Why This Recession Indicator Leads to Value Investing

There’s a powerful recession indicator that’s flashing red. The yield curve inversion is catching headlines but it’s largely misunderstood. So today, let’s look at why it’s a sign of an economic downturn. And with the stock market near all-time highs, the next crash will provide great value investing opportunities.

Warren Buffett is preparing and it pays big dividends to follow his moves. With Buffett’s passive approach, you can use some of his same techniques. But before we dive into that, let’s look at the yield curve indicator…

Recession Indicator Yield Curve Inversion

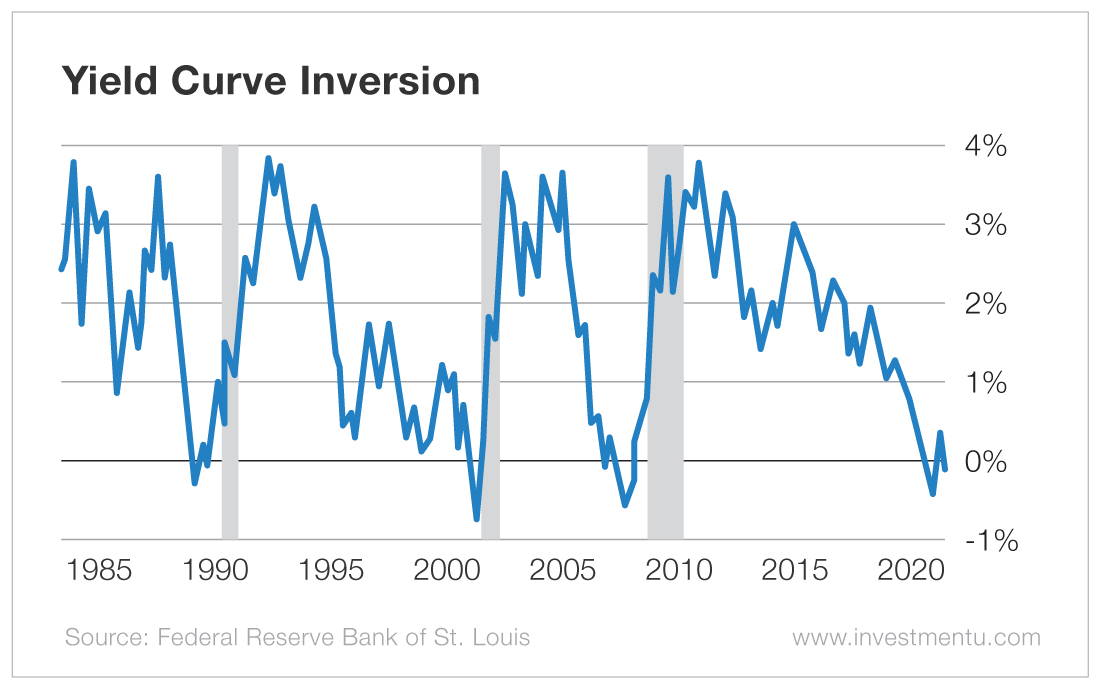

For over 50 years, the yield curve inversion has predicted every U.S. recession. And the chart below shows the last three times it’s happened. The blue line shows the 10-year interest rate minus 3-month rate since 1985…

Each time 10-year interest rates have dropped below 3-month rates, a recession has followed. Recessions are marked by the gray shading. And on average, a recession starts roughly a year and a half after it dips into negative territory.

Some analysts also point to the 10-year minus 2-year inversion. This similar indicator also dipped into the red in August of last year… so a recession might be coming soon.

Why is the Yield Curve Inversion a Recession Indicator?

There’s a clear pattern. But why is the yield curve inversion a recession indicator? The yield curve is influenced by millions of data points. It’s a complex system but overall, it helps reveal investor and regulator expectations…

When investors are uncertain about the economy, they gravitate toward safer investments. And U.S. debt is one of the safest investments available – thanks to the power to tax.

On top of this, the bull market has run long in the tooth. Stocks and other assets have become expensive. Investors are struggling to find better places to park their money. As a result, investors are more willing to lock into lower rates. And this increased demand for long-term treasuries has pushed rates down.

The yield curve inversion also flips the banking model upside down. Banks borrow in the short term and lend in the long term. They’re spread businesses. So an inversion can lead to lending losses and put downward pressure on total lending. That might be another reason recessions follow the yield curve inversion.

One last widely stated reason is that the yield curve influences monetary policy. The Federal Reserve lowers or raises the fed funds rate based on business cycle expectations.

Now, history doesn’t repeat itself but it often rhymes… a recession might be on the horizon. And to prepare, let’s look at how one of the world’s best investors has prepared in the past.

Value Investing with Warren Buffett’s Playbook

Warren Buffett sticks to owning and buying great businesses – or pieces of businesses. Although he doesn’t rush into every deal. And he’s now struggling to find good value investing opportunities. This makes sense after the longest bull market in U.S. history.

Berkshire Hathaway’s cash has climbed from about $40 billion in 2010 to $128 billion today. It’s earning little interest but he knows that patience pays…

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

When a recession hits the stock market and fear is high, Berkshire will deploy its cash pile. For example, in just two months in 2008, Berkshire invested more than $15 billion. That was in companies such as Goldman Sachs (NYSE: GS) and General Electric (NYSE: GE).

This contrarian approach has helped Buffett outperform the market in the past. And I’m excited to see how he deploys capital during the next recession.

The yield curve inversion is just one of many indicators pointing toward a recession. The next downturn might happen in 2020 or take a few more years. No one has a crystal ball but we can use history as a guide. To help prevent big portfolio losses during a crash, you can shift from riskier assets to top consumer staple stocks.

Here at Investment U, we keep you updated with important market news and ideas. We’re also dedicated to helping you learn how improve your finances. So swing by any time and if you choose to, you can sign up for our free e-letter below. It’s packed with insight from market experts.

[adzerk-get-ad zone="245143" size="4"]