Starbucks’ Dividend History Shows an Income Opportunity

Starbucks’ dividend history shows consistent growth, and it’s been a great stock for investors. But will this continue going forward? To help answer this question, let’s look at past dividend trends.

And before we dive into that data, it’d also be useful to look at the overall business. For many retail coffee stores, 2020 has been a tough year. Starbucks has performed relatively well, though. That’s largely thanks to its size and the technologies it uses…

Business Overview and Highlights

Based on its current market cap, Starbucks is a $116 billion business. The company is based out of Seattle, Washington, and employs 349,000 people.

In the fourth quarter of 2020, the company pulled in $6.2 billion in sales. That’s down 8% year over year. And for the full year, total sales came in at $24 billion. That works out to $67,000 per employee.

Starbucks has seen a decrease in sales, but it could have been much worse. Going into the pandemic, the company already had a strong online ordering system. It’s easy-to-use app has helped keep customers buying its products.

This has helped Starbucks maintain an investment-grade credit rating. It comes in at BBB+. And this allows Starbucks to issue cheap debt to expand operations and finance other initiatives like paying bigger dividends…

Starbucks’ Dividend History of Growth

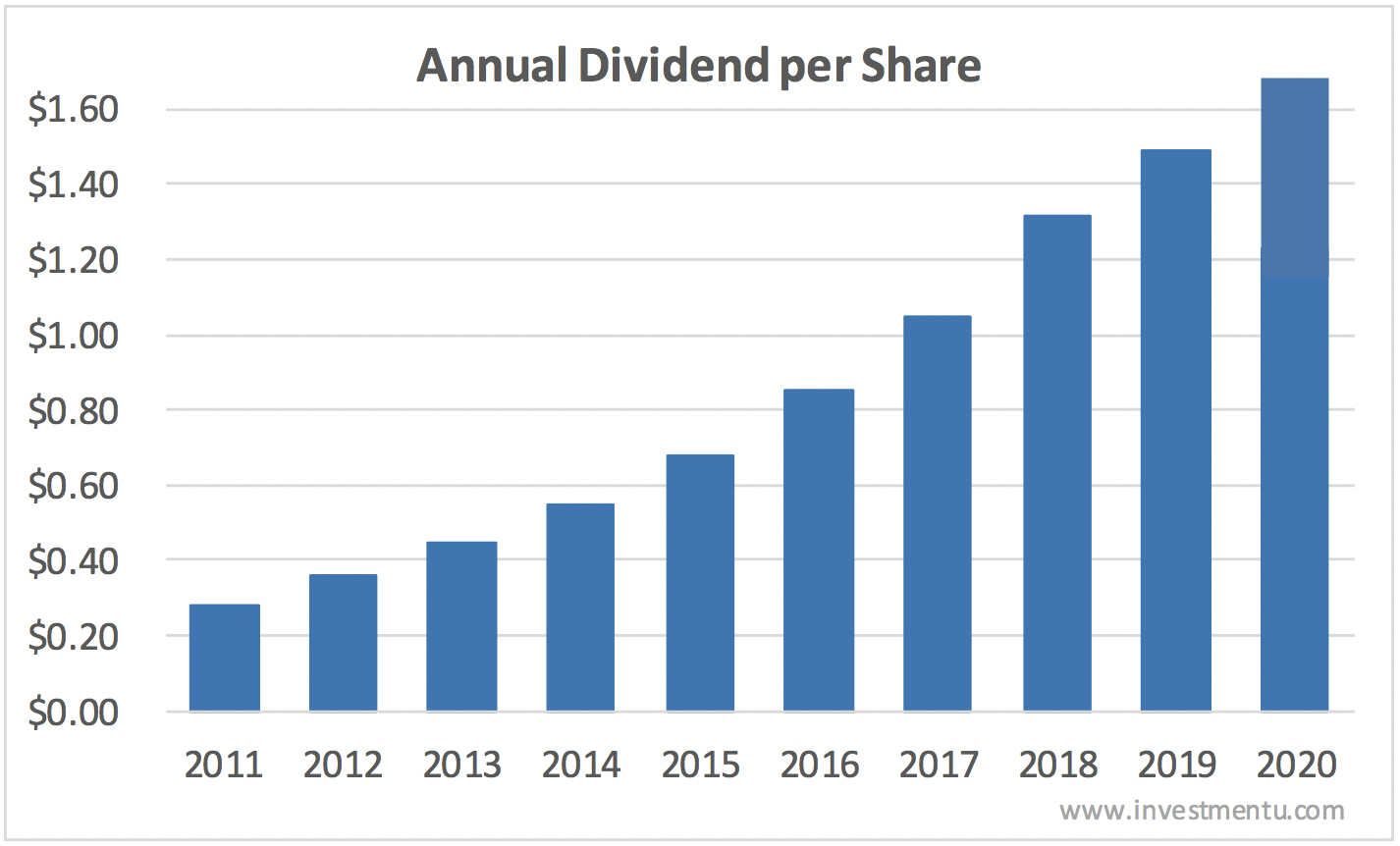

The company paid investors $0.28 per share a decade ago. Over the last 10 years, the dividend has climbed to $1.68. That’s a 500% increase, and you can see the annual changes below…

Starbucks’ compound annual growth is above 19% over the last 10 years… And over the last year, the dividend has climbed 13%. This dividend growth is a great sign. Starbucks management continues to reward shareholders.

The company pays quarterly dividends and this is common for most companies. Some pay monthly, though, and that can be great for meeting monthly expenses. If you’re interested in seeing the top monthly dividend stocks, click on that link.

Now another important factor to consider is the current dividend relative to price. So, let’s take a look at the dividend yield…

Current Dividend Yield vs. 10-Year Average

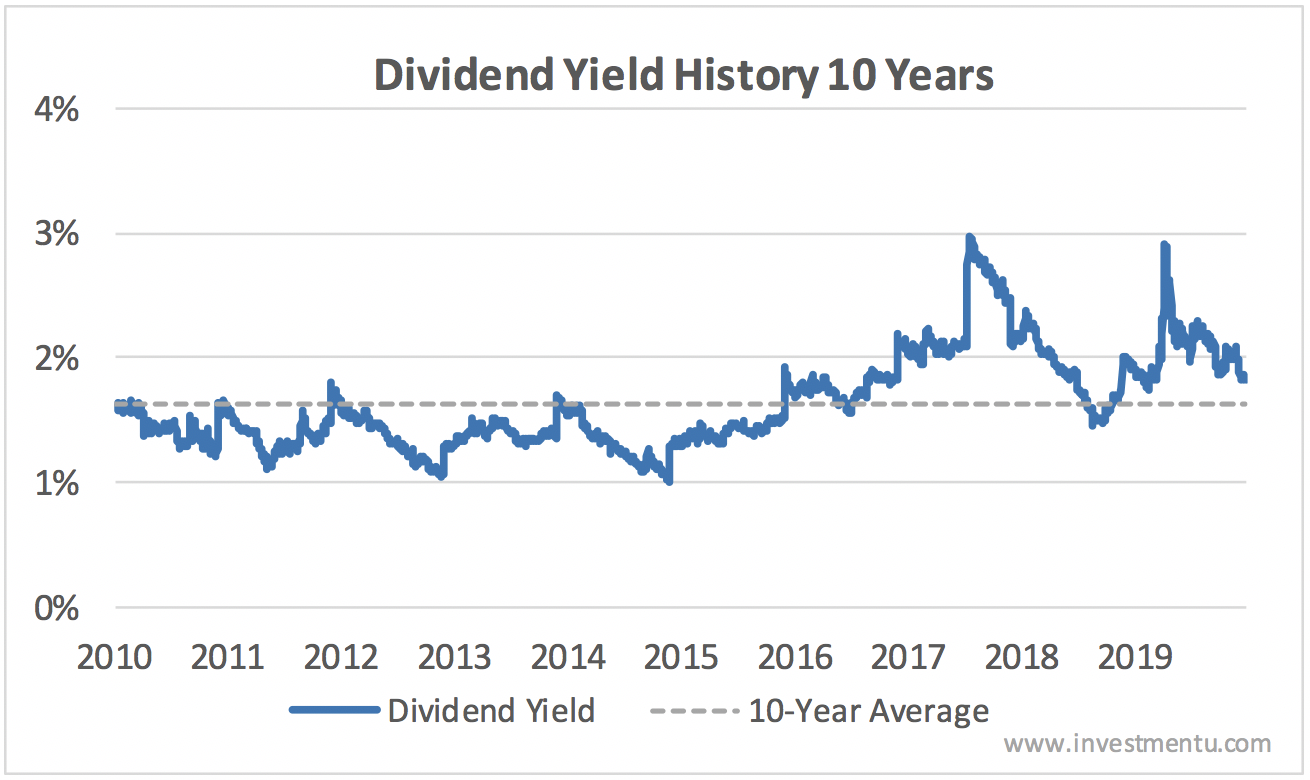

Starbucks’ history of dividend growth has made it one of the best income stocks around. This also makes its dividend yield a great indicator of value. A higher yield is generally better for buyers. That’s assuming it’s sustainable, and we’ll look at that after the dividend yield history.

Starbucks’ dividend yield comes in at 1.83%, above the 10-year average of 1.63%. The chart below shows the dividend yield over the last 10 years…

The higher yield shows that the annual dividend growth has outpaced share price growth. If you invested in Starbucks today, you’d be getting a higher yield than many investors got in the past.

Now, a 1.83% dividend yield isn’t huge, but it is higher than CDs and other short-term savings securities. Plus, if the board of directors continues to increase the dividend, your dividend yield based on the current price will climb. Maybe in another three years, your dividend yield on cost will have climbed to 2.5%.

But the dividend growth might not continue. How safe is Starbucks’ dividend today and going forward? To answer this, it’s helpful to look at the dividend payout ratio.

Dividend Payout Ratio

To determine whether a dividend is safe, we can look at Starbucks’ income relative to the total dividend it pays investors. Outside of this year and a spike in 2013, this ratio has been at or below 50% every year. That’s a good indicator of future payouts.

To better understand this ratio, a payout ratio of 50% would mean that for every $1 Starbucks earns, it pays investors $0.50. That’s a simplified explanation, and a lot goes into calculating a company’s net income. Still, it can be a useful metric when looking at dividend safety.

The more concerning issue is the spike this year. It makes sense given the shutdowns and the reduction in travel, though. Over the next year, there’s a good chance that sales will climb once again. This should trickle down to net income.

If income climbs over the next few years, Starbucks’ dividend history should continue to match it. But ultimately, only time will tell. Investing is never a risk-free endeavor. So it can be good to diversify your portfolio…

If you’d like to see more dividend research and other investing opportunities, consider signing up for our free Investment U e-letter below. It’s packed with insight from investing experts.

[adzerk-get-ad zone="245143" size="4"]