Scorpio Tankers Is a Winner You’ve Never Considered

Buy high – sell higher.

As we continue to trade within a market that simply refuses to move lower, this trading tactic seems to be the name of the game right now.

In The War Room, Karim and I are both attempting to carefully pick and choose names that we feel comfortable playing calls on at these elevated levels.

For me, this has led to five winning trades on Walmart.

And for Karim, this has led to a winning put sell play on Cisco Systems.

But just to further strengthen the point that there’s shockingly little value to be found right now, Warren Buffett is sitting on $128 billion in cash – and he hasn’t made his “elephant sized” acquisition yet. Why not? Well, primarily because he cannot find anything that’s undervalued right now.

If you’ve been a longtime follower of The War Room or Trade of the Day, then you’ve heard me speculate that Buffett is sniffing around at names like Delta Air Lines, Walgreens Boots Alliance, Southwest Airlines, FedEx and even United Parcel Service.

But so far, he hasn’t been able to pull the trigger on anything.

So while we continue to scour this market for value, I came across something that I’d like to bring to your attention today.

I hadn’t really considered this sector before, but thanks to some recent news, trading in it now makes a ton of sense.

Here’s what Barron’s had to say about the sector:

Shipping companies should benefit from the Phase 1 China and U.S. trade deal.

According to Evercore ISI analyst Jonathan Chappell, the deal “benefits [their] entire coverage universe,” which includes shipping names like Genco Shipping & Trading, Euronav and Scorpio Tankers (NYSE: STNG).

Specifically, Chappell says that Scorpio Tankers will benefit from “the return of long-haul U.S. crude oil volumes to China.”

Of all these names, only Scorpio Tankers trades options, so that’s why I’ll feature it for you here in Trade of the Day.

Scorpio Tankers was founded in 2009 and is based in Monaco.

The company engages in the “seaborne transportation of refined petroleum products” using 128 product tankers. With an average tanker age of 3.7 years, Scorpio Tankers offers a newer fleet, and its stock has responded accordingly.

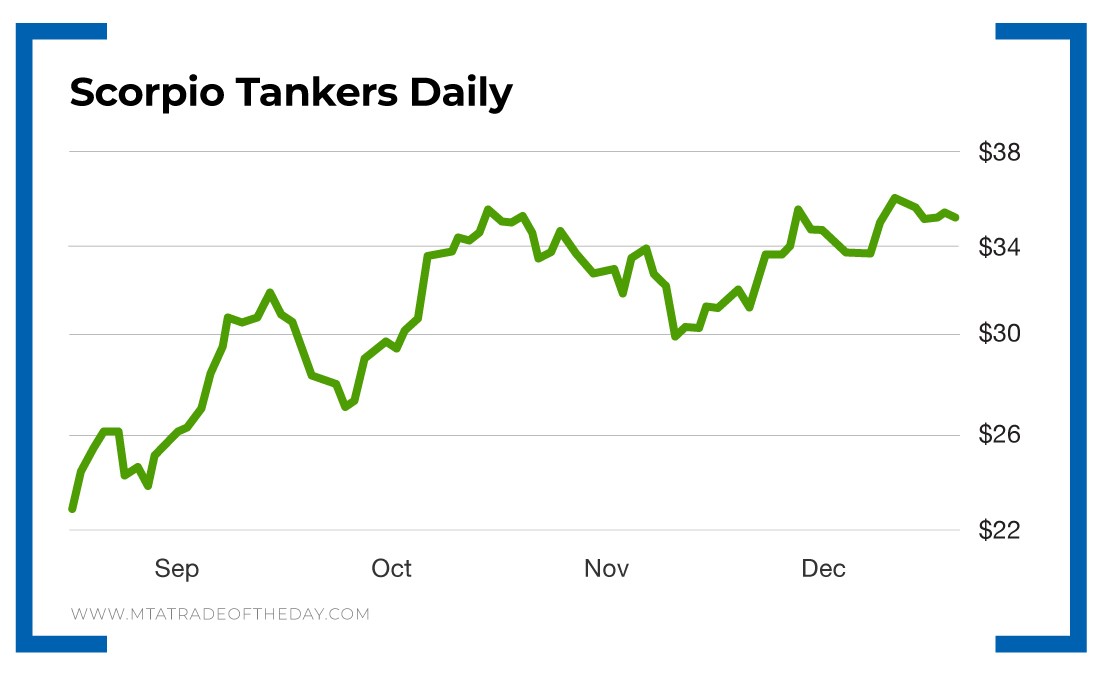

Over the last 52 weeks, the company’s shares are up 112.95%. On a pullback to the $34 to $35 range, Scorpio Tankers will look buyable again – with the trade war news as a continued upside catalyst headed into 2020.

Action Plan: Shipping stocks could be among the group of winners in a Phase 1 trade deal, so accumulating shares on a strong company like Scorpio Tankers might be a viable strategy going into 2020. Over in The War Room, many of you have been asking to get a snapshot of our trading performance. So here goes…

In this past week’s closed trades, we won 13 of 15 trades (86.67%), with eight winners in a row. We closed one trade this week for a slight loss.

Of all the trades we opened and closed this week, we won 13 of 14 (92.86%), with nine winners in a row!

All told, it was another fantastic trading week.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.