Don’t Be Scared by Volatility

Trump tweets… and the market falls.

Two days later, he tweets again and the market rises.

Trade wars, earnings, economic data and a wide variety of other factors all affect the market and can cause sudden sharp moves up and down.

That volatility can be scary for investors, who sometimes feel like the rug has been pulled out from under them when the market tanks for seemingly unimportant reasons.

Long-Term Trends in Stock Market Volatility

Markets go up over the long term. We know that, and that’s why I preach owning stocks for years. But to get to the promised land of strong long-term returns, you have to endure a lot of trying times.

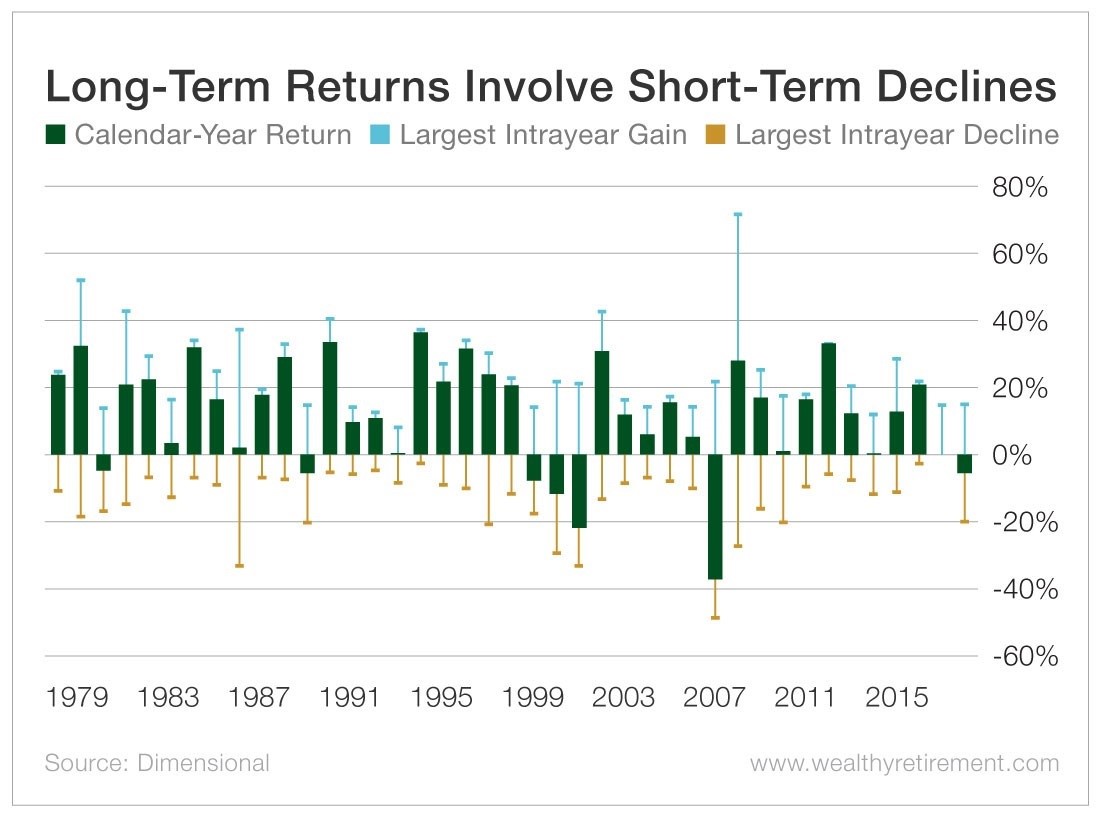

The U.S. stock market was up in 33 of the past 40 years. Despite that 83% win rate, stocks averaged a 14% decline at some point in any given year and were down at one point every single year.

As you can see from the chart, even positive years can suffer significant drops before final results are tallied. Just take a look at 1980, when the market rose more than 30% but also fell nearly 20%.

Of course, 1987 had a crash, but it still finished the year with a positive return. The return in 2011 was also positive, but with a big fall.

On the flip side, negative years also had periods where the market was up a strong amount. The market gained more than 20% at one point in 2008 before it logged the worst performance in decades.

Last year was also a down year in the markets, but at one point it was up nearly 20%. And during the dot-com crash in 2001 and 2002, markets rose nearly 30% each year before wiping out those gains.

So for traders, volatility can be difficult to manage.

You can be trading the greatest stock chart ever seen by mankind and feel certain a company is going to report blowout earnings. You can have confidence in the bull market. But one tweet can wreck your best trading ideas.

How to Profit From Stock Market Volatility

Fortunately, there are various ways that you can get a handle on volatility to protect your trades and portfolio. You can also use volatility to your advantage and make a profit from it.

Here are a few ways:

1. Use Trailing Stops

Place a trailing stop underneath your stock. Make sure that your stop rises as the stock climbs. If the market or stock suddenly tanks, you’ll minimize your losses and protect your profits.

2. Use Options to Hedge

You can buy puts on your positions as insurance. The best time to buy puts is when the market is strong and volatility is low. Volatility affects prices, so lower volatility results in lower options prices.

3. Use Options to Generate Income

When volatility is high, you can sell puts and calls to generate income.

4. Trade Volatility

You can profit directly from volatility by trading options on the CBOE Market Volatility Index (VIX). You can also trade exchange-traded funds (ETFs) or options on the ETFs that are related to the VIX.

Some of these include the iPath Series B S&P 500 VIX Short-Term Futures ETN (NYSE: VXX) and the ProShares Ultra VIX Short-Term Futures ETF (NYSE: UVXY).

The good news is that you can use volatility to your advantage. You can hedge, generate income or even profit.

Use the above tools, and the next time the president tweets and the market moves, he may put some money in your pocket.

[adzerk-get-ad zone="245143" size="4"]About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Lightning Trend Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.