Playing The Children’s Place Lower in The War Room

Does a sharp paper trader – with intimate knowledge of fall children’s fashion – know something we don’t?

If you look at today’s options transactions, it would definitely appear that way.

Here’s the scoop…

This afternoon, a very interesting trade crossed the tape on The Children’s Place (Nasdaq: PLCE).

Someone bought 2,897 of The Children’s Place October $75 puts for $1.04 million.

That’s a pretty sizable order.

But they weren’t quite done.

Moments later, 1,986 additional October $75 puts were bought for another $714,960.

So someone with rather deep pockets is now putting more than $1.7 million on the line – speculating that The Children’s Place will move lower between now and October 18.

Could this be a direct result of the Stitch Fix (Nasdaq: SFIX) earnings that we highlighted in yesterday’s Trade of the Day issue?

To circle back to that article, Stitch Fix reported earnings of $0.07 per share on revenue of $432 million. This was a big beat from the company, as the analysts at FactSet were expecting earnings of $0.04. Stitch Fix also reported a powerful 18% increase in active clients to 3.2 million.

All good, right?

Not so fast…

Stitch Fix issued Q1 revenue guidance in a range between $438 million and $442 million, which was far below the Wall Street expectation of $451.3 million. And just like that, the company reversed hard to the downside – moving 13% lower at today’s open.

While the correlation between Stitch Fix and The Children’s Place might be small, there’s a chance this big put buyer is using the negative reaction on Stitch Fix to prepare for a similar move on The Children’s Place.

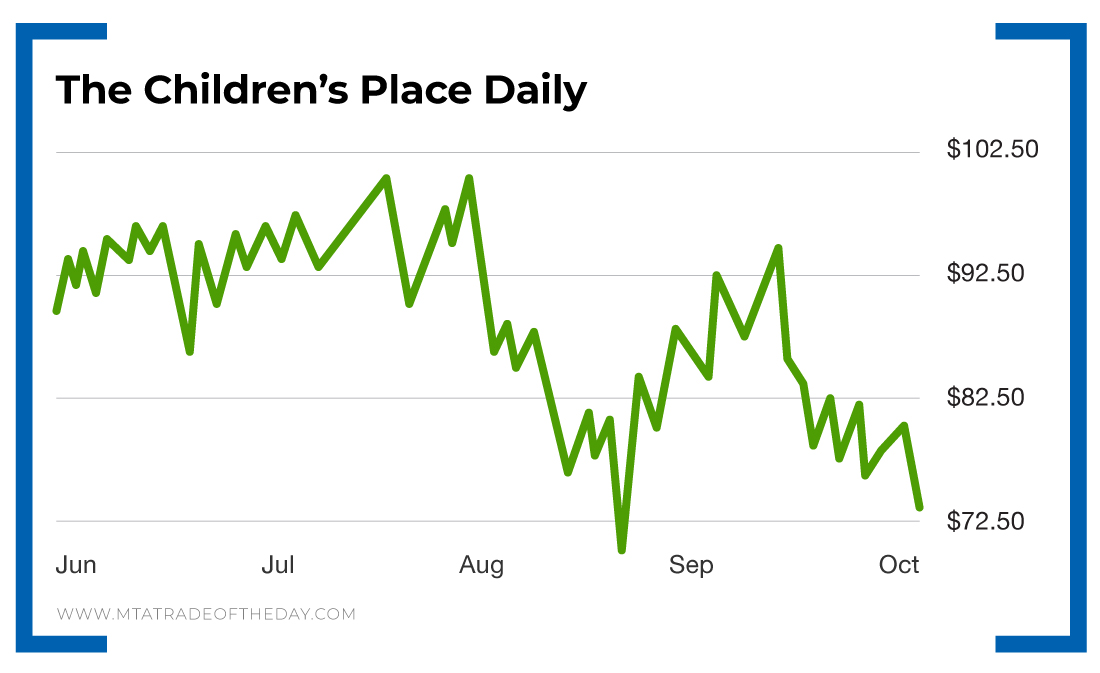

Action Plan: From a chart perspective, negative retail earnings – combined with a weak market environment – could easily be the catalyst to trigger a retest of the August lows on The Children’s Place around $70. Combine those indicators with a heavy put buyer (noted above), and it all lines up for jumping on board and playing it lower. That’s exactly what we did today in The War Room.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.