If You Think That Banks Were Too Big to Fail… Check This Out

How long can the good times last?

That was the question last week as we closed out our Founder’s Retreat in Maine. Our Manward subscribers were eager for our advice and nervous about the news we’d deliver.

“It looks to go on for a long time,” we said. “But don’t let the numbers deceive you. This bull isn’t what he used to be.”

With that, we went on a bit of a rant.

It’s simple math… and more dumb human tricks.

Ummm… About Those Promises

You’ve probably heard about the nation’s pension problem. It’s a trillion-dollar crisis.

News of what’s happening may have been mentioned on the nightly news or on the Today show, but surely neither took the time to detail what it means and the effects it will have on you… the responsible American who’s going to have to pay for it all.

Some folks say the nation’s public pension funds are short some $2 trillion. Others say it’s more like $6 trillion.

We say it doesn’t matter… at that scale, it’s like trying to count the fleas on a dog.

Lazy politicians and bold lies are the culprit. The money the government should have squirreled away to keep good on its promises was long ago spent on the flashy sorts of projects that keep politicians employed.

You know… like a new stadium for the high school or hiring monitors to watch Baltimore’s squeegee boys as they harass drivers.

But here’s the thing – the important part.

States are falling short on their pension promises at exactly the wrong time. Just as they’re realizing they made a huge mistake… Mr. Market is making it harder and harder for them to make a buck.

Bad Math

Oh sure, the stock market has blown our hats off for the last decade, but pension managers don’t like the sort of risk that comes with equities. They’d rather take advantage of the guaranteed math of bonds and other fixed-income investments.

But as interest rates sink lower and lower, these funds have watched their returns head in the same direction.

Higher needs and lower returns have pushed more than one fund boss out of a job.

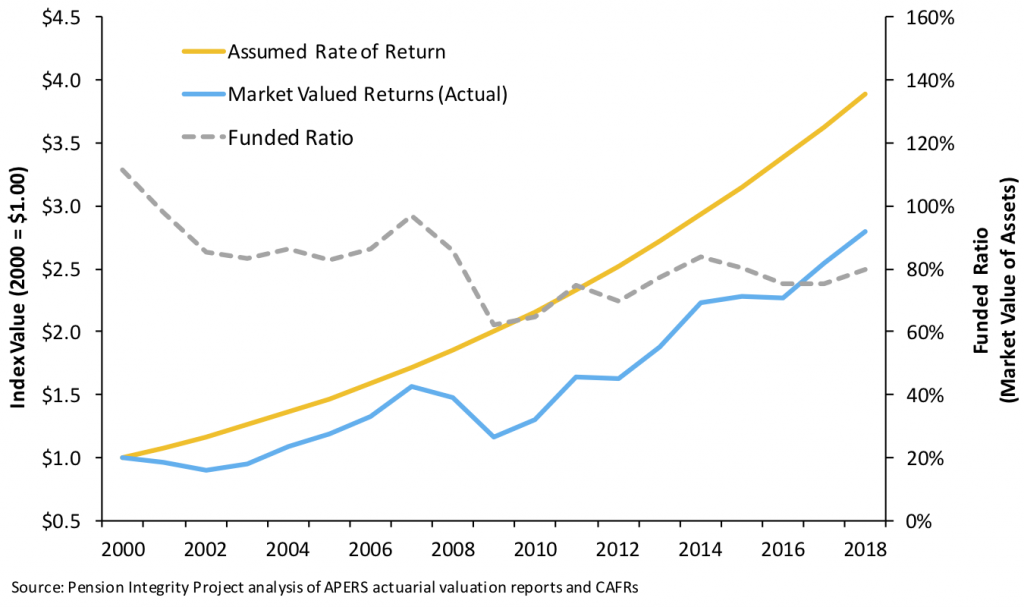

The Arkansas Public Employees Retirement System is one of the better-funded plans in the nation, and yet this chart from the Pension Integrity Project shows just how troubling things have become.

That growing gap between expectations and real-life returns proves that the system is broken. What used to work no longer gets the job done.

With each year that funds miss their goals, the unfunded liability grows.

Risky Business

With just 50% of its obligations funded, Illinois gets the trophy for worst financial management. But many folks are surprised to hear Kentucky takes second place and Connecticut (with the highest median income in the country) takes a close third.

As the investments that pension funds traditionally lean on hand out less and less cash, the folks in charge of them have been forced to change their math. Over the last decade, they’ve brought their “expected” annual return down from 8% to an average of just 7.45%… and they’re still having trouble.

Again, as the return on conservative assets sinks, it forces managers to take on riskier assets.

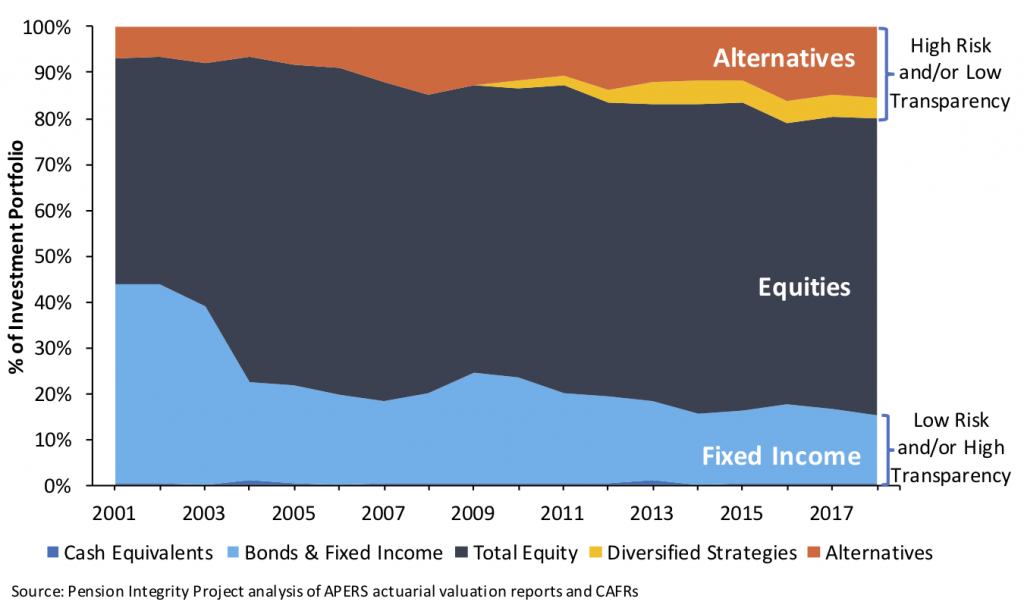

In 2001, when the Fed’s key interest rate was at 6% (ah, the good ol’ days), pensions put nearly half their money into fixed-income investments.

Finding another 2% or so worth of return via stocks and other long-term assets was easy.

But now that the Fed has rates hovering just above zero, bonds make up less than 20% of the typical fund’s holdings… and, as the chart shows, the figure is quickly falling.

All that money is now going into stocks and other higher-risk assets.

It’s bad news.

It means a severe downturn in stocks could wipe out trillions of dollars of promises.

It’d be hell.

But it’s also very good news.

That’s because if you think that banks were too big to fail and that General Motors was worth a taxpayer bailout… wait until you see the lengths politicians are willing to go to save the retirements of their best voters.

It’s why this bull market will scream on for far longer than we think.

And it’s why we tell folks to buy stocks… and mix themselves a nice, stiff drink.

[adzerk-get-ad zone="245143" size="4"]About Andy Snyder

Andy Snyder is the founder of Manward Press. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. In the years that have followed, he’s become sought after for his outspoken market commentary.

Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world – from four-star ballrooms to Capitol hearing rooms – and has rubbed shoulders with lawmakers, lobbyists and Washington insiders. He’s had lunch with John McCain… fished with America’s largest landowner… and even appeared on the Christmas card of one of Hollywood’s top producers.

Today, Andy’s dissident thoughts on life, Liberty and investing can be found in his popular e-letter, Manward Financial Digest, as well as in the pages of Manward Letter. He also is at the helms of the award-winning VIP Trading Research Services Alpha Money Flow and Venture Fortunes. Andy resides on 40 bucolic acres in rural Pennsylvania with his wife, children and a steadily growing flock of sheep.