.

So how do you make sure your investments – particularly your income-generating investments – keep up with inflation so that your buying power doesn’t erode?

Dividend growth stocks.

Since 1960, members of the S&P 500 have grown their dividends by 5.1% annually, which exceeds inflation. That means that by investing in dividend growth stocks, not only does your buying power not erode – it actually increases.

How Dividend Growth Stocks Increase Buying Power

To put it another way, investing in dividend growth stocks allows you to buy more stuff.

At 5.1% for five years, $1,000 grows to $1,282.

You can see that your buying power increases when you invest in dividend stocks, and it grows larger as time goes by.

After one year, what once cost $1,000 now costs $1,032 due to inflation. But meanwhile, if you’ve received $1,000 in dividends, after one year, you can cash checks for $1,051.

Four years later, it will cost $1,171 to buy $1,000 worth of goods, while your dividends will be up to $1,282. You’ll have an extra $111 to spend or invest.

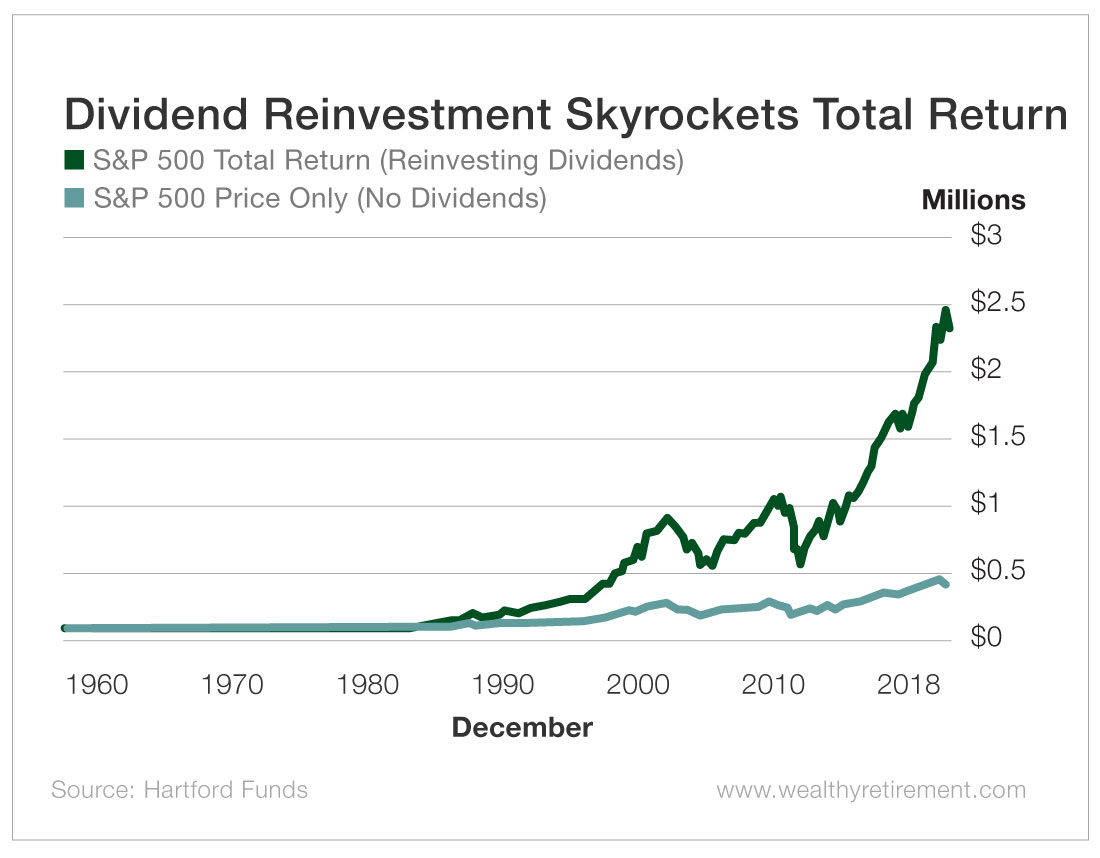

But don’t think that dividends are only for investors who need income today. Since 1960, reinvested dividends have made up 80% of the S&P 500’s return.

An investment of $1,000 in 1960 was worth $431,397 at the end of 2018, when only factoring in price increases. With dividends reinvested, the total is nearly $2.5 million.

Finding great dividend growth stocks is how I spend the vast majority of my day. It’s the subject of my bestselling book Get Rich with Dividends and the focus of my newsletter, The Oxford Income Letter.

But I’m not satisfied with just 5.1% growth. Many of the stocks that are in The Oxford Income Letter’s portfolios grow their dividends at 10%.

For example, NextEra Energy Partners (NYSE: NEP) is a stock I recommended in the March issue of The Oxford Income Letter. The company recently raised its dividend for the 20th quarter in a row.

The payout to shareholders has grown 13% over the past year. I expect double-digit increases for the foreseeable future.

If you’re relying on Social Security or other forms of fixed income to pay for your retirement, you’ll be in for a very rude awakening when inflation eventually moves higher.

By investing in dividend growth stocks, you’ll ensure that inflation does not wreak havoc on your lifestyle.

In fact, the opposite will occur. Each year, you’ll be better off than you were the year before.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.