Playing Oil Price Uncertainty with Intercontinental Exchange

Oil price shocks…

I think it’s fair to say that they’re every investor’s worst nightmare.

In fact, I’d put those three words right up there with hearing things like “Your water heater is shot” or “Your root canal is way more complicated than we originally thought.”

From an investing standpoint, oil price shocks are so troubling because they’re unexpected, they’re unpredictable and they always lead to uncertainty.

None of those U-words (unexpected, unpredictable, uncertain) is what any investor wants to hear.

So the big question is…

As traders, how do you play this?

In The War Room, we have a solution. And it works.

Here’s the scoop…

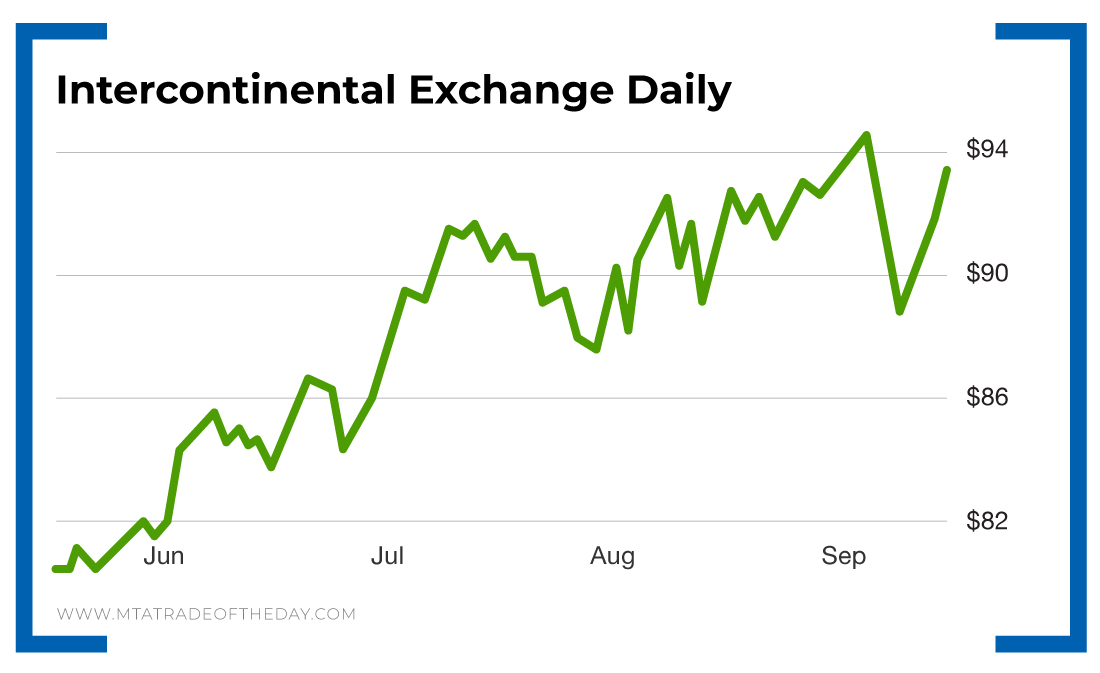

The name we’re using to play oil price uncertainty is Intercontinental Exchange (NYSE: ICE).

The company operates exchanges, clearing houses and listing venues for commodity, financial, fixed-income and equity markets. The Intercontinental Exchange operates in the United States, the United Kingdom, the European Union, Asia, Israel and Canada.

The company’s trading and clearing segment maintains marketplaces for energy and agricultural commodities, metals, interest rates, equities, credit derivatives, exchange-traded funds, bonds and currencies.

The data and listings segment offers data services to support the trading, investment, risk management and connectivity needs of customers across major asset classes.

Over the last five years, Intercontinental Exchange has grown 36% in earnings year over year.

And, starting September 23, the company will start offering bitcoin futures trading.

Those two data points are certainly enough to paint a bullish argument.

But here’s why I especially like trading the financial market company…

Oil price shocks create more trading volume in the energy sector. And by design, more trading volume equates to more transaction volume. In other words, oil price shocks equal more business.

Action Plan: This week in The War Room, we’ve traded in and out of Intercontinental Exchange, which has resulted in winning trades. We continue to like the idea of buying on dips.

Today, a new member, Robert B., said, “3 for 3 winners.” To get the exact entry and exit advice and to start hitting daily winners, we invite you to join us in The War Room today!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.