Using the “Parking Lot Indicator” on Cracker Barrel

In 1969, a man from Tennessee named Dan Evins realized that the country’s interstate highway system was quickly expanding.

This new network of roadways was now connecting people from all over the country – allowing them to jump into the car and have access to places that were never available before.

It was an exciting time. And for Evins, it gave birth to a new, unmet market need…

You see, Evins quickly realized that families on road trips didn’t have a place to stop along the highway that offered them a quality, home-cooked meal at a fair price.

So 50 years ago in Lebanon, Tennessee, Evins opened the first-ever destination for Southern, homestyle cooking, warm hospitality and unique retail offerings.

At the time, crackers were delivered to his store in old country barrels. Customers would congregate around these newly delivered barrels full of crackers to discuss the news happening that day. Some called them the “original water coolers.”

And with that, Cracker Barrel Old Country Store (Nasdaq: CBRL) was born.

Fast-forward to today and Cracker Barrel has 660 locations in 45 states across the nation. Every time I drive past a Cracker Barrel, no matter whether it’s 10 a.m. or 7 p.m., one thing is consistently true…

The parking lot is always jam-packed.

In fact, the white rocking chairs on the wooden front porch are always occupied. To me, this means one thing: Its business model is working.

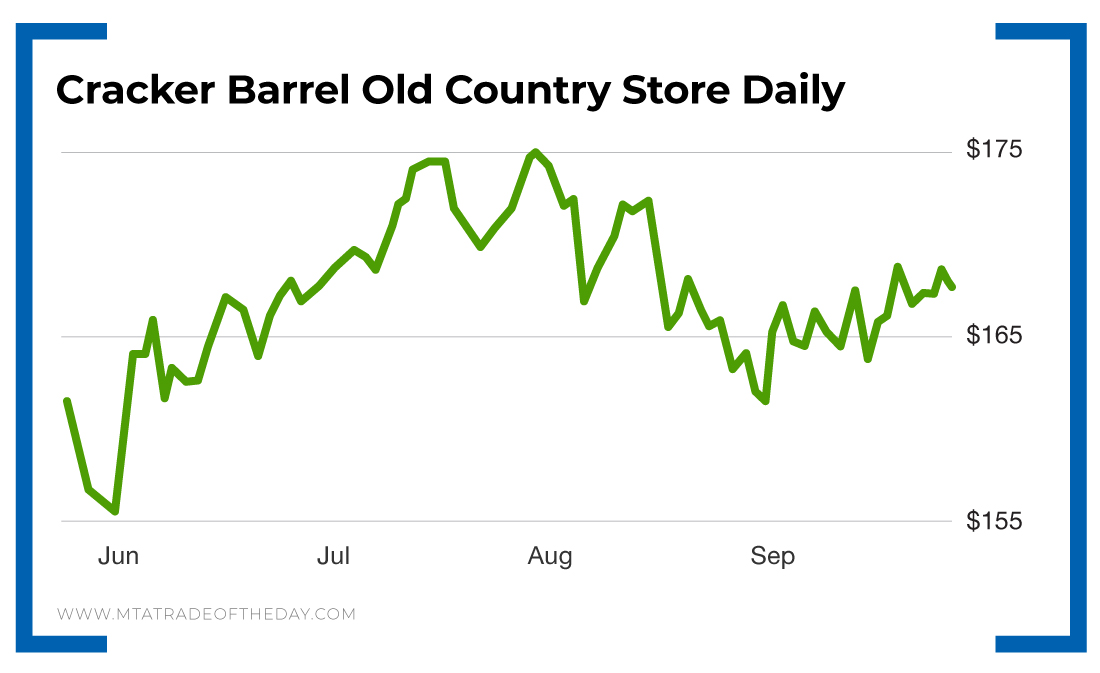

Look at the numbers – you’ll see that the “parking lot indicator” works. On September 18, Cracker Barrel reported better-than-expected fourth quarter fiscal 2019 results. In fact, the company beat the Zacks consensus estimate for the fourth straight quarter.

Adjusted earnings came in at $2.70 per share, far better than the estimate of $2.43. Revenues of $787.1 million surpassed the consensus mark of $774 million. And the company’s bottom line increased 23.3% year over year.

Over the last 52 weeks, Cracker Barrel is up 14%, far outpacing the S&P 500’s gain of 2.6%.

Zacks just upgraded it to a buy, saying, “This rating change essentially reflects an upward trend in earnings estimates – one of the most powerful forces impacting stock prices.”

Action Plan: In The War Room, we’re taking a medium-term approach on the homey restaurant chain and getting positioned to continue inching higher. After all, if we do enter into a recession, it’s my belief that people will not stop going out to eat but instead will scale back their restaurant choices. If that’s the case, then Cracker Barrel stands to be positioned correctly – recession or no recession.

If you’re interested in actionable advice on trading, join our free Trade of the Day e-letter.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.