Sector Rotation With Kimberly-Clark

One of the biggest things I highlighted in The War Room recently was an unmistakable sector rotation that’s occurring right now in some unique market segments.

Specifically, over the last week, traders have been selling high-flying names such as Okta, Roku and Twilio, just to name a few.

Look at these pullbacks so far just in the month of September.

- Okta: $130 down to $102

- Roku: $170 down to $147

- Twilio: $135 down to $109

What does this tell you?

Most importantly…

It tells you that investors and traders alike are moving into what’s perceived as more value and safety positions.

In case we fall into a recession – or in case the U.S. markets react negatively to the drone strikes that knocked out about half of Saudi Arabia’s daily crude production – it’s smart to start getting more defensive here.

After all, a sharp rise in oil prices is ramping up worries about how the U.S. economy can handle such a sudden price increase. If this price hike slows economic growth – even in the smallest way – it could threaten an already fragile economy.

How do you manage this?

That exact question came up last week during a panel discussion at The Oxford Club’s Private Wealth Seminar in Carmel Valley, California. When the microphone was passed to me, I used the example of taking safety in a name like Kimberly-Clark (NYSE: KMB).

My rationale: No matter whether we’re in a recession or not, new mothers will still buy diapers from Huggies and Pull-Ups.

Oxford Club Chief Trends Strategist Matthew Carr also jumped into the discussion, saying, “You won’t go without buying toilet paper either.”

As the maker of branded products such as Kleenex, Scott and Cottonelle, Kimberly-Clark is one of my favorite recession-proof plays available today. To me, that means the company’s pullback is buyable.

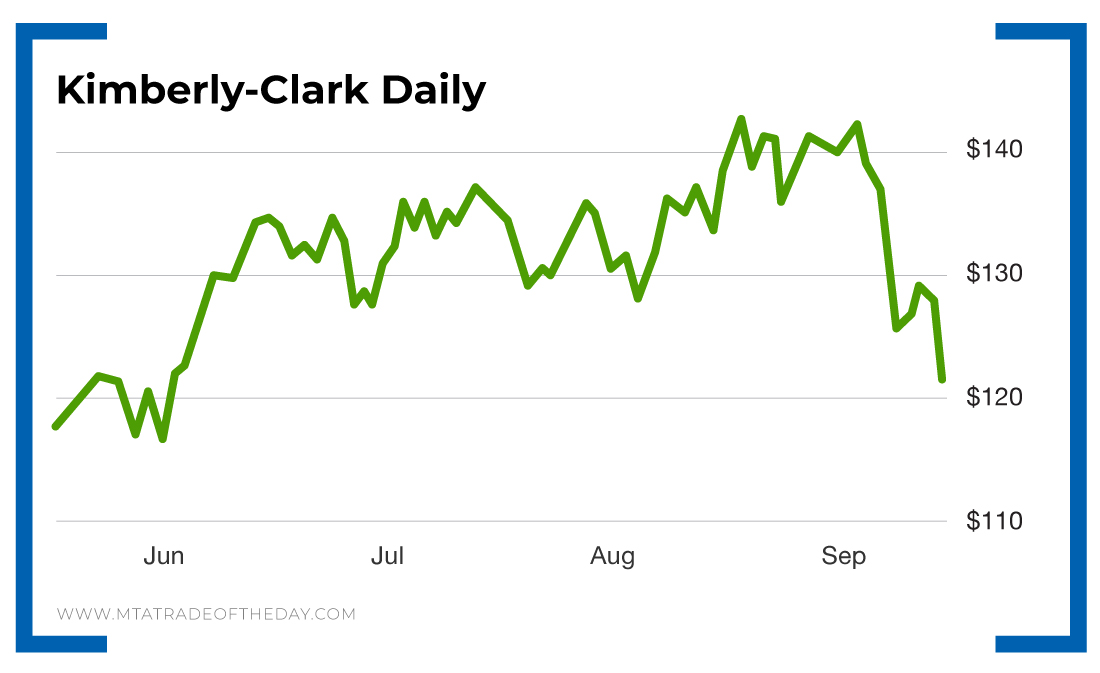

Action Plan: The $126 to $128 level represents a June support zone on Kimberly-Clark that we’re watching carefully. To receive updates and learn more about other trading opportunities, sign up for our free Trade of the Day e-letter.

[adzerk-get-ad zone="245143" size="4"]About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.