Why Jack Bogle Is Smiling From Heaven

- Jack Bogle introduced index funds – a major financial innovation – in 1976.

- Today, Nicholas Vardy explains why they are still one of the most innovative and impactful tools for investors, along with one of the easiest ways to earn money.

Jack Bogle – the founder of Vanguard and the father of index funds – passed away in January 2019.

He introduced the first index mutual fund back in 1976. This bit of clever financial engineering allowed the small investor to take a stake in the entire stock market at a minimal cost.

At first, Wall Street mocked Bogle and his newfangled index funds.

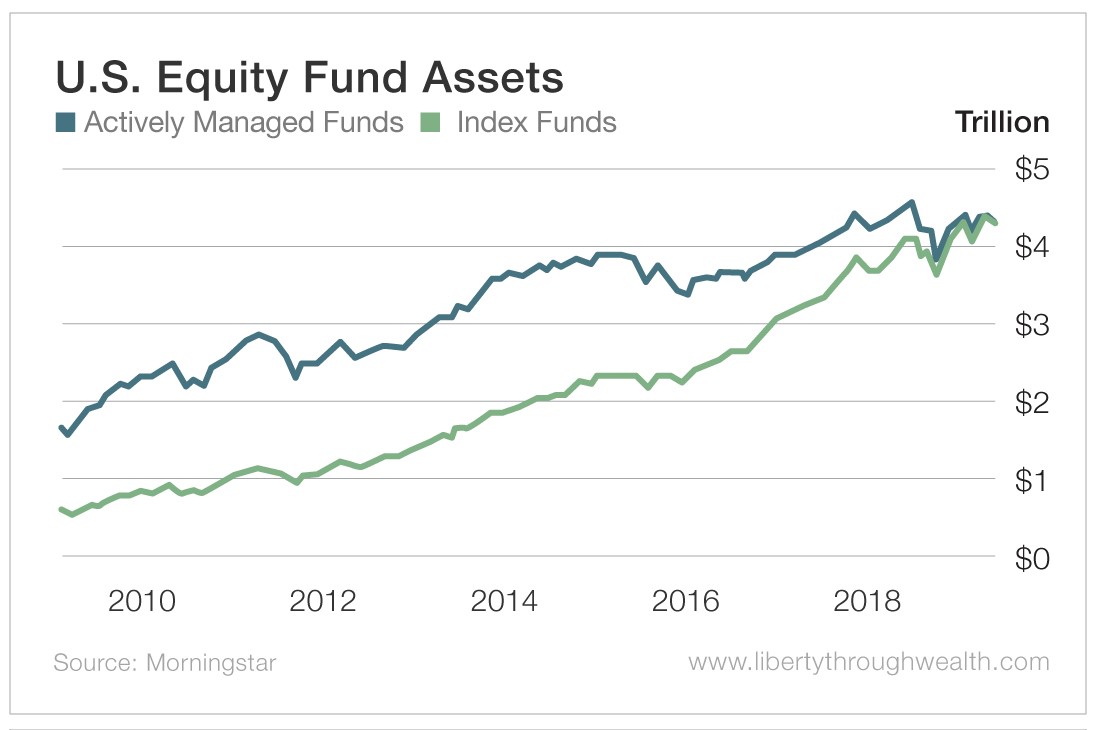

He did not live to see his innovation overtake active managers in terms of assets managed. But that day has now arrived.

The close of August marked the first time in financial history that the money managed by index funds – $4.25 trillion – exceeded the amount managed by active managers, if only by a hairsbreadth.

Even The Wall Street Journal heralded the news as “one of the most dramatic transformations in the history of financial markets.”

No financial innovation has touched the lives of more investors than Bogle’s simple and straightforward index fund.

Here are three reasons why…

First, index funds radically cut the cost of investing for the small investor. The U.S. mutual fund I managed in the 1990s charged 1.5% in annual management fees. In contrast, the Vanguard 500 Index Fund Admiral Shares (Nasdaq: VFIAX) charges a microscopic 0.04% a year. That’s just $4 for every $10,000 invested.

How much do fees matter?

Consider the performance of the Rydex S&P 500 Fund (Nasdaq: RYSOX) versus Vanguard over just the past five years.

The return on these funds should be identical. After all, both are index funds that invest in the S&P 500.

The only real difference? The Vanguard 500 Index Fund charges a fee of 0.04% compared with the Rydex S&P 500 Fund’s 1.55%. (To add insult to injury, Rydex also charges an additional sales fee of 4.75%.)

Second, Bogle’s innovation shined a bright light on the lagging performance of Wall Street’s active stock pickers.

With a combination of high fees and poor stock picking… more than 80% of U.S. actively managed equity funds underperformed the S&P Composite 1500 in the decade that ended in 2018.

Finally, the success of index funds heralded the unexpected rise of financial institutions like Vanguard, State Street and BlackRock.

These retail-driven organizations are cut from a very different cloth than Wall Street giants like Goldman Sachs and J.P. Morgan.

Are Index Funds a Bubble?

The success of index funds has led to talk about how indexing has entered a bubble.

The argument is straightforward.

Index funds distort prices and exacerbate market turbulence. Company share prices tend to rise when they are added to major benchmarks. This causes short-term price swings as money moves in and out of indexes.

Here’s why I don’t buy this argument…

First, index funds are big players. But they hardly dominate the U.S. stock market. U.S.-focused index funds still make up less than 14% of the entire market. (That’s up from roughly 7% in 2010.)

Second, index funds don’t trade much. Annual turnover in an S&P 500 index fund stands at 5%. Compare that with actively managed funds, where annual turnover routinely exceeds 100%.

Finally, there are hundreds of index funds out there. They track dozens of indexes that don’t trade in tandem. The danger of all index funds running for the exits at once is overstated.

The bottom line is this: Index funds have been remarkably successful. And yes, they have disrupted the money management business like no financial innovation before them.

So it’s hard not to see the criticism of index funds by money managers as a self-serving effort to shift attention away from the high fees and lagging performance of most actively managed mutual funds.

That’s why Jack Bogle is right to continue to savor the success of his remarkable index funds from heaven.

As Warren Buffett put it, “If a statue is ever erected to honor the person who has done the most for American investors, the hands-down choice should be Jack Bogle.”

[adzerk-get-ad zone="245143" size="4"]About Nicholas Vardy

An accomplished investment advisor and widely recognized expert on quantitative investing, global investing and exchange-traded funds, Nicholas has been a regular commentator on CNN International and Fox Business Network. He has also been cited in The Wall Street Journal, Financial Times, Newsweek, Fox Business News, CBS, MarketWatch, Yahoo Finance and MSN Money Central. Nicholas holds a bachelor’s and a master’s from Stanford University and a J.D. from Harvard Law School. It’s no wonder his groundbreaking content is published regularly in the free daily e-letter Liberty Through Wealth.