Build a Wealthy Retirement by Practicing Healthy Savings Habits

This week, we’re honoring National Savings Day by taking a look at our readers’ savings habits.

It can be difficult to save for a distant retirement or to manage high monthly expenses and still set income aside – but as our readers know, it is crucial to save early and often. As one reader wrote…

My 7-year-old granddaughter has a “bank,” which has three slots… save, share and spend. When she receives cash money, she allocates money into each slot…

In addition, she does have a savings account at her parents’ credit union. She knows that this is her 529 college fund, and she periodically checks it.

This week, we asked Wealthy Retirement readers how they have been doing dividing their income among the categories of their own piggy banks.

How Much Should You Be Saving?

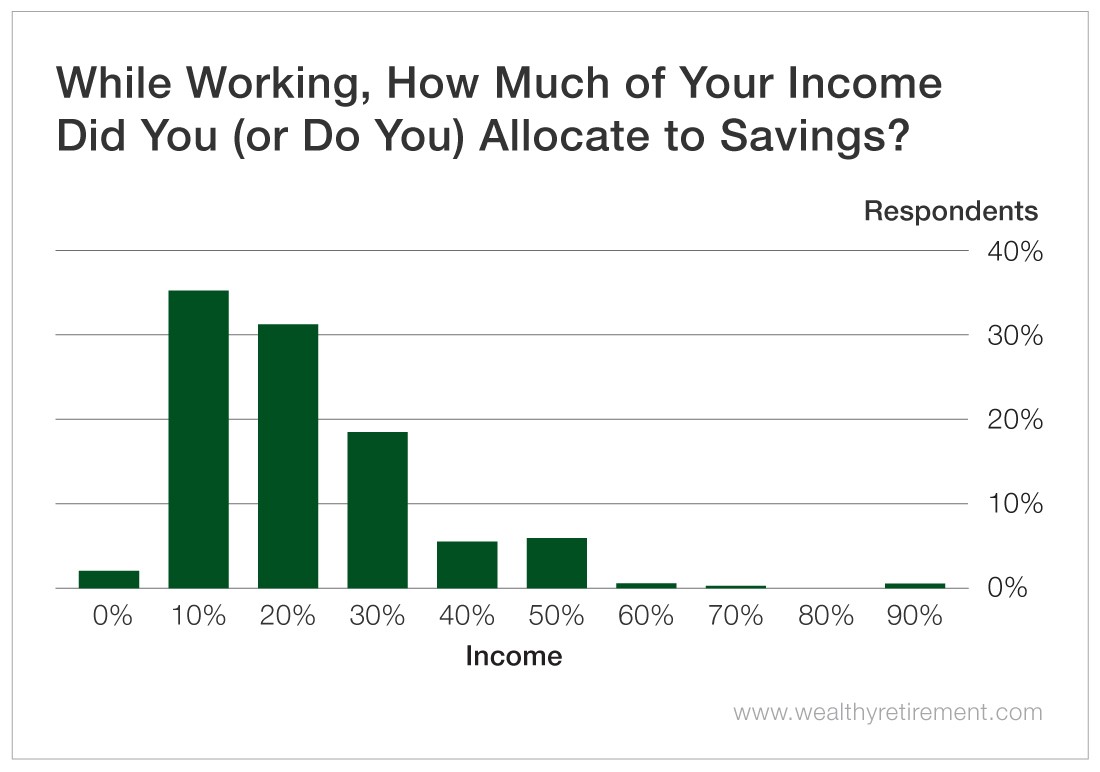

First, we asked our readers how much income they set aside while working. The majority of our respondents reported setting aside between 10% and 20% of their income.

Others reported setting aside between 30% and 50%, and a few readers even reported saving 60% or more – an impressive effort.

A small cohort of our readers reported saving nothing.

Sometimes, it can be difficult to save… Low or inconsistent income, unexpected expenses, debt, lack of formal financial education, and limited access to tax-advantaged plans are just a few common hurdles.

However, no matter how late it may feel, there’s no time like the present to get started.

Once you’ve resolved to make saving a habit, determine what proportion of your income you can afford to set aside.

Fidelity recommends saving at least 15% of your pretax income.

Savers seeking a more comprehensive plan can also consider the popular 50-20-30 budget rule. This rule allocates 50% of after-tax income to needs like living costs and minimum debt payments, 30% to nonessential “wants” like cable television, and 20% to savings, investments and debt repayment.

However, before you get starry-eyed at potential capital gains, remember that the first goal of building a saving habit is to establish a strong safety net.

According to traditional wisdom, you should aim to have at least six months of expenses set aside and should consider maxing out your 401(k) contributions as well before you begin investing.

In 2019, the maximum 401(k) contribution is $19,000, plus an additional $6,000 if you are 50 or older and wish to make a catch-up contribution.

For an IRA, this limit is $6,000 for savers who are not yet 50 and $7,000 for savers older than 50 who are making catch-up contributions.

Then, once you’ve got a fledgling nest egg, you can consider putting it to work…

Where Should You Hold Your Savings?

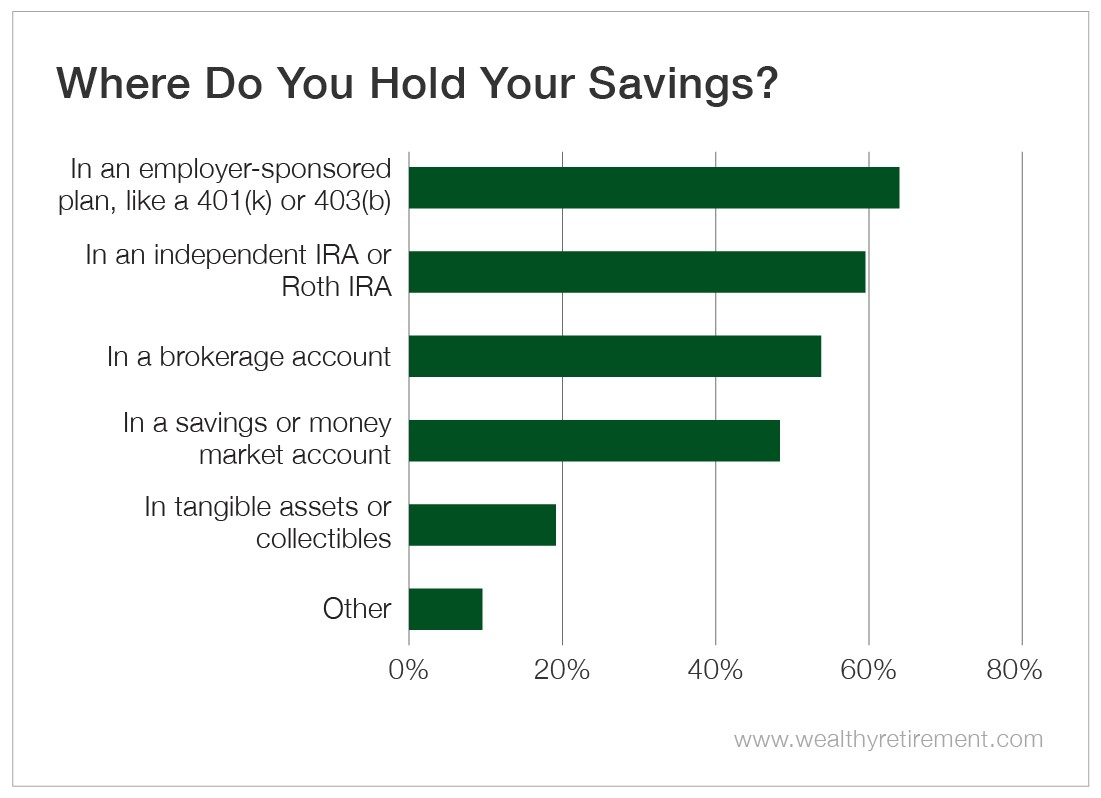

Next, we asked our readers where they hold their savings. The majority of our readers indicated that they use more than one type of account to protect and grow their wealth.

The majority, however, have turned to tax-advantaged plans, like employer-sponsored 401(k)s and 403(b)s and independent IRAs and Roth IRAs.

Because these plans allow participants to make pretax and post-tax contributions, and because many plans offer employer matching, savers can optimize the income they earn on their deposits.

We’re happy to hear that some of our readers have hit the ground running here… One reader wrote:

Our daughter could balance a checkbook at age 10. She opened a self-directed rollover IRA when she left her physical therapy job and graduated from nursing school.

Now she has that and an employer-directed 401(k) that matches 6% – and no student loan debt. Good start, huh? We are proud.

Another reader said:

I am currently mentoring a young man who is finishing his college degree… He has no current debt, and his credit cards are paid in full every month.

Plus, he is allocating 20% of his earnings to his company-sponsored 401(k). After he graduates, he plans to fund a Roth IRA to maximum annually.

To get their children interested in investing, one very generous reader even took the concept of matching into their own hands…

Each of my children hear about saving early and often. When they’ve gotten jobs, I’ve had them save 10%. And I match it.

Readers also reported using brokerage, savings and money market accounts.

Fewer readers reported holding tangible assets or collectibles. Some readers shared that they hold their savings in real estate, annuities or whole life insurance, in shares of a personal company, or in cash.

There is a wide variety of options available for savers who hope to put their nest eggs to work. And even for those of us who’ve run into more financial hurdles, there are ways to build and protect our wealth…

Overcoming Hurdles to Build Strong Savings Habits

Savers who don’t have access to tax-advantaged plans, but who have been able to set up a financial safety net, can benefit from the zero-commission offerings of deep-discount brokers like Charles Schwab and Fidelity.

Additionally, platforms like Robinhood offer investors the ability to purchase single shares of stock.

That means that even if $150 is the only wiggle room your budget provides (after saving for emergencies), you can still benefit from owning a Perpetual Dividend Raiser like IBM (NYSE: IBM), which is currently trading at $141.

Individuals who struggle to set funds aside can also consider options like Acorns, an app tied to users’ checking and savings accounts that allows them to automatically invest their spare change.

One thing to keep in mind: It’s true that there are some “miracle stories” from the market…

I have discussed this with my two sons and now with some of the grandkids. I taught money matters with 7th grade students during homeroom. One student came to me in 2007 and said he received money from a grandfather.

He asked what stock I recommended. I said I didn’t make recommendations.

He pressed harder, and I said I thought Netflix (Nasdaq: NFLX) sounded good because they just started releasing movies…

I saw him about three months ago. He had invested $7,500 into Netflix and was now a millionaire. He told me he would never forget me.

But the most effective “saving grace” when an emergency strikes, or when it’s finally time for retirement, will be the one that you’ve steadily built for yourself over time.

Consider whether there are opportunities to save on everyday expenses, such as using programs like Acorns, saving on healthcare by using a health savings account (HSA) or a flexible spending account (FSA), or auditing which subscriptions are still tied to your online banking accounts. You may be surprised with what you’re able to gather for winter.

Dollar by dollar and brick by brick, you can build a wealthy retirement.

[adzerk-get-ad zone="245143" size="4"]