Can This 9.9% Yield Keep Up Its Tradition?

My teenage daughter embarrasses easily. If I’m talking too loudly, gesturing a little too dramatically or… breathing, she wants to crawl under a rock.

Like many girls her age, she spends most of her time in her room.

So I was pleasantly surprised last week when she announced that she wanted to watch the Macy’s (NYSE: M) Thanksgiving Day Parade together like we have every year since she was very little.

The parade has been held in New York City every year since 1924, and we’ve been watching it curled up on the couch since she was 4.

This year, due to high winds, the balloons had to fly much lower than normal.

This was an appropriate metaphor for Macy’s financial performance.

My daughter asked how Macy’s can afford to pay for the parade. Like the Grinch analyst that I am, I stated, “I’m not sure that it can. Macy’s cash flow is way down this year.”

While my daughter shook off the fact that, like a needle to the astronaut Snoopy balloon, I had potentially popped her dreams of continued Thanksgiving traditions, I began to wonder…

If Macy’s couldn’t afford to pay for the parade, would it also leave shareholders out in the cold when it came to its dividend?

Dividend Safety Starts to Deflate

Macy’s pays a sky-high 9.9% yield thanks to a nearly 75% decline in stock price over the past four years.

It currently pays a quarterly dividend of $0.38 per share, or $1.51 annually.

The retailer has paid a dividend since 2003, cutting it in 2009 during the Great Recession. It raised the dividend every year between 2011 and 2016, and it’s been frozen at the same level ever since.

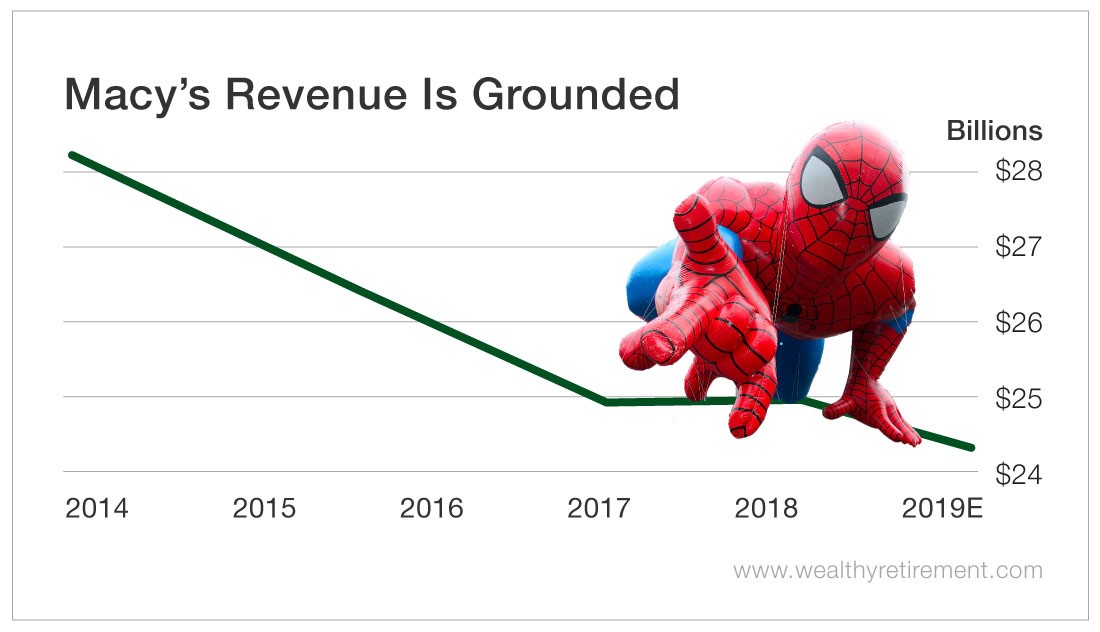

Except for last year when sales were flat, Macy’s revenue has been slowly eroding, slipping since 2015 to around $24.3 billion in 2019.

Free cash flow has also been dropping. In 2017, Macy’s free cash flow totaled $1.6 billion. Last year, it slipped to $1.28 billion.

About the only positive news is the company’s payout ratio. Macy’s paid out just $463 million in dividends for a low payout ratio of 36%.

Its payout ratio is low enough that it should be able to support its dividend in the immediate future. And importantly – the parade.

But if sales and free cash flow continue to decline, Macy’s may have to rethink its dividend policy, especially considering that the yield is so high.

Dividend Safety Rating: D

If you have a company whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.