Will This 9% Yielder Continue to Pay Its Dividend?

MPLX (NYSE: MPLX) is a master limited partnership (MLP) formed by Marathon Petroleum Corp. (NYSE: MPC). Like many MLPs, its main business is operating oil and gas pipelines.

The stock yields a juicy 9% based on the last dividend (it has raised its dividend for the past 10 quarters and every year since it started paying one in 2012).

Can the company continue to pay that healthy of a dividend yield?

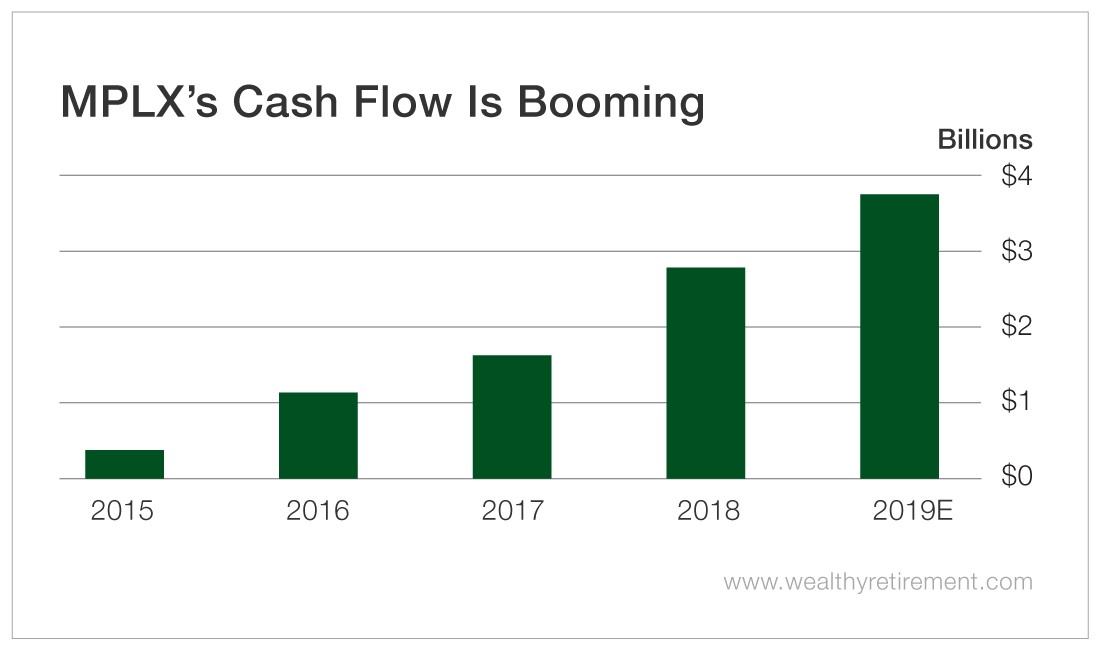

Last year, cash available for distribution (CAD), a measure of cash flow for MLPs, was $2.78 billion. It has been climbing steadily over the years, and in 2019, it is expected to surge to $3.75 billion.

In 2018, the company paid out $1.9 billion in distributions, or 68% of the total CAD. That’s a payout ratio well within my comfort zone.

This year, the company is forecast to pay investors $2.8 billion, or 75% of CAD. That’s still low enough not to be worried that the company can’t afford what it’s paying out to shareholders.

I like the fact that although its history of distributions to shareholders is short, it is impressive with yearly and now quarterly increases.

The only blemish on MPLX’s record is that its debt is a bit high.

Its debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) ratio, which is a common measure of leverage, is 4.05 and is expected to rise to 4.57 by the end of the year.

That’s considerably more than the 3.29 of just three years ago.

Because the company can easily afford its distribution, the high debt level isn’t something that is too concerning, but it definitely should be watched.

There could be a point in the future where CAD is declining and the debt could become a problem. But for now, the dividend looks safe.

Dividend Safety Rating: B

If you have a dividend whose safety you’d like me to analyze, leave the ticker symbol in the comments section.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.