Big-Name Investor Sells Shares and Triggers a Play Opportunity

On August 28, I introduced the idea of following along with Schedule 13D filings – which are reported to the Securities and Exchange Commission (SEC) – because they can sometimes lead to great moneymaking opportunities.

As a refresher, I wrote…

A Schedule 13D must be submitted to the SEC within 10 days by anyone who acquires beneficial ownership of more than 5% of any class of publicly traded securities in a public company. These documents give the public transparency into purchases that large shareholders make in any public company.

More importantly, they often contain hints about potential future events at the company, including hostile takeovers, company breakups or any other “change of control” situations.

I noted how Carl Icahn’s recent buying activity revealed a possible profit opportunity in a little-known digital interactions company in Southern California called Conduent.

But today, the story is reversed…

You see, recent 13D filings show that another big-name investor is now selling his shares of a different company.

And a quick look at the company’s chart gives you some telling clues as to why he might be making this move.

Here’s the story…

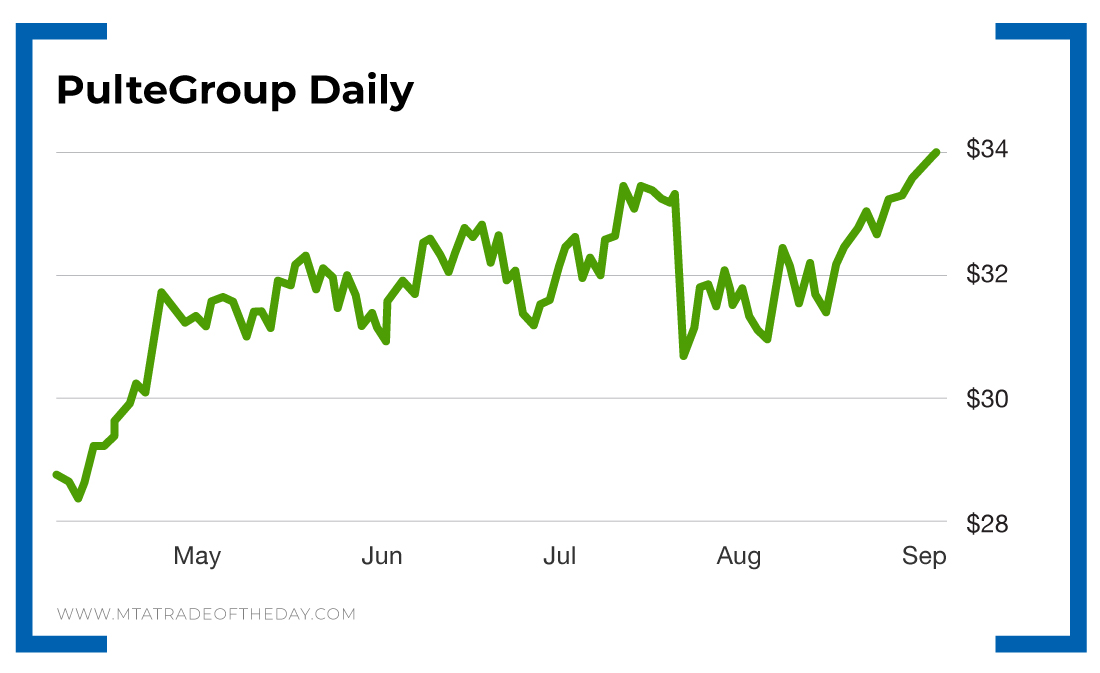

From July 22 to August 23, Mark Pulte disclosed the sale of more than 2.3 million shares of PulteGroup (NYSE: PHM), with prices ranging from $32.82 to $34.02. This reduced his stake to just above 14 million shares, which is about 5.3% of the outstanding shares.

Why would he sell?

As you can see in the chart, the stock price has moved above resistance at $33.50, which might indicate that it’s ready to extend higher.

Mark Pulte’s actions suggest otherwise.

Action Plan: The last time PulteGroup tested the $34.50 level was in December 2017. From there, it fell back to around $28 in May 2018 – only to extend down further to $20 by October 2018. Will this same pattern play out again?

That’s impossible to say.

But the actions of Mark Pulte give us a clue as to what the insiders feel about PulteGroup at these levels…

Hint: They’re telling you to play it lower.

For more insight on stock pullbacks and insider knowledge, join me in The War Room, where I share information like this every day in real time!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.