iShares U.S. Aerospace & Defense ETF Could Outperform Following a Middle East Crisis Event

According to CNBC, defense companies have historically outperformed the broader market over the six months following a crisis event in the Middle East.

According to data going back to the 1990 Gulf War, the defense sector averaged a 6.7% return after 19 separate “Middle East crisis events” over the past three decades.

This outperforms the 3.3% average return for the S&P 500 over the same time frame.

So when Middle East tensions once again flared up earlier this month – which could lead to more military action as the 2020 year progresses – I thought it would be a smart idea to look at one of the very best ways to play the entire sector.

That’s why the iShares U.S. Aerospace & Defense ETF (NYSE: ITA) will be the basis behind today’s Trade of the Day.

As a quick backdrop…

President Donald Trump signed a $738 billion National Defense Authorization Act last month, which allocated $21 billion more for defense spending than last year’s bill.

So for the foreseeable future, defense spending will remain strong.

But when it comes to choosing between expensive names such as General Dynamics, Raytheon, Northrop Grumman or even Boeing, how do you even know which stock to buy?

Well, that’s where the iShares U.S. Aerospace & Defense ETF comes in. With one simple purchase, you get them all!

Here are the ETF’s top holdings:

- Boeing: 21.11%

- United Technologies: 16.99%

- Lockheed Martin: 6.34%

- Raytheon: 4.66%

- L3Harris Technologies: 4.75%

- Northrop Grumman: 4.81%

- General Dynamics: 4.49%.

I admit, seeing Boeing as its No. 1 holding might seem concerning. However, the numbers speak for themselves. When it comes to performance, it doesn’t get much steadier than this…

- One-Year: 30.52%

- Three-Year: 17.88%

- Five-Year: 15.45%

- Ten-Year: 17.32%.

Now, here’s the thing…

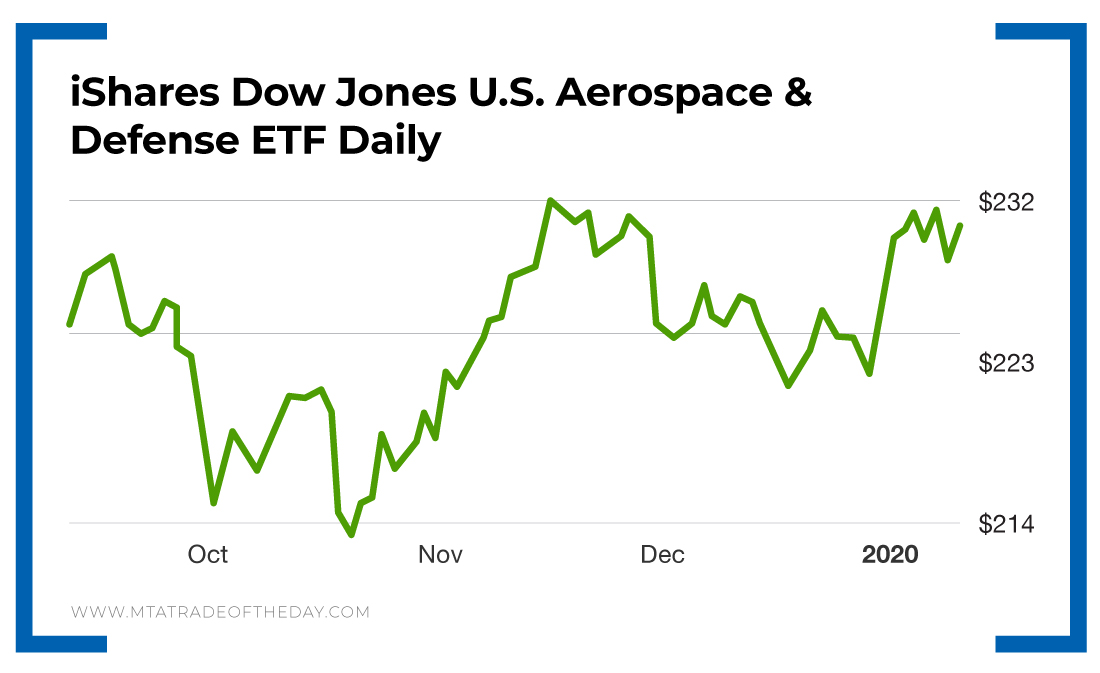

Over the last month, the iShares U.S. Aerospace & Defense ETF has gone down 3.39%. So if you’re looking for that one small window of opportunity to get in, this might be it.

Action Plan: Because of the iShares U.S. Aerospace & Defense ETF’s track record of powerful growth going back a decade and the United States’ 2020 defense budget increase, buying shares of the ETF on this dip might be a smart way to capitalize on a new geopolitical flare-up.

If you’d like to start trading plays like this, with Pro Traders in real time, join me in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.