Revisiting Our Profitable Predictions on Best Buy and Dollar General

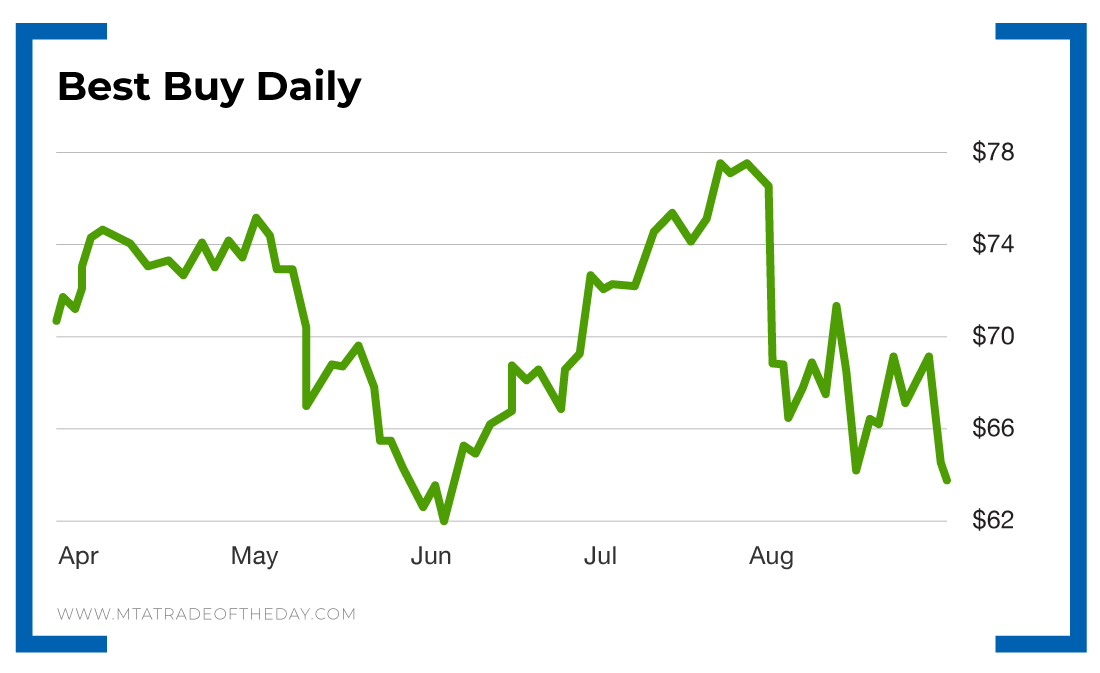

Back on July 17, I published a Trade of the Day titled “Why Best Buy’s Resistance Level Is Worth Tracking.”

In it, I wrote…

Whenever you have a stock hitting a double top resistance – at the same time that insiders are selling stock – your speculative antenna should go up. Why? Because that’s two bearish indicators – occurring simultaneously. That’s exactly the situation facing Best Buy (NYSE: BBY) right now…

A big part of trading is following support and resistance levels that just occurred – and Best Buy at $75 qualifies as the most recent resistance level worth tracking. Combine that with two significant insider sales – and this is a name worth biasing lower.

Now let’s look at how the company has reacted since we published that article, which advised readers to bias Best Buy lower at $75.

It’s moved all the way down to its current level of $63.

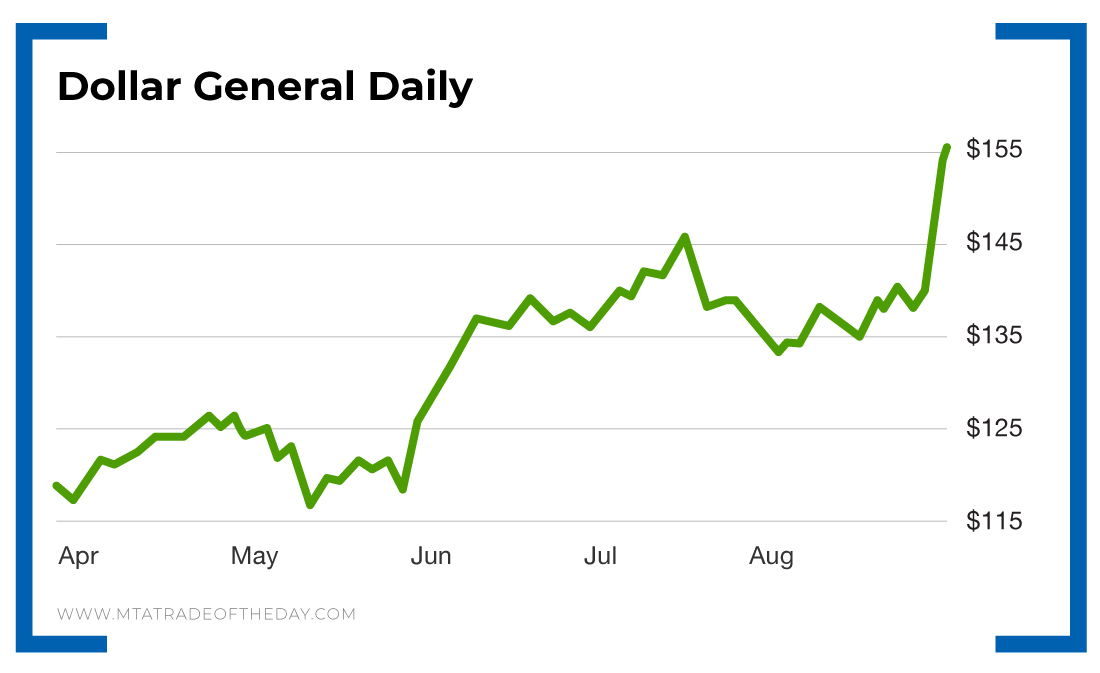

On April 16, I published a Trade of the Day titled “How a Florida Getaway Revealed This New Play.”

In it, I wrote…

Despite its massive presence in the south, Dollar General (NYSE: DG) still has very minimal exposure to the northern states – which is why the company is still in rapid expansion mode.

During fiscal year 2018, Dollar General opened 900 new stores, remodeled 1,050 stores and relocated 115 stores. And during fiscal year 2019, it plans to open another 975 new stores, remodel 1,000 stores and relocate 100 stores.

This is the sort of growth that keeps stock charts moving up. What’s more, Dollar General management is quite confident in its growth model – which is why the company bought back 9.9 million shares for $1 billion during fiscal year 2018… Look to continue riding Dollar General with an upside bias.

Let’s look at how the company has reacted since we published that article, which told readers to bias Dollar General higher at $95.

It’s moved all the way up to current levels of $156.

Just this week, Barron’s said that 75% of the goods Dollar General sells are not subject to China tariffs. That’s likely why John Heinbockel of Guggenheim Partners said, “Dollar General is uniquely positioned, relative to most retailers, to manage these tariffs.”

Action Plan: It’s often a good idea to keep tabs on past Trade of the Day forecasts because, as you can see, many of them can make you a lot of money.

Shorting Best Buy at $75 (now at $63) and buying Dollar General at $95 (now at $156) are just two recent examples. For more profitable information and exact trade advice on potential setups like these, join me in The War Room!

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.