Making a 130% Overnight Gain on Kellogg

Many of us woke up this morning to another round of heavy selling pressure – which is being attributed to inverted yields on the two-year Treasury vs. the 10-year Treasury.

What exactly does that mean, and why is it so alarming?

First off, it means that the two-year yield is now higher than the 10-year yield.

Secondly, it’s the first time since 2007 that this has occurred. Whenever this does happen, it’s considered a reliable indicator of an economic recession.

In fact, according to research from Credit Suisse, this yield curve inversion has preceded every recession over the past 50 years – with a typical recession lasting 22 months following such an inversion.

Yikes.

If the forecast is true – and we’re in store for 22 months of recession – does this mean trouble for you and your investments?

Honesty, if you’re a War Room member, it shouldn’t matter.

You see, The War Room is like a social media club for investors with a singular goal: to make winning trades.

Forget Facebook with your brother-in-law’s political rants.

Forget LinkedIn with your former co-worker hitting you up for a job referral.

Forget Instagram with your friend’s uncentered sunset picture.

And forget Twitter with its endless feed of nonsense.

Right now, you can join a social media club for investors interested in only one thing: making you money. Spending 15 minutes in The War Room could be the most profitable 15 minutes of your day.

What sets The War Room apart from everything else? I’ll show you.

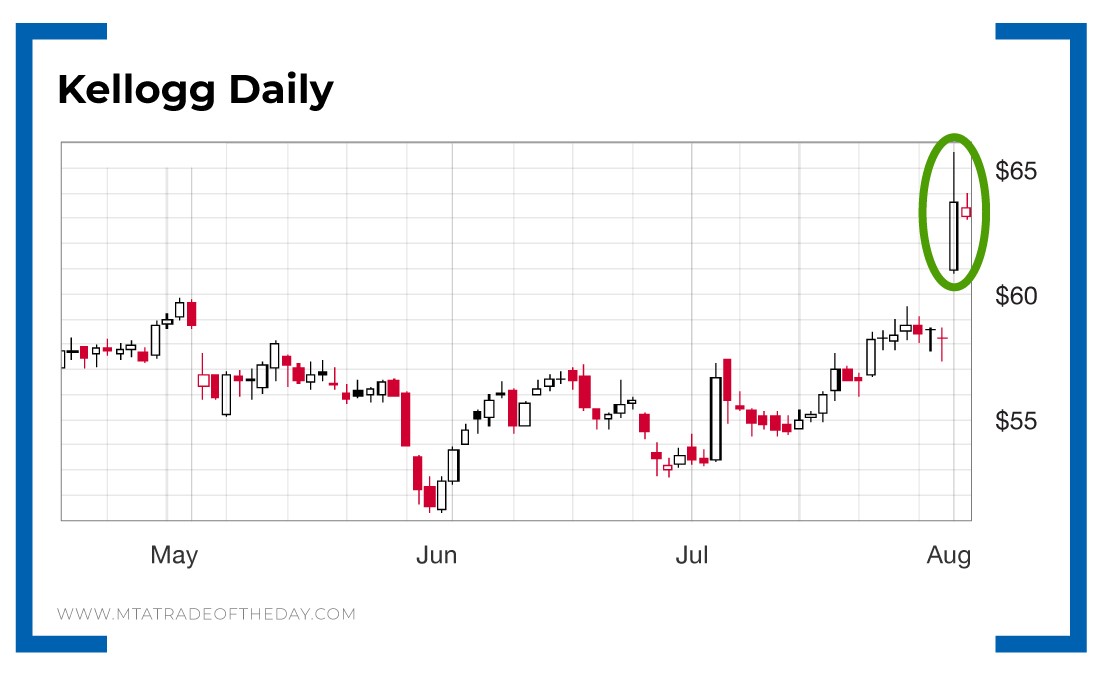

Let’s go back to a real winner we had with Kellogg (NYSE: K)…

On July 31, we recommended entering a call and put combination for $2.15.

Why was it so cheap?

Quite simply, nobody in their right mind thought that the maker of Pop-Tarts, Eggo Waffles and Pringles could make a big move.

That is… nobody except our members in The War Room!

You see, Kellogg fit perfectly into my selection methodology – so War Room members jumped in.

And what happened?

Kellogg stock exploded higher!

And the play War Room members could’ve entered for $2.15?

They had the chance to sell it for $5.01.

That’s an overnight gain of 133%!

Do you want to start racking up winners like that? You can gain more trading insight by signing up for our free Trade of the Day e-letter.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.